|

|

Posted By IIAW Staff,

Monday, November 8, 2021

Updated: Wednesday, December 1, 2021

|

By: Matt Banaszynski, IIAW CEO This month’s magazine highlights the incredible dedication and work of our Board of Directors. These esteemed men and women are very accomplished business leaders of whom I have the pleasure to work with and learn from each day. They inspire their employees and create cultures of success within their respective organizations. I’m always trying to gleam successful qualities, characteristics and initiatives of which I can replicate and instill into the IIAW. This month I thought it would be fitting to write about a topic I have long contemplated and discussed with many individuals from board members to a plethora of professionals from other industries. The topic: turning values into vision. If you surveyed your employees, they would likely have a variety of responses when asked why they do what they do. Do they universally understand your company’s core values? How do they contribute to the overall vision that drives their success and that of their employer? Once values are determined, it is important to make sure all employees are part of the conversation, and they embrace those values; not just at work but out in your community as well. Values can be easily stated, but difficult to live out. That’s why it’s important to identify values that your employees try to live by day-in and day-out to incorporate them into the culture of your business. As I converse with our Board of Directors, they all share similar principles, characteristics and ideals that contribute to their vision of how they accomplish success. Many of them hold strategic planning sessions or roundtables to discuss and set company values. Strategic planning sessions and roundtables aren’t just for large companies. Some of the smallest companies I know are very successful in hosting such events to keep the pulse on their office and to set the direction for the future. Far too often as a society we fail to live up to our expectations and stay true to our values. Let’s be honest, we’re human and can slip up. The question is are you accountable for your actions? Do you understand what causes you to stray from your principles? According to author Lee Colan, in his article titled “How to Turn Your Values into Action”, “The most valuable type of knowledge is self-knowledge. Knowing your tendencies, preferences, values, personal limits, natural gifts and weaknesses helps you make the right commitments and keep them.” Aside from personal introspection, a good way to learn about yourself is to capture data on how others perceive you. For example, regularly ask your team what you can “Start, Stop and Keep” doing to be a better leader and support their success. You can have a “Start, Stop and Keep” discussion after finishing a project, wrapping up a meeting or during a scheduled review. Another important aspect of self-knowledge is to have a clearly thought out set of personal values, a few things that are vital to you and reflect your uniqueness.” For example, my personal values are to respect, serve, motivate, advocate and empower others. For each of these values, I have specific behaviors that I strive to demonstrate each day. Your values should dictate your decisions and behavior, not your circumstances or fleeting feelings. Being a reliable and reputable person not only means doing what you say, it also means doing what is right. These are just a few of the values that been ingrained into our organization by the fine men and women who serve and have served on our Board of Directors and by our staff who live by them as they seek to provide you with the best possible member experience.

Why Values Matter As I wrote the previous paragraphs, I found myself searching for an example to reference in which people make decisions that seem to go against their values. Not on purpose, but on accident and without them ever knowing it or the damage it could cause. This time of the year brings about a lot of change. Whether its mergers and acquisitions, adding or losing personnel or perhaps new technological initiatives, changes tend to occur at the end or beginning of the year for a myriad of reasons. I like to think a new year motivates individuals to make a positive change. I bring this topic up because (like death and taxes), rumors are certain to rear their ugly head this time of year. Over my last eleven plus years at the Association, I have heard from many agency owners and principals who have asked me to let them know if I hear others talking about their agency, and what types of things they might be saying. As we all know, it’s easy to forget our values and spread (potentially) negative information causing adverse consequences. Our industry is especially susceptible to this type of activity because it is a close-knit group of competitors and acquaintances. Being in a sales-driven industry makes us good “talkers”. Wisconsin has many strong professionals who share education and information with the many families and businesses they insure. As professionals, we are held to high ethical standards and even have mandatory courses to complete every two years. These courses remind us to focus on the values and principles of our business, yet some individuals can lose sight of this. My message here is to remind yourself and your colleagues to discuss your personal and professional values and how you can use them to drive success. Spending time on these discussions will translate into a more positive culture and will leave a positive impression on employees. Individuals should be encouraged to emulate positive behavior inside and outside of the office and look for truth before passing along information about their competitors in the industry. As we reflect on the past year and set the course for a bright and prosperous new year, there is no better time to engage in these ethical conversations. I will leave you with this: To live a life of integrity, stay true to your values. We are limited not by our abilities but by our lack values that defines our vision, our missions, our passion.

Tags:

insurance bartender

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Monday, April 5, 2021

Updated: Thursday, April 1, 2021

|

The IIAW is pulling out all the stops for InsurCon2021. We couldn’t be together in 2020, and we want to make it up to you.

How? We’re so glad you asked!

First and foremost, this will be an event where you will feel safe and comfortable while enjoying some much-needed time with industry friends. With 18,000 square feet in both our main hall and our exhibit hall, we will be taking full advantage of this

new facility and all it has to offer. Do you think the Waterpark Capital of the World is ready for the state’s largest insurance conference? We will be cruising down the Wisconsin River, giving away big prizes and kicking those dress shoes off on

the dance floor. Move over kids, the best industry ever is in town.

We cannot forget our big speakers. This year we snagged the best of the best. Beth Z is

your “Nerdy Best Friend” and her action-packed presentation will you get you energized about igniting productivity in your personal and professional life. Bill Pieroni is the smart and entertaining President & CEO of ACORD and will cover the shifting landscape of distribution across the insurance industry and the keys to high performance.

