|

|

Posted By IIAW Staff,

Friday, January 29, 2021

Updated: Thursday, January 7, 2021

|

By: Josh Johanningmeier | IIAW General Counsel

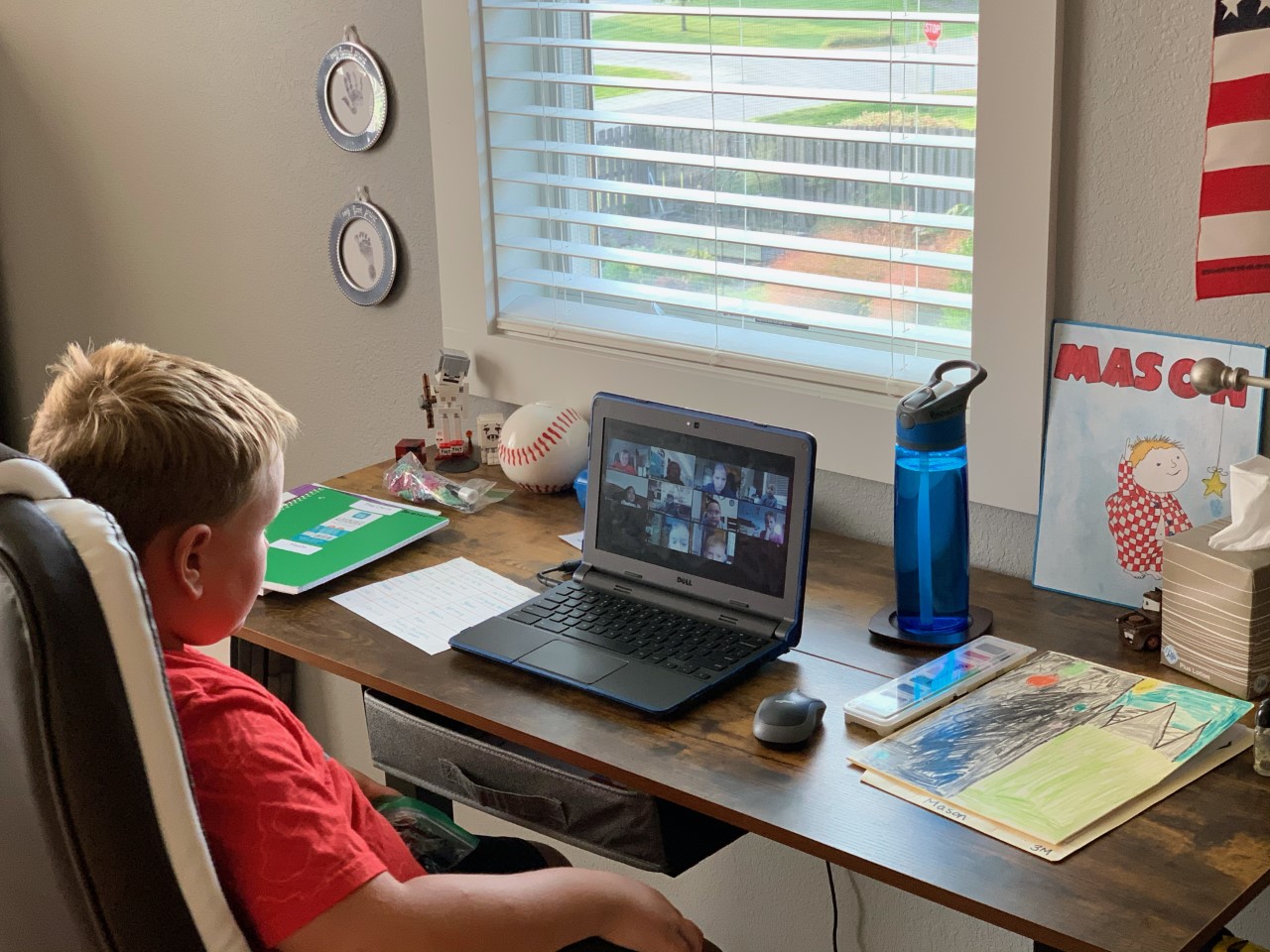

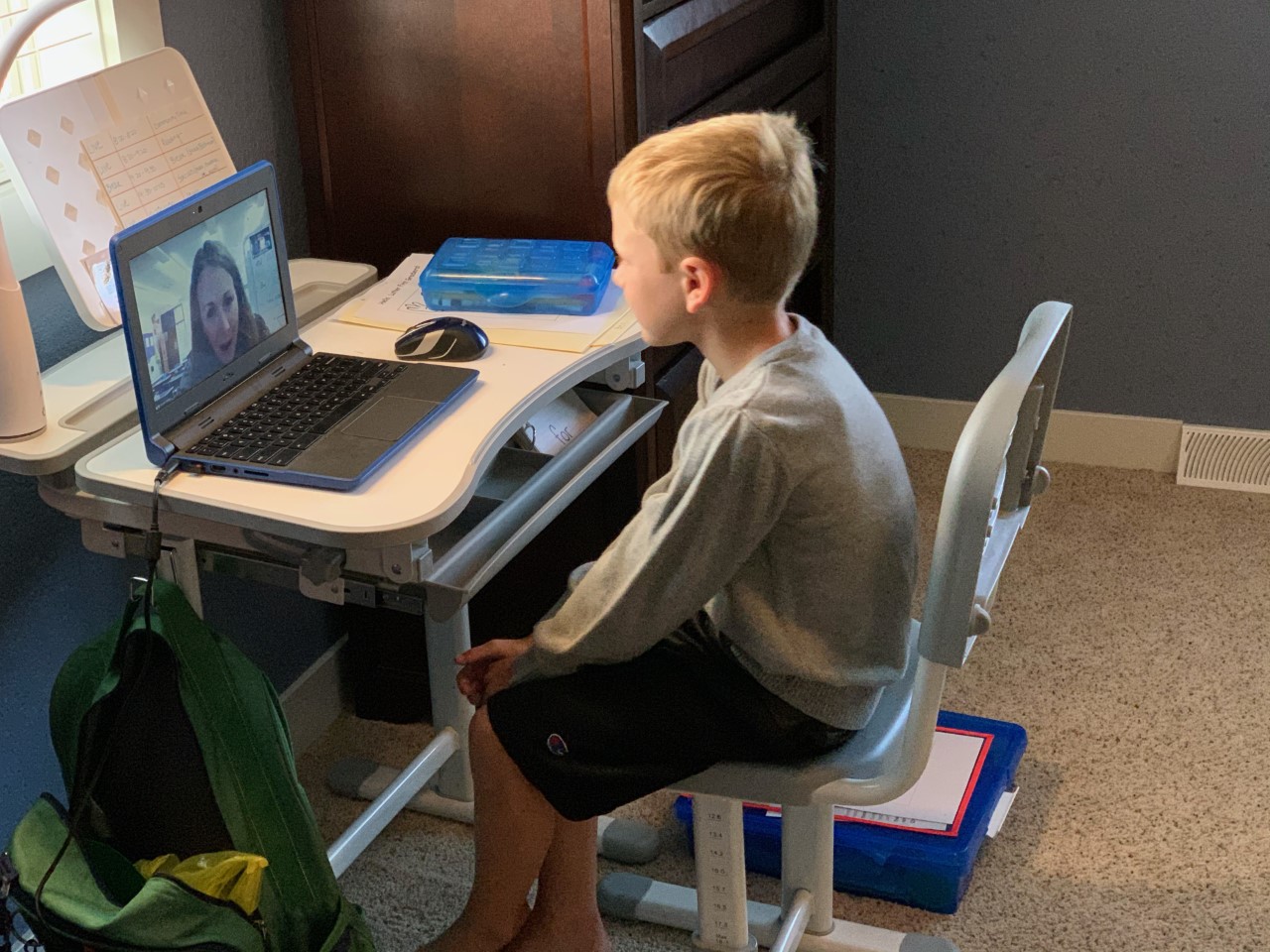

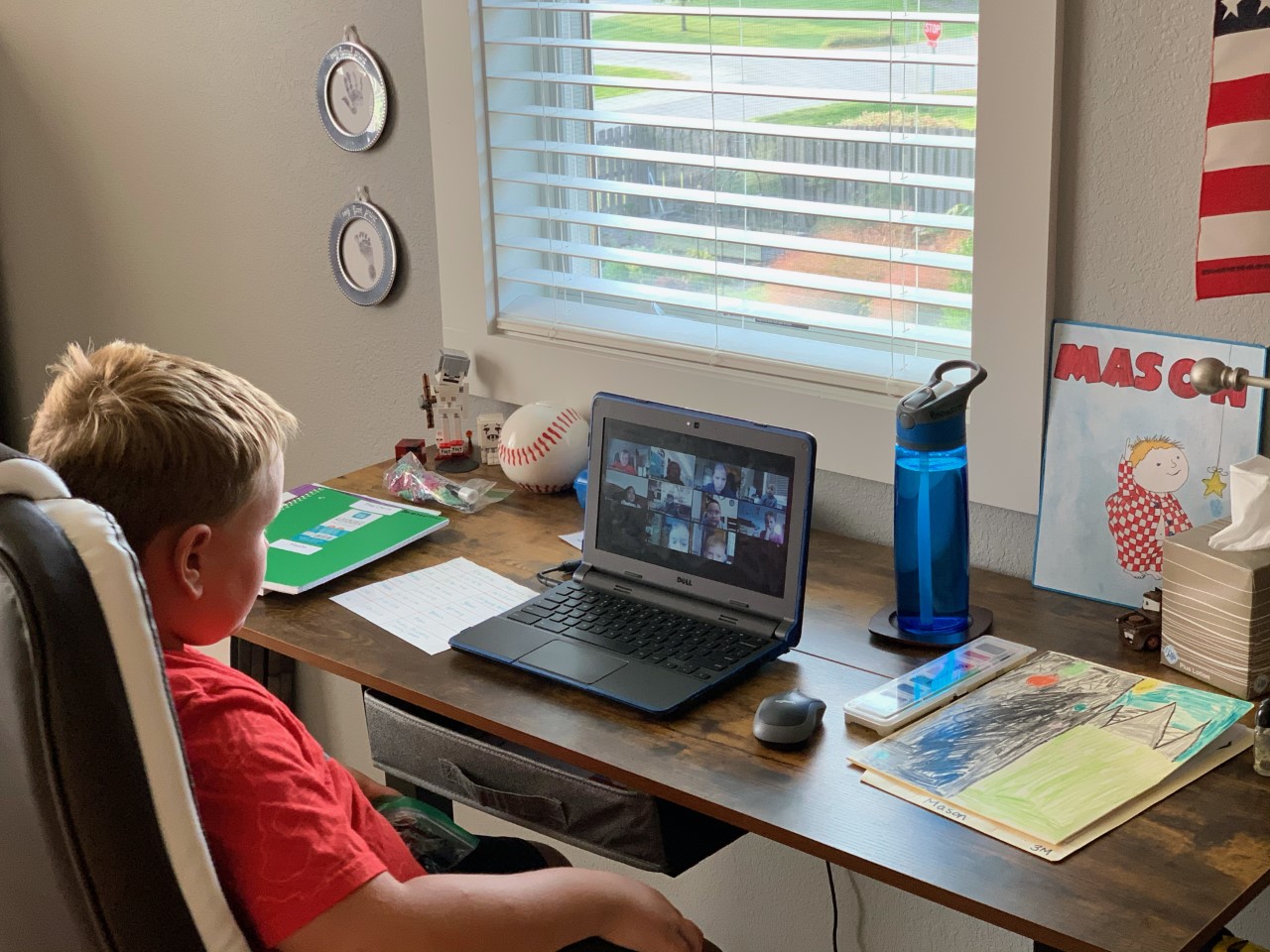

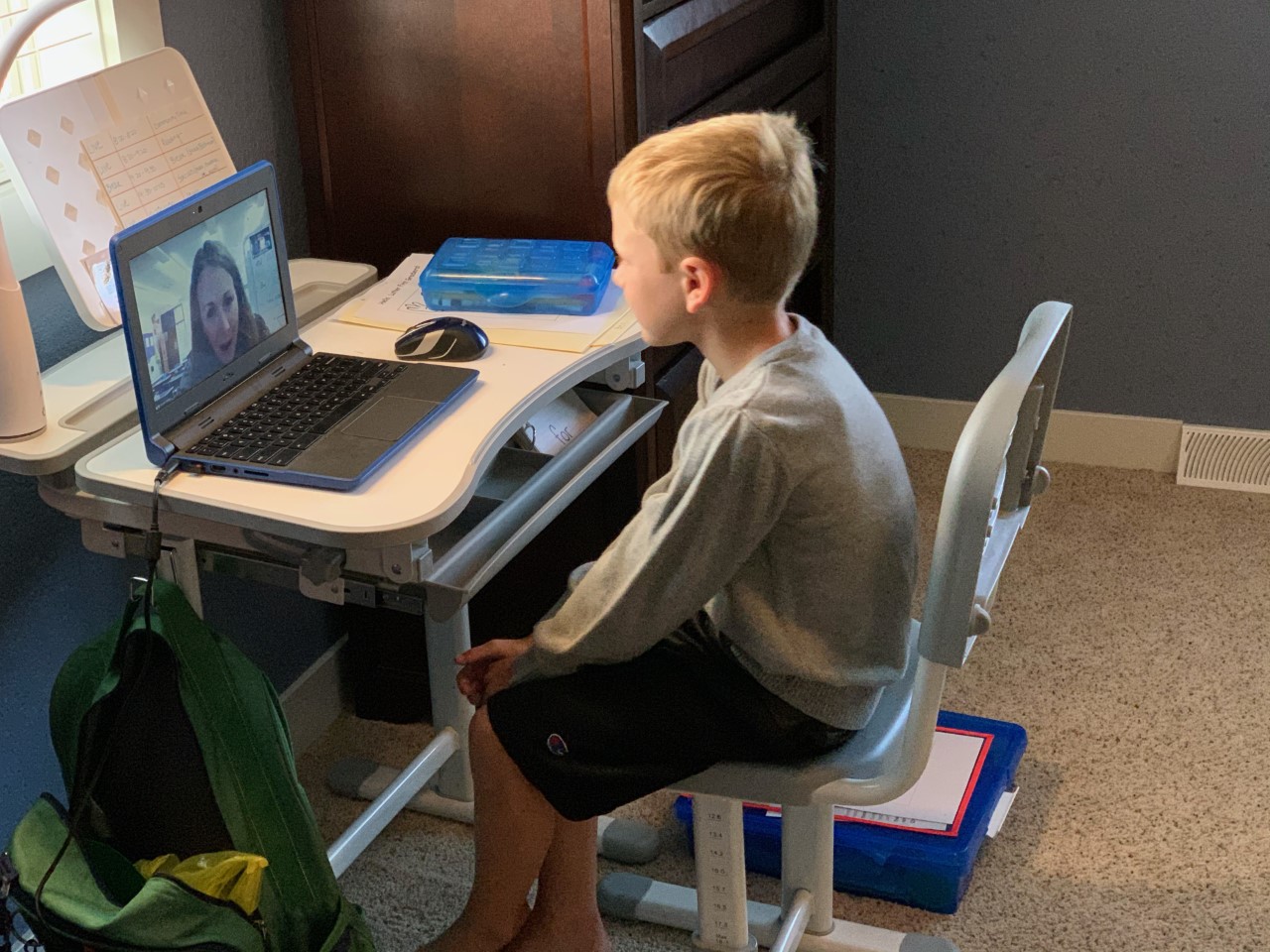

In addition to all of the other complications created by what has been a very complicated year, it’s likely that both you and your business clients have encountered the difficulties of coordinating a remote workforce at some point in 2020. From trouble with Zoom calls to remote notarizations, the problems associated with working from home can be frustrating. Unfortunately, with Covid cases on the rise, many workforces may again make the transition back to remote work environments. Many may have never transitioned back to the office at all. One issue that should not be forgotten as both your agencies and your clients prepare for a winter working from home is the possibility of workers’ compensation liability even when an employee is off company property. While ensuring employee safety from afar may seem impossible, there are steps that can be taken to reduce the risk.

