The all-inspiring Simon Sinek asks, “How do you explain when things don’t go as we expect, or how do you explain when others are able to achieve things that seem to defy all of the assumptions?”

For example, how are some insurance agencies so innovative? How do they seem to thrive, grow and expand at a pace that is greater than the vast majority of others? Why do they appear to have something different?

If you ask someone why their product, service or company failed, people will always give the same three answers:

1. Under capitalized

2. The wrong people/employees

3. Bad market conditions

Simon, in one of his famous Ted Talks asks, “Why is it that the Wright brothers were able to figure out controlled, man-powered flight?” When there were other teams who were better qualified to achieve man-powered flight, better funded and all around

better equipped, the Wright brothers beat them to it. Simon goes on to discuss that there is something bigger at play.

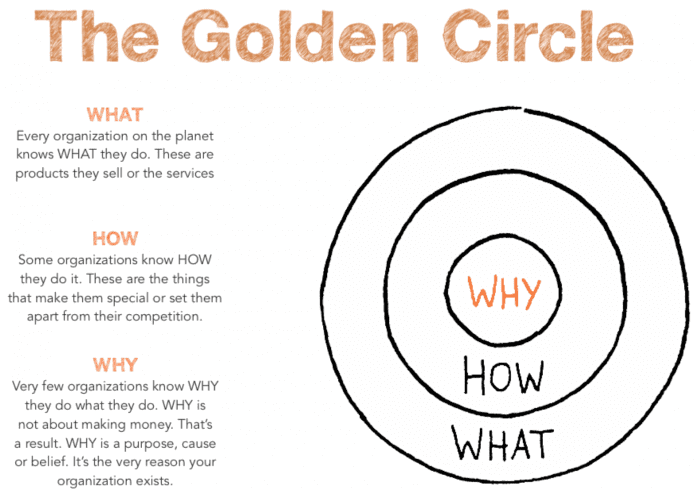

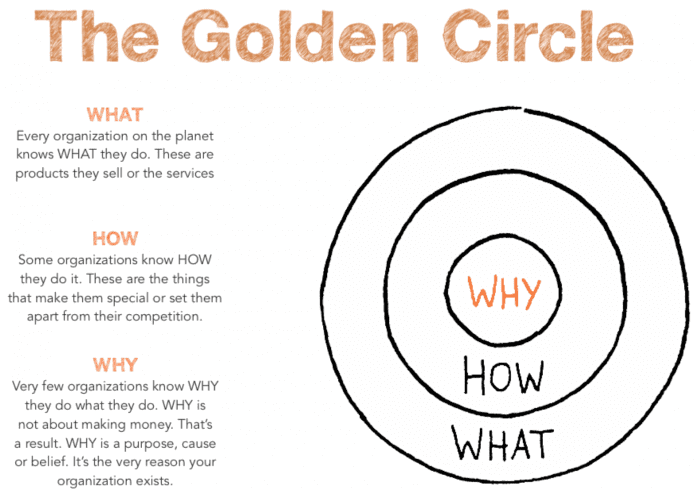

He codified it in his very simple, yet revolutionary idea titled the Golden Circle and the theory, “Start with Why”. This theory explains why some organizations are able to inspire where others aren’t.

Photo: Smart Insights

You see, people do not buy what you do, they buy why you do it. What is your purpose? What is your cause, your belief? Why does it exist and why should anyone care?

As an independent agent, you should strive to do business with people who believe what you believe. Insurance is vital to one’s economic security and that you are not just selling them an insurance policy, but peace of mind. Price is not a determining

factor in what policy they purchase. What drives the decision is the superior coverage, the value of working with an independent agent and the ancillary benefits the insurance company offers. How all of these factors come together to support their

American dream is what drives the passion within the industry.

When it comes to hiring individuals or companies to work for you, your goal should be to not just hire people who need a job, but to hire those who believe in what you believe as it relates to the products and services you sell and offer.

Simon Sinek says, if you hire people just because they can do a job, they will work for your money, but if you hire people who believe what you believe, they’ll work for your dream.

Nowhere else is there a better example of this than with the Wright brothers. In Simon’s famous talk, he goes on to tell a story of Samuel Pierpont Langley. Samuel was given $50,000 (which was a lot of money back in the late 1800’s and early 1900’s) by

the United States government to figure out and create a flying war machine or airplane.

He had, what everyone would assume to be, the recipe for success. He was well capitalized, had access to some of the best and brightest minds money could afford and the perfect market conditions to achieve their intended objective.

How come very few people today have ever heard of Samuel Pierpont Langley?

That’s because two brothers, Orville and Wilbur Wright, beat him to it. You see, the Wright brothers didn’t have any money, not a single person on the Wright Brothers’ team had a college education. The difference was that Orville and Wilbur were driven

by a cause, by a purpose, by a belief. That if they could develop this flying machine it would change the course of history. Those around them believed in the same cause driven by the same belief. Samuel Pierpont Langley was driven by the pursuit

of fame and fortune and so were the people around him. The people who believed in the Wright Brothers did so with blood, sweat and tears and not for the paycheck.

As a result, on December 17, 1903, the Wright Brothers took flight and very few people were there to experience it. The irony is that on December 17, 1903, Samuel Pierpont Langley quit. He wasn’t getting rich or famous as he had hoped so he quit.

Simon finishes this story be saying if you talk about what you believe in, you will attract those that believe in what you believe, whether that be your customers or employees.

Here at the Independent Insurance Agents of Wisconsin, we founded Catalyit with the belief that we were founded for you, to support you, and to work for you with blood, sweat and tears! We understand

that working hard for something we don’t care about is called stress but working hard for something we love is called passion. We are enthusiastic towards seeing you succeed and to help you pursue a sustainable competitive advantage for your agency

and its employees. We understand why you do what you do, why your customers respond the way that they do to what you do, and why your employees and co-workers are loyal to you.

At Catalyit we don’t just understand your why, we want you to spend more time finding your why, growing your why, and to come together with others that want to see you, your agency, and your employees/co-workers

be successful. Catalyit was founded by a group of people who believe in you and the work that you do with the understanding that your time is valuable, and resources are limited. Catalyit wants you to be able to focus more on what you do best and take the stress and pain that technology can cause you, away.

Catalyit is more than a company. It’s an enlightening experience that simplifies technology for insurance agencies because with the right tech, agencies will thrive and that is exactly what we are going to help

you do. We believe that with the right experts, solutions, training and community, we can come together to help your agency increase profit, improve its customer experience, cultivate its ethos among its employees all while digitally transforming

itself.

In world dominated by a lot of Samuel Pierpont Langleys - be the Wright Brothers and let Catalyit help you take flight.