We invite everyone to enjoy a delicious Kalahari lunch while listening to Hall of Fame Quarterback and former NFL star Joe Theismann.

This inspiring and intriguing man will have your full attention so do not forget to chew! You know we can’t bring in a big name like this without giving away some authentic autographed items as well, but you have to be there to win.

Following this presentation, grab a drink and head over to the Exhibit Hall right next door for cash prizes, Super Door prizes and a competitive game of BINGO!

But wait – we cannot end it there! This year’s evening entertainment will take you back to the 90’s and early 2000’s, but definitely not 2020! Live music from one of Madison’s best cover bands, Granny Shot, will be the perfect end to our InsurCon event,

and we cannot wait for you to experience it all with us.

Cheers, and we will see you in August!

Tags:

Insurance Bartender

insurcon

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Monday, January 4, 2021

|

By: Matt Banaszynski | CEO of IIAW

Congratulations! You made it to 2021. 2020 will almost surely be defined by the COVID-19 pandemic. Despite the challenges presented by the pandemic, I see 2020 as the year I gained new perspectives, discovered five years’ worth of innovation in one year,

and came to appreciate the little things in life that in a normal year often get overlooked. Recently, I was sitting in my office and was reminded of an article I read back in April titled, “What Hard Times Teach Us: 5 Pandemic-Inspired Lessons That Will Make You Better For The Long Term” by Tracy Brower. I thought I would combine some of her advice with my own words of wisdom that came to mind when I introspectively

examined what I learned from this past year. I thought I would share them with you before I file away 2020 in hopes of making 2021 the best year yet!