Remote Workers’ Compensation Liability

Worker’s compensation laws vary by state, but under most state laws, including Wisconsin’s, employers are liable for employee injuries that arise both out of and during the course of employment. According to Wisconsin’s Department of Workforce Development, this liability extends to “[a]n injury occurring away from the company premises, but while the employee is still performing service for the employer and under the employer’s direction and control.” Moreover, an employee whose job requires travel is covered at all times during a business trip. While air travel and hotel stays may have seen a significant recent drop, many companies have likely seen their employees driving more for work. Importantly, traffic accidents occurring while on company time are compensable under Wisconsin’s workers’ compensation laws. All of this combines to mean that workers’ compensation liability can extend far beyond the brick and mortar.

Now What?

The prospect of ensuring a safe work environment for at-home workers can seem daunting for employers, but it can also get lost in the shuffle of the logistical issues currently facing businesses around the world. Reaching out to your clients with a list of best practices for protecting at-home employees will not only generate goodwill, it may also reduce the prospect of future liability.

Specifically, here are some recommended practices when engaging a remote workforce:

• Require express written authorization before an

employee can work remotely

• Update and maintain accurate employee job descriptions

and expectations, and confirm that employees

understand the specific responsibilities of their positions

when working from home

• Require employees to specifically define their home

office space and provide employees with information

and training about safe workstation set-ups, consistent

with your in-office practices

• Create and maintain a safety checklist for home offices

to ensure employees’ offices are free from any recognized

hazards

• Remind employees, in writing, of their obligation to

promptly report all work injuries consistent with your

worker’s compensation and safety policies, even if they

occur at the remote worksite

• Remind employees, in writing, of who should receive

any reports of injuries that occur in their home office

environment

• Require both non-exempt and exempt employees to

record and maintain a detailed record of actual time

worked, including a detailed record of meal breaks and

other personal breaks during the workday.

While a remote workforce can create innumerable complications, it is still important to ensure that employee safety does not get lost in the shuffle. Continue to follow updates from the IIAW and this column for more suggestions on how to best protect your agencies and serve your clients.

Tags:

commentary from counsel

insuring Wisconsin

remote work

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

work from home

workers' compensation

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, January 26, 2021

|

It's hard to believe January is almost over - today marks the last Wednesday of the month! This week we are discussing IIABA's new Agency Guide to Getting Started With Social Media, a new report identifying and ranking the top risks of 2021 by likelihood

and how PPP loans could be taxed by state.

The Agency Guide to Getting Started with Social Media

IIABA has released their new guide to help agencies get started with social media, and while we won't give away everything in the report - there are a few key topics that we wanted to break down.

First, the guide outlines the demographics that mainly use each platform:

• Facebook - 46% of American users are age 65+, 75% of ages 18 to 45 use Facebook. Usage among those ages 20-30 and 30+ is similar to these stats.

• Instagram - 75% of Americans ages 18-24, 57% of Americans age 25-29, 47% of Americans age 30-49 and 23% of Americans age 50-60 use Instagram.

• Twitter - 44% of Americans age 18-24 use Twitter. 80% of people under 50 use Twitter globally and Twitter tends to skew mostly male for its users.

• LinkedIn - 27% of Americans age 26-35, 34% of Americans age 36-45 and 29% of Americans ages 56+ use LinkedIn.

This guide also breaks down the main content trends for 2021:

• Content value will beat production value

• Conversational marketing will change its tone

• Consumers will crave snackable content (content that is very short and memorable)

• Video will continue to take center stage

This is just a glimpse at the great content shared within this guide. If you want to dive deeper, check out the IIAW's Digital Marketing Playbook here.

Top 5 Risks of 2021, Ranked By Likelihood

The results for the Global Risks Perception Survey from Zurich have been released. The 2021 Global Risks Report includes an analysis of the growing social, economic and industrial divisions in the U.S. and abroad, their interconnections, and their implications

on society's ability to resolve major global risks. According to NU Property Casualty 360, "Researchers believe the factors of job losses, a widening digital divide, disrupted social interactions and and abrupt shifts in markets could lead to 'dire

consequences and lost opportunities' for large parts of the global population."