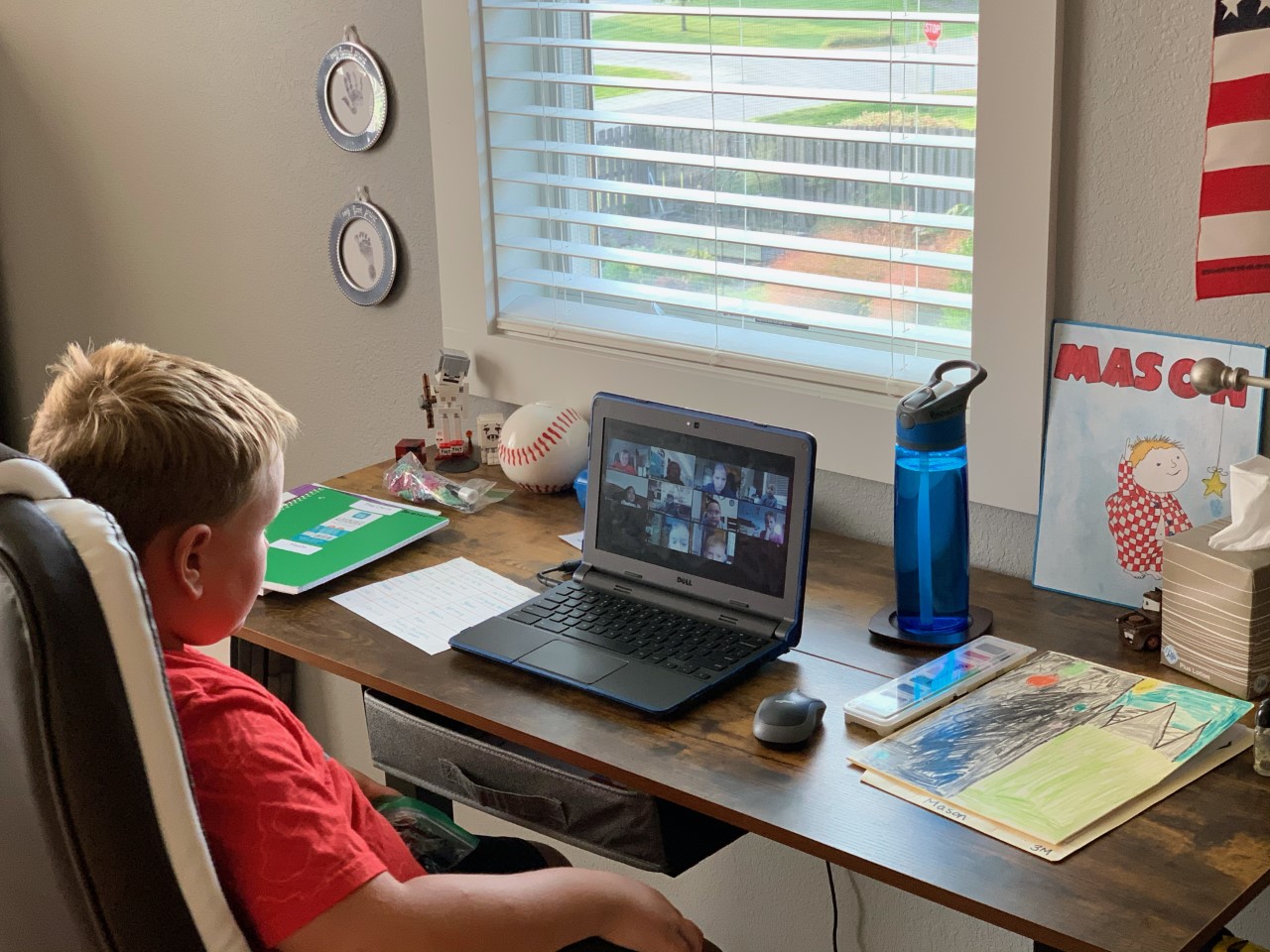

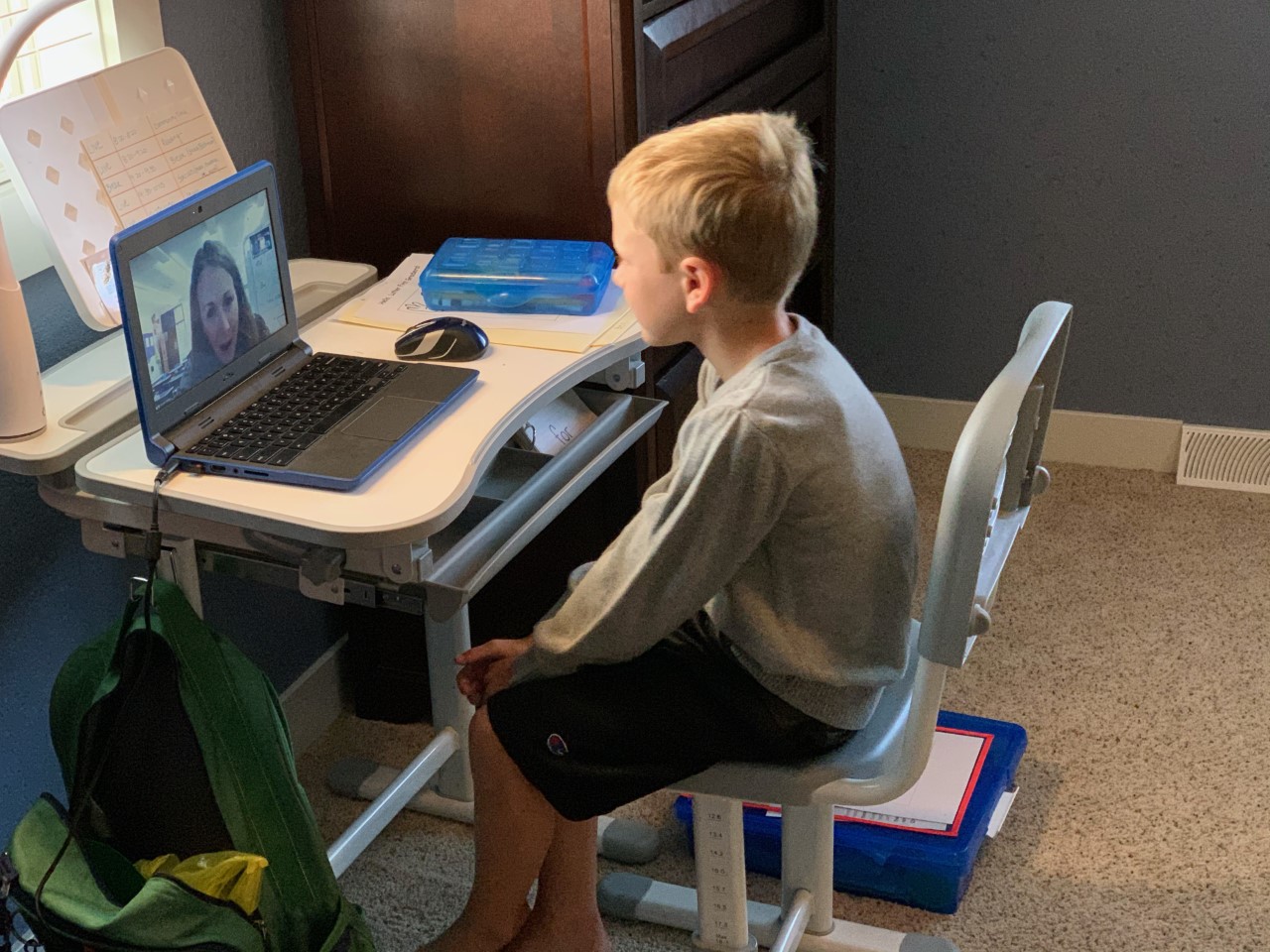

Patience: If you have children, you may have an abundance of patience or lack it

entirely, but one thing is for sure, this pandemic pushed it to its limit. Whether it was/is navigating and balancing the complexities of virtual learning with working remotely, waiting for the quarantine to lift, or anticipating your favorite

restaurants to reopen and spring back to life. One thing was for sure, we are never going back to “normal”.

Finding patience can yield a different perspective and even at times, new appreciations in life. As importance as patience is to your well-being, it is also important to understand and recognize the sign of impatience.

According to Mindtools.com, “Patience is a vital quality in the workplace. It can reduce stress and conflict, lead to better working relationships, and help you

to achieve your long-term life and career goals. Many of us struggle with impatience. Learn to recognize the physical and emotional symptoms associated with it, and to identify the situations that trigger it. When you understand the causes

of your impatience, you can develop strategies to prevent or overcome it. These could include attending to your physical well-being by using deep breathing and relaxation techniques and developing your empathy and emotional intelligence skills”.

Playing the long game: A term often used to describe how taking the necessary

steps now will to set yourself up to long-term success. It means not sacrificing long-term gains for short-term wins. Tracy Bowers says, “With a narrow perspective, current reality can be even more challenging, but by taking a longer-term

view, you can reassure yourself that current realities will shift, and good things will come—ultimately—from today’s experiences and lessons”. Warren Buffet once said, “Someone is sitting in the shade today because someone else planted a tree

a long time ago.” Do not focus on the here and now, especially when the here and now are so tumultuous. Take solace in the fact that this too shall pass, you will get through it and you will be better because of it. The race is long, and in

the end, it’s only with yourself!

Adaptability: A term that most certainly comes to mind when you look to define

2020. You cannot always control what happens, but you can control how you respond. Benjamin Franklin famously proclaimed, “Change is the only constant in life. One’s ability to adapt to those changes will determine your success in life”. This

guiding principle is one that has propelled the American spirit forward for generations and will continue to do so. Some consider this soft skill the most important. As Bob Dylan famously sang, “The times, they are a changin’.” Being adaptable

allows you to take control and chart your own course, instead of just letting things happen around you. Remember, change is constant, even without global pandemics, our industry is undergoing a significant amount of change. Be empowered in

the face of change.

In his article in Forbes entitled, “14 Signs of an Adaptable Person,” Jeff Boss identifies the following traits of

adaptable people: they experiment, they see opportunity where others see failures, they are resourceful, they think ahead, they don’t whine, they talk to themselves, and they don’t blame others. They also don’t claim fame, they are curious,

they open their minds, they see systems, and they stay current.

If you do not possess these traits or would like to refine them, there are ways you can train yourself to be more adaptable. Consider reading, “How to Survive Change . . . You Didn’t Ask for: Bounce Back, Find Calm in Chaos, and Reinvent Yourself”

by M.J. Ryan.

Resilience: Research shows that resilience is enhanced by having a clear view

of reality, a sense of meaning and an ability to improvise. In addition, according to Professor de Weerd-Nederhof of the University of Twente, resilience is both a personality trait

and a skill. Hard times may be easier if it is part of your character, but it’s also a competence you can develop through today’s challenging times. The American Psychological Association has a great short read on “Building your Resilience” that is worth checking out.

If you would like to become more resilient, consider these tips:

• Get connected.

• Make every day meaningful.

• Learn from experience.

• Remain hopeful.

• Take care of yourself.

• Be proactive.

Responsiveness: Reacting quickly and positively is an art and an interquel part

of good customer service. Responsiveness is a must-have in your communication and customer service toolbox. You show responsiveness through prompt attentiveness when asked for something. This term likely took on new meaning during 2020. Perhaps

you found it more important than ever to be responsive to the needs of your loved ones, co-workers, customers, and other business partners. Being responsive creates an opportunity to build trust and respect by acting quickly and proactively,

thus eliminating concerns and anxiety during a time of uncertainty. Being responsive during these turbulent times meant the opportunity to create a deeper, more meaningful connection. Consider these 7 ways to be more responsive to your customers

according to SmallBizDaily:

1. Ask your customers what they want.

2. Manage customer expectations.

3. Develop procedures.

4. Educate your employees.

5. Provide self-service options.

6. Use technology.

7. Stay human.

Gratitude: Being grateful for the people and things in your life that have a

positive impact is critical to happiness. Whether you’re appreciating the companionship of friends, extended time with family, or the bond you’re building with coworkers through shared struggles, there is a lot to be thankful for. Be sure

to share your gratitude to those that have contributed towards it and do not be afraid to

“pay it forward”.

Happiness: Happiness is a mindset that can be difficult to explain or define.

Much like beauty is in the eye of the beholder, it’s different for everyone. Happiness is an important component to a meaningful life - it can provide a sense of purpose. It’s also something that doesn’t come easy and needs to be earned.

Regularly indulging in small pleasures, getting absorbed in challenging activities, setting and meeting goals, maintaining close social ties and

finding purpose beyond oneself all increase life satisfaction. It isn’t happiness that promotes well-being, it’s the actual pursuit that’s crucial.

If you want to learn how to boost your wellbeing with strategies from groundbreaking research, visit happify and read through the resources on The Science of Happiness and How to be Happy.

Self-discipline: Self-discipline is about controlling your feelings to overcome

your weaknesses - something many of us may have found challenging in 2020. Sure, you can binge-watch your favorite tv show instead of working remotely from home, but as Tracy Bower puts it, “This is a great time to learn new approaches to

managing your behavior and building new habits”. Self-discipline is an essential quality, and it’s a key differentiator between people who are successful in life and those who struggle to be.

Make sure that you take time to continually develop it!

According to MindTools.com: To develop self-discipline, follow these steps:

1. Choose a goal.

2. Find your motivation.

3. Identify obstacles.

4. Replace old habits.

5. Monitor your progress.

Instituting and refining self-discipline won’t always go according to plan. You will have ups and downs, successes and failures. The key is to keep moving forward. When you have a setback, acknowledge what caused it and move on. It is easy to

get wrapped up in guilt, anger, or frustration, but these emotions will not help build or improve self-discipline. Instead, use the setbacks in your plan as learning experiences for the future.

Self-care: Taking care of your physical, mental, and emotional health is

more important than ever during these stressful times. Develop a process of purposeful engagement in strategies that promote healthy functioning and enhance your well-being. Physically speaking, be sure to get enough sleep, eat healthy

and exercise. Social and mental self-care can be difficult in times of isolation. Find ways to get face-to-face (virtually and physically), nurture your relationships with friends and family, make time for activities that mentally stimulate

you and find ways to proactively invigorate your life. Set goals to realize your ambitions or aspirations. Develop methods and outlets to allow you to process and recognize your emotions.

Incorporate activities that help you recharge. Assess which areas of your life need attention and as your situation changes your self-care should as well. Self-care is vital for building a resilience toward those stressors in life that

you can’t eliminate or predict.

Enhancing Your Community: You have probably heard the phrase, “It takes a

village…” The truth is that it takes a village to achieve just about any meaningful change in your life. This term took on much more meaning in 2020. You leaned on your various communities, tribes, networks, cliques, associations or whatever

you want to call it for support, and you worked harder to provide help and assistance to those that need it in your community. Your community may have evolved to include more people or it may have shrunk to focus more of your efforts on

those who needed it most. Building, supporting, and connecting with your community is as important as it has ever been.

Tracy Bowers perfectly concluded her article (far better than I can for this one) by saying, “You’ve pushed yourself beyond your limits—not by choice—but by necessity. The good news is these hard times can be the catalyst for new habits, behaviors

and lessons. You’re finding perspective by learning to operate your patience button (or just find it) and taking the long view. You’re learning more about resilience and your response by expanding your adaptability and coming up with creative

hacks. You’re reinforcing your appreciation for community by connecting with others and embracing gratitude. And you’re managing yourself in new ways with self-discipline and self-care. Perhaps best of all, you’re finding new paths toward

happiness. All of these will pay off for you today, but also in the new normal of tomorrow.”

My concluding opinion: advice is a form of nostalgia, and dispensing it is

a way of fishing the past from the disposal, wiping it off, painting over the ugly parts and recycling it for more than it’s worth! If I can offer you one tip for the future, it is this…

Whatever you do, don’t congratulate yourself too much or berate yourself either. Your choices are half chance, so are everybody else’s!

Tags:

insurance bartender

insuring Wisconsin

wisconsin independent agent

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, October 7, 2020

Updated: Tuesday, October 6, 2020

|

By: Matt Banaszynski | CEO of IIAW

Thank you!

I want to start off by thanking all our company sponsors. Without their support, the IIAW could not do what we do on behalf of the independent

agency channel. Their support is critical to our mission of serving independent agents. As a member of the association, please take a moment the next time to chat with one of our company supporters and thank them for their support of your association.

Schedule Rating Update

As you may know, several carriers have been advocating for the implementation of schedule

rating. Early last year the IIAW Board of Directors voted unanimously to oppose efforts within the

Workers Compensation Rating Bureau (WCRB) to recommend to the Commissioner of Insurance that Wisconsin move to adopt schedule rating. As a result, IIAW Government Affairs Chairman Jeff Thiel and I have been very active in presenting at and attending WCRB meetings and voicing our opposition to any

effort to adopt schedule rating. The IIAW has also discussed our opposition with Insurance

Commissioner Mark Afable and his staff.

On September 2, 2020 a motion was brought forward within the WCRB’s rating committee that would have advanced the exploration of schedule rating in

Wisconsin. The vote on the motion resulted in a 6-6 tie. In the event of a tie, the motion goes to OCI to break the tie. On September 16th, the IIAW was notified that OCI had chosen to abstain from voting on the motion whether to move forward

with further evaluating the extent of industry support for schedule rating in Wisconsin.Pursuant to WCRB Bylaws, Article XI, Paragraph 2, because a majority of members of the Rating Committee did not assent to the motion and the OCI abstained,

the motion did not pass.

We will continue to monitor the situation, but we hope, for now, the issue of advancing schedule rating in Wisconsin is dead. If more action is taken, we will be sure and communicate accordingly to our members and move aggressively to defeat it. The IIAW wishes to thank those carriers that voted against schedule rating and stood with their independent agency sales force in opposition. If you have any

questions regarding the events that occurred and would like additional insight and information, please do not hesitate to contact me.

City of Milwaukee Contractor Insurance Requirements

Over the last month, I have been contacted by several agency members regarding whether the City of Milwaukee’s standards preclude permitting

contractors who meet the City’s insurance requirements through surplus lines insurance. The City of Milwaukee (or one or more of its departments) has denied permits to contractors who seek to meet the City’s insurance requirements through surplus lines insurance. The City has relied on contract terms which require that a contractor’s insurance carrier “be

authorized to sell insurance in the State of Wisconsin and . . . submit its agent’s license with the certificates [of insurance].” The City’s reliance on those terms appears to be misplaced.

In working with IIAW’s Legal Counsel, Josh Johanningmeier, we reviewed the sample terms which the City has cited when denying contractor clients permits. According to the team at Godfrey & Kahn S.C., “the short answer is that the City’s standards

likely do not preclude the use of surplus lines insurance. As an initial matter, Wis. Stat. § 618.41

permits domestic surplus lines insurers and nondomestic insurers that have not been licensed by the State to place surplus lines coverage in

accordance with the statute. Such surplus lines insurers are, thus, “authorized” to sell insurance in Wisconsin.

In addition, published terms and conditions governing City of Milwaukee contracts require that contractors provide the City with a certificate of insurance that is either issued by a company licensed to do business in the State of Wisconsin

or signed by an agent licensed by the State of Wisconsin. A contractor should thus be permitted to meet the City of Milwaukee’s insurance requirements through surplus lines insurance,

provided the contractor supplies the City with a certificate of insurance signed by a licensed surplus lines agent.”

I wanted to share this information with you in the event you are having any similar issues with the City of Milwaukee or any other municipality as it relates to their insurance requirements. IIAW’s legal counsel has prepared a memo

for the Association on this topic that is available to members to provide to municipalities in the event you are faced with a similar situation or interpretation. If you are, please do not hesitate to contact me to discuss the situation further and receive this memo.

Tags:

contractor insurance

insurance bartender

insuring Wisconsin

schedule rating

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Monday, September 14, 2020

Updated: Thursday, September 10, 2020

|

Matt Banaszynski | CEO of the IIAW

This article was originally published in our September 2020 Wisconsin Independent Agent magazine issue.

In last month’s issue of Wisconsin Independent Agent, we announced our new platform, the Online Community. IIAW’s Online Community will help our members, vendors, sponsors and IIAW staff connect. This new member benefit will launch on November 1st, and

we have a big incentive for members to participate:

Top contributors of our Online Community will receive gifts and prizes that will give back to their local communities, simply for participating.

Participating in our Online Community is easy. All you need to do is sign up, join Groups, connect collaborate and engage to earn gifts that will give back to your local communities.

Sign Up:

On November 1st our Online Community will go live for all members. Once live, IIAW members can log into their profile on our website, iiaw.com, to access the Online Community. If you or someone within your company would like to join the Online Community

but don’t currently have an account through our website, please contact us atinfo@iiaw.com and we will send you a link to be added as a user under your company’s membership. You can also email us at info@iiaw.com

if you have any questions about logging into an existing account.

Join Groups:

We are moving our current committees online, and they will now be called Groups. Amidst COVID-19, in-person gatherings are hard to accommodate. Instead, we want to continue offering a place for those with like interests to gather together but in a more

attainable way - online. Recently, we opened Group sign up to those who would like to be Thought Leaders (previously known as committee members). Thought Leaders will lead discussions within their Groups and answer any questions that may arise. Prior

to the launch of our Online Community, we will be opening the sign up for those that would like to be generalcontributors of Groups. There are no obligations to join a Group as a contributor, but contributors

can still soak up the information being shared within the Groups they choose to join. When members log into their account on our website November 1st, they will already be a member of the Groups they selected in previous sign-ups.

As we move our current Groups (formerly known ascommittees) online, we are also introducing a few new Group interest areas.

• Legal - This Group will be a source for news and articles. This will be a place to discuss laws and legal implications. Information within this Group will be general in nature, and the forum will not be used to provide personal or

agency-specific legal advice and counsel.

• Education and Events - This Group will shareprofessional development and continuing education opportunities. Members in this Group will learn about industry educational offerings and events.

• Internet of Insurance - The Internet of Insurance User Group will assist users in the utilization and troubleshooting of the IOI, a free platform for members. Members can share questions, comments and connect with Thought Leaders within the Internet

of Insurance space to make improvements to the customer and user experience. Within the Group, members can learn more about the platform and use it to your agency’s advantage. Founders and employees of DAIS, the company that

created the IOI, will be Thought Leaders within this Group.

Connect, Collaborate and Engage

Our Online Community is our industry-curated version of Facebook and LinkedIn. Similar to your favorite social media sites, you can connect with others, read, comment, like posts and much more within Groups and on the feed (MyFeed). Connecting, collaborating

and engaging with other members of our Online Community is the best way to get the most value out of this new member benefit.

Earn Gifts that Give Back

One of the important features of our Online Community is how we will be giving back to local communities. We have created a rewards system to award those who actively participate in MyFeed and Group discussions. Topcontributors

will earn gift cards/gift certificates to local eateries (Wisconsin small businesses), donations to local charities and handpicked IIAW swag and prizes.

Additionally, participation will also play a part in theselection process for IIAW’s end-of-year Association Awards like Agent of the Year, Industry Representative of the Year, Emerging Leader of the Year and

more.

If used to its full potential, our new Online Community will be a great member benefit. Being an active member of our Online Community and its Groups will give members the ability to be a part of just that - an online community of professionals that understand

the industry, customers and values.

We are excited to offer our members this free and valuable benefit, and we are eager that together, as a community,

we can support your local communities too!

Tags:

Insurance Bartender

insuring Wisconsin

online community

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, August 5, 2020

Updated: Monday, July 20, 2020

|

This article was originally published in the August issue of the Wisconsin Independent Agent magazine. Read more from Wisconsin Independent Agent here.

Henry Ford famously said, “Coming Together is a beginning, Staying together is progress, and Working together is success.” You have likely seen this quote a lot from the IIAW as it perfectly illustrates the type of community the IIAW is working to build

among its members and stakeholders. An ecosystem of insurance professionals and solutions to help drive the industry to new heights.

Historically, the IIAW has brought together its members in the form of meetings, events, and conventions/conferences. In the COVID-19 environment that exists now, in-person gatherings can be difficult and risky, but the need to connect, collaborate and

engage with other individuals has never been greater. That is why, later this Fall, the IIAW will be launching a new online “curated” community and app where members can seek out and engage with other members/stakeholders within the association

or with association staff/experts. Post questions, topics, and articles for feedback from other agency staff, insurance company employees, vendors, or staff. Search past posts or blogs to obtain valuable information quickly and easily. This platform

seeks to bring insurance professionals together in a virtual curated format to provide a more cohesive, comprehensive, and responsive community environment to meet the evolving needs of our Association’s members, sponsors and stakeholders.

Data shows an overwhelming percentage of members only sign-in to renew their dues and register for an event. The Online Community integrates with IIAW’s association management system and website to provide simple and quick access to community features

such as blogs, forums, groups, member directories and more. Accessibility and personal interaction preferences are key to the platform. Instead of members interacting and engaging with content and other members in a more traditional format, the IIAW

online Community will tailor its approach to the member by bringing together relevant data and information into an easily consumable and familiar source through the “My Feed” function.

Alerts are also an essential piece of the community online platform and SocialLink Mobile App. These Alerts keep the member engaged with instant updates on activity that is happening within their Community Feed and Connections. Alerts can range from

updates to a particular post you have made or contributed to as well as Connection requests from other community members. The online community and app will have push notifications/alerts that populate member’s “My Feed” from the backend of the

website allowing for the distribution of quick and relevant information.

Gamification is adding game principals or mechanics into nongame environments, like a website, online community, or learning management system to increase participation. The goal of gamification is to encourage the engagement with consumers, employees,

and partners to inspire collaborate, share and interact. The IIAW will be incentivizing participation by integrating gamification into its platform. We will be rewarding users/members for their participation in the form of points that can be redeemed

for Amazon gift cards, local merchant gift cards, IIAW swag and more. It’s easy, participate to earn points, cash in those points for cool prizes.

In order for our new virtual community to succeed we need everyone to participate. We sincerely hope that you and your company will join us this Fall as we look to inspire, educate, collaborate, engage and connect with insurance professionals across

Wisconsin to help drive the industry toward continued prosperity.

“Alone, we can do so little, together we can do so much!” - Helen Keller

Tags:

insurance bartender

insuring Wisconsin

online community

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Matt Banaszynski | CEO of IIAW,

Monday, June 1, 2020

|

For decades independent agents have heard the term, “SEMCI”, which promised to connect them and their clients to their insurance companies faster and more efficient through a single system. Agents were told they would be able to obtain multiple quotes from one application/entry allowing them to easily compare carriers to their customers. The idea of single-entry multi-carrier interface seemed so simple yet proved to be an enormous challenge for the technology juggernauts that power the insurance industry for decades. But WHY?

As insurance carriers and independent insurance agents alike have upgraded their technology stacks over the years, these advancements were built on antiquated equipment and tech. It became more and more challenging over the years to leverage

technology that burst onto the scene with the advancement of the internet and upload and download. Yet, the industry never truly reached

SEMCI-status across all lines of business. Rising technology costs for insurers, the inability to upgrade existing technology, low adoption and demand by agents, etc. were all blamed for the startling, lethargic rise (*cough) of SEMCI over the decades. Granted gains were certainly made in the personal lines arena where commoditization demanded it.

Over the last several years, new insurtech startups such as the Internet of Insurance, Tarmika, SEMSEE, Bold Penguin and more have burst onto the scene challenging the status quo and pushing the industry to new heights.

Insurance carriers such as ACUITY, EMC, CNA, Liberty Mutual, West Bend Mutual and more are aligning with technology companies to develop or enhance their Application Programming Interfaces (APIs) to deliver SEMCI to their independent agency force, while some are finding it more challenging.

“The promise of SEMCI is fantastic: single-entry, multi-carrier. It has the potential to be a huge time saver for agents and an easier way for carriers to grow, but it turns out that it’s really, really hard to do it right - in practice”, stated Jason Kolb Founder and CEO of the Internet of Insurance.

Jason continued, “Most often what happens is “single-entry, some carriers” because most carriers just aren’t equipped to quote programmatically via Application Programming Interface (API).

And even then, some of the carriers that do have API’s may be constrained by the lines and classes they can support, which leads to a frustrating experience for agents, lower growth than expected for carriers, and an underwhelming experience for policyholders.”

In May of 2019 at the IIAW’s 120th annual convention, Ansay and Associates using DAIS’ Internet of Insurance (IOI) submitted a commercial business package virtually (without APIs) to EMC and Western National underwriters live on a stage in front of 500+ attendees. Using the IOI and its Single Entry Multi-Carrier Interface, business was submitted, underwritten, quoted and bound. It was a revolutionary moment for an industry that had been promised full SEMCI for decades but never truly got to experience it.

The Internet of Insurance uniquely offers 5 (soon-to-be 6) distinct ways for carriers to connect, as opposed to just the typical rating API connection. “This all represents some extremely heavy technical lifting, but we decided to do it to support all carriers and all lines, regardless of the carrier’s technical sophistication,” stated Kolb. “Single-entry, all carriers. Then we paired that with a suite of powerful tools to help agencies grow and be more efficient: an agency storefront for policyholders, a cloud environment for handling mid-market submissions and underwriter referrals, real-time collaboration and notifications, and so much more, concluded Kolb.”

The Internet of Insurance is a unique product of the Internet age, providing full SEMCI to the insurance ecosystem regardless of how advanced or behind an agency’s or carrier’s technology stack is.

Technology companies offering SEMCI are racing to provide the independent-agency-system with powerful, modern tools that are built on an

industrial-strength cloud-native platform that makes data easy for agents and carriers to collect and act on.

Agents must leverage SEMCI to succeed in this new digital age. As ACUITY likes to say,

"Open SEMCI!"

Tags:

Bold Penguin

Insurance Bartender

SEMCI

SEMSEE

Tarmika

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, May 13, 2020

Updated: Wednesday, April 29, 2020

|

By: Matt Banaszynski | CEO of IIAW

This article was featured in our May 2020 Wisconsin Independent Agent Magazine. Click here to read the full May 2020 issue.

The IIAW welcomes Kaylyn Zielinski to the team. Kaylyn has some wonderful tips to share with our readers about digital marketing and using social media for your agency. She has also created a complete Digital Marketing Playbook, which all of our members have access to. Enjoy these quick tips from Kaylyn, the new IIAW Marketing Specialist.

When today’s consumers are looking for insurance, they turn to their phones, computers and tablets to find exactly what they’re looking for at exactly the time they’re looking for it. Consumers are no longer looking in a phone book to find providers in their areas. To capture the attention of these digital-age consumers, you’ll need to show up on their devices. Now, more than ever, you will need to debut on their screens and stick in their minds. There’s no time like the present to develop your digital footprint.

With a proper marketing plan, a website and a social media presence, you can create an online existence that will push your agency ahead of your competitors. The best part of this process is that most digital marketing is free. The biggest investment you’ll face is in the time and the attention you will spend developing your online presence. However, this time investment will pay off.

Your Marketing Plan

A quick Google search for “how to create an online presence” will leave your mind reeling as you decide where and how to start. First, start by creating a marketing plan. If you already have a marketing plan for traditional outlets, it’s time to apply it to today’s new medium by focusing on your website and social media sites. Next, run through your agency’s strengths and develop goals on how you plan to exploit those strengths online. Finally, determine your target audience. As an insurance agent, you may describe your target audience as individuals, families, business owners and commercial businesses in XYZ city or certain area.

Understanding your goals and your target audience will help you further develop content that will put your agency at the forefront of their online searches.

Your Website

Your website should be the cornerstone for all information coming from your agency. If you don’t have a website already, today’s the day to start. The Big I partners with ITC, Forge 3, Titan Web, Advisor Evolved and Marketing 360.

When creating or optimizing your website, keep these best-practices in mind:

• Prioritize your top-visited webpages -

On average users spend about 15 seconds on a website, according to Tony Haile of Chartbeat. Those visiting your website don’t want to have to spend a lot of time to search around. If they have to search, they may go elsewhere (potentially your competitors) to find the information. The most visited webpages should be the easiest to find. If they’re not, it’s time to rearrange your layout.

• Check your analytics and create content that’s targeted to what your most visited pages are. (Your website host may offer built-in analytics, otherwise, Google Analytics is a helpful tool for reviewing your website stats.)

• Keep visitors engaged by making your website visually appealing.

• Ensure your website is mobile friendly. According to Statistica, over 52 percent of all web traffic worldwide is done on a mobile device.

• Have a complete website. Ideally, a complete website will answer these questions: who, what, when, where, why and how. A customer on your website should have no problem finding the answers to their questions and they should feel compelled to start the process by requesting a quote.

Your Social Media Presence

Social media is a great way to freely engage with your audience. You can get to know your clients, and your clients can get to know you too. While there are multiple social media sites you can join, keep these rules in mind across all platforms:

• Keep your pages consistent by having all accounts under the same profile name. Your customers will be able to find you easier by keeping the same name. Along the same lines, make your profile photo the same. We recommend using your agency logo as your profile photo for your business pages.

• Create a publishing schedule and stick with it. Keep your pages relevant by posting up-to-date content on a regular basis.

• Allow your agency’s personality to shine through your social accounts. You want your social media platforms to be the go-to spot for engagement, and the most engaging content is humanizing content. Social media allows you to show the human side of your business and allows you to build a community that others want to be a part of. If it aligns with your brand’s marketing plan, stay away from overly formal content on your pages. You can share formal ideas, but make them fun to understand and/or interact with.

Now you have the framework to get started on developing your online presence. Read our Digital Marketing Playbook here.

Tags:

digital agency

digital marketing

digital presence

Insurance Bartender

social media

Permalink

| Comments (0)

|

|

|

Posted By Administration,

Wednesday, April 29, 2020

|

By: Matt Banaszynski | IIAW CEO

* This article was featured in our April 2020 Wisconsin Independent Insurance Agent Magazine. Read the full April issue here.

The Coronarita is a drink that seems to defy gravity. You would expect that, when you flip the beer upside down in your cocktail, the mixture would overflow and spill all over the place. But curiously, it all stays in place.

How the Coronarita works has to do with pressure. If you flipped a bottle of Corona upside down normally, the beer would fall out and be replaced inside the bottle by air. But, in a Coronarita, the mouth of the bottle is surrounded by liquid, which prevents air from entering the bottle. The air that is inside the bottle creates pressure that keeps the beer from spilling out into the margarita. But, when you sip on the margarita with a straw, the liquid level in the glass will go down, and the beer inside the bottle will then flow into the glass to make up for the missing liquid.

Matt's Mixology - Coronarita

Ingredients:

• Ice cubes

• Rimming salt

• 1 1/2 oz. silver tequila

• 3 oz. lime sour mix

• 1 12 oz. bottle of Corona, Dos Equis, Pacifico, Tecate, Carta Blanca, Modelo or your favorite Mexican beer

Steps to Make It:

1. Pour ice cubes, tequila, triple sec, and lime sour mix into a cocktail shaker.

2. Shake the mixture and strain it into a salted pint glass.

3. Quickly flip the beer upside down and place it into the drink, so it dispenses slowly as you drink your delicious Coronarita from a straw.

Whether you call it a Coronarita, a Mexican Bulldog Margarita, or a Mexican Car Crash, this tequila-inspired Mexican drink recipe is sure to be a hit with your friends and family. Though this drink is not always served in a traditional margarita glass, it still delivers on the familiar and refreshing flavors of two classic beverages. Perfect for Cinco de Mayo!

Tags:

Insurance Bartender

Permalink

| Comments (0)

|

|