According to the report, "Short term threats (0-2 years) show concern with the immediate impact of the crisis on lives and livelihoods - among them are infectious diseases, livelihood crises, digital inequality and youth disillusionment.

In the medium-term (3-5 years), respondents believe the world will be threatened by knock-on economic and technological risks that may take some years to crystalize, such as asset bubble bursts, IT infrastructure breakdown, price instability and debt

crises. Existential risk - weapons of mass destruction, state collapse, biodiversity loss and adverse technological advances - dominate long-term concerns (5-10 years)." Read more here.

PPP Loans Could Be Taxed by State, Central Wisconsin Business Weighs In

Businesses who received PPP loans will have to pay Wisconsin state taxes on them. According to WAOW, "The federal government is allowing businesses to make deductions on those loans, but the Wisconsin Department of Revenue website says:

'A taxpayer that received a covered loan guaranteed under the PPP and paid or incurred certain otherwise deductable expenses listed in section 1106 (b) of the CARES Act may not deduct those expenses in the taxable year in which the expenses were paid or incurred if, at the end of such taxable year, the taxpayer reasonably expects to receive forgiveness of the covered loan on the basis of the expenses it paid or accrued during the covered period, even if the taxpayer has not submitted an application for forgiveness of the covered loan by the end of such taxable year.'

Co-owner of Wausau's Bull Falls Brewery, Michael Zamzow, hopes that something changes before Tax Day, as he the loan would be more impactful if the funds weren't taxed. Read more here.

For more news, check out the Action News section of our weekly e-newsletter

Big I Buzz.

If you aren't subscribed, click

here

to add your email to our emailing list. Don't forget you can stay up-to-date on other industry news and conversation by joining the IIAW's Online Community, exclusively for IIAW members.

You can join the Online Community here.

We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Monday, January 25, 2021

Updated: Thursday, January 7, 2021

|

By: Mallory Cornell | IIAW Vice President & Director of Risk Management Reducing Exposures for Direct Commission Payments Can I get a ‘woohoo’ for talking about E&O exposures?

Hello?

Anyone out there?

Just me, huh?

That’s ok, I’m not offended. I know there are a couple of you out there because I’ve had some great E&O exposure questions come in the past few months. The scenario below came in more than once so that’s my cue to make sure I share it with the greater audience – just in case you don’t want to call and ask.

Scenario: A licensed agent is writing life insurance on behalf of the agency but receives 100% commission and the commission check is sent directly to the agent. If the commission is going directly to the agent, is there E&O coverage for that agent since its not funneling through the agency?

Sound familiar? It might and so should the term “insurable interest”. That is what your E&O carrier would need to show in order to cover any E&O issues that may arise between the agent and this customer.

E&O Coverage Tip: All company contracts should show the agency, not just the agent. Furthermore, business written between agents and costumers must be on behalf of the agency for that agent to be covered under the agency’s E&O policy.

If you have a question about E&O coverage feel free to give us a call. Its likely you’re not the only person who is wondering and E&O risk might be more fun to talk about than you think.

Tags:

insuring Wisconsin

Risky Business

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, January 20, 2021

|

Happy Wednesday! This week we are discussing the new start to tax filing season, how COVID's effect on workers' comp claims has varied by state and the newest update to Wisconsin's mask mandate. IRS Delays Start of Tax Filing Season to Feb. 12 Typically, tax filing season starts in late January for those who want to get a head start on their taxes and receive their refunds a little earlier. This year, the tax filing season doesn't start until February 12th. Because of the COVID Relief Act that took effect in late December, the IRS will need more time to prepare for tax season. However, the filing deadline is still April 15th. How COVID Effect on Workers' Compensation Claims Has Varied by State, Industry According to new research and Insurance Journal, "The percentage of COVID-19 claims among all workers compensation paid claims has varied greatly among states and occupations, as has the decrease in non-COVID claims. The Workers Compensation Research Institute (WCRI) has found that there has been a substantial concentration of COVID-19 claims among workers employed in service industries (85 percent in 2020 second quarter), particularly in assisted living facilities, hospitals, and the offices of physicians and dentists." Read more about the study here. Gov. Evers Officially Extends Wisconsin Mask Mandate to March 20 On Tuesday January 19th, Gov. Tony Evers extended the statewide mask mandate requiring face coverings through March 20th. Alongside the extended mask mandate, he proclaimed a new public health emergency, designating the Wisconsin Department of Health Services as the lead agency in response to the COVID-19 pandemic, and authorizing the Adjutant General to activate the Wisconsin National Guard if needed. Read more about Executive Order #104 and Emergency Order #1 here. For more news, check out the Action News section of our weekly e-newsletter Big I Buzz. If you aren't subscribed, click here to add your email to our emailing list. Don't forget you can stay up-to-date on other industry news and conversation by joining the IIAW's Online Community, exclusively for IIAW members. You can join the Online Community here. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Monday, January 18, 2021

Updated: Thursday, January 7, 2021

|

By: Connie George, CPCU, ARM, AU, AIM Wahve Placement Specialist

Remember when power-napping at work was a trend? Or when gym balance balls suddenly cropped up in workplaces to help improve posture? And who can forget when Stephen R. Covey’s The Seven Habits of Highly Effective People hit the shelves in 1989 and that’s

all everyone talked about? This year, an inconspicuous workplace trend has emerged, and it’s one you may take for granted: working from home with pets.

Dog adoptions and sales have skyrocketed this year. It began in March with a sudden surge in demand, and by mid-summer, many shelters, breeders, rescues and pet stores reported more demand than could be filled. As we continue to settle into our work-from-home

lives, many of us are now reaping the benefits of spending more time with our furry companions.

Pet lovers have long intuitively felt the benefits and joys that dogs and cats bring – and there’s science behind these benefits. Scientists believe that the source of humans’ positive reaction to pets stems from oxytocin, a hormone that stimulates bonding,

relaxation and trust – and eases stress.

Working from home with a pet can also reduce anxiety, loneliness and depression, which is especially important now, as more people suffer from mental health issues and businesses struggle to provide support.

Beyond mental benefits, studies also show that pet owners are more likely to stay physically active, and tend to have lower blood pressure and cholesterol levels.

Here’s another surprising benefit. According to The Health and Mood Busting Benefits of Pets, studies have shown that pet owners over 65 make 30 percent fewer visits to their doctors than those without pets. What company wouldn’t be in favor of better

health and fewer doctor visits for their employees?

The verdict is in: being at home with pets can make working from home more enjoyable and productive – and that’s the way it should be. Our pets wake us up in the morning, sit at our feet as we sip our morning coffee, and they settle into sun-soaked naps

as we join Zoom calls. They give us more unconditional love than we could ever deserve – and are right there with wagging tails through good days and bad.

So, the next time your dog barks during a conference call, you’ll have to forgive his minor transgression and remember all that he does for your health and well-being. Spending all day with your pet may

just be the most underrated benefit of working from home.

Tags:

insuring Wisconsin

remote work

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, January 13, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing a new update to the Dane County COVID-19 restrictions, how social media ghosts can cause a risk management nightmare and how you can stay up-to-date on what's happening in politics and government. Dane County Issues New Public Health Order, Increases Outdoor Gathering Limits A new Emergency Health Order goes into effect on Wednesday, January 13th. The order allows for indoor gatherings of up to 10 people (mirroring the previous Emergency Health Order) and limits outdoor gatherings to 50 people (increased from the last Emergency Health Order's outdoor capacity limit of 25 people.) Schools are still allowed to continue in-person learning for all grade levels, and colleges, universities & other higher education centers can also remain open. Restaurants in Dane County can offer indoor seating capacity of 25%, while restrictions remain the same for bars and taverns. According to the City of Madison, violation of the emergency order could result in a $1,000 fine. Read more here. Social Media Ghosts Are Real In May, the United Way of Southeast Missouri faced a fake social media profile that claimed to be an employee of their business posting racist memes and causing an uproar online. While they worked to mitigate the damage from this fake profile, they are still needing to respond to comments about the fake profile months later. This 'ghost' caused reputational damage and they needed to use their workforce for the first week of this incident to respond to angry emails, comments and other communications about the fake profile. According to Property Casualty 360, "The organization did not have insurance coverage for the incident for this incident. And even if it had a cyber policy, it is unlikely it would have responded. Cyber insurance typically covers losses from computer-based attacks on a firm's information technology systems. Claims payments compensate for costs from the theft of data, loss of funds from online fraud, or lawsuits from privacy or regulatory violations... But the reputational damages from incidents like this are tricky to quantify. While there's no simple, easy-to-buy insurance protection from social media ghosts, you and your client organizations can take away a few important lessons from the United Way's ghostly experience: • Create a crisis plan. • Engage experts. • Stay on message. • Move fast. • Ask critics for viral help. • Strengthen your diversity and inclusion action plan." Learn more about the incident and how you can prepare for this harsh social media reality here. Stay Up-to-Date on What's Happening in Politics and Government The IIAW's Online Community offers 11 different Groups to join, one of those being our Government Affairs Group. This Group will keep you informed on all the state and federal changes happening politically and emerging issues. This Group monitors legislation on state and national levels, they help direct grassroots lobbying efforts to support legislative activities. If you're not already one of the over 180 members of our Online Community, click here to join. For more news, check out the Action News section of our weekly e-newsletter Big I Buzz. If you aren't subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Monday, January 11, 2021

Updated: Thursday, January 7, 2021

|

By: Paul Rudersdorf | SFB CEO & President

Not every bank is equipped to finance the purchase of an insurance agency simply because they don’t understand the nuances of the industry. At Security Financial Bank (SFB), we’re different. When we say we get it – we really do. We understand that excellent

management leads to business stability and customer retention. We see your book of business as a predictable earnings stream.

But, it wasn’t always like that. Initially, our lenders and credit analysts were uninformed about what comprised the financial viability of an insurance agency. So, we decided to get educated.

First, we needed to have a basic understanding of the industry. A CPA firm with industry expertise met with our lending and credit teams over several sessions to educate us on how agencies are valued and how to analyze and dissect an agency’s “book

of business.” This was an invaluable exercise.

Subsequently, we had the opportunity to educate our Board of Directors so all areas of the bank had a strong understanding of what makes an insurance agency prosper.

And eventually, we even created a separate section in our loan policy to address this significant niche.

Over the years, we have learned that for a bank to partner in lending with an insurance agency, it requires much more than turning on a switch to enter this lending arena. There is work to do and knowledge to acquire. At SFB, our commitment

began with education and has taken years to refine by doing transactions that make sense.

If you would like to learn more about how we can use our industry expertise to help you with your next project, please contact us. We look forward to partnering with you.

Tags:

finance

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Thursday, January 7, 2021

|

Date: November 25, 2020 To: Insurance Licensees and Registrants From: Mark V. Afable, Commissioner of Insurance

Beginning February 1, 2021,the Office of the Commissioner of Insurance (OCI) will send license renewal notifications only by email,rather than the current practice of sending renewal notifications via email and U.S. Mail. OCI currently sends renewal notifications to all licensees/registrants via U.S. Mail and email using the business email address on file within 60 days of a licensee’s expiration date. Beginning in February, OCI will only be sending notices to your business email address. How Does This Affect You? If your license/registration expires January 31, 2021 or February 28, 2021, you will still receive your renewal notification via email and U.S. Mail within 60 days of the expiration date. If your license/registration expires on or after March 31, 2021, you will only receive an electronic renewal notification at your business email address. What Should You Do? Check your licensing/registration information using the SBS portal at https://sbs.naic.org/solar-externallookup/license-manager to ensure that all your contact information including your business email is accurate and up to date. You can change your email information using one of the following methods: 1. Email OCI directly at ociagentlicensing@wisconsin.gov 2. Change your email with SBS through the SBS portal 3. Individual licensees/registrants can go to NIPR and submit email changes through the following link https://nipr.com/licensing-center/ change-contact-info Current Information is Required Section 6.61 (1) and 6.61(15), Adm. Code. states that each intermediary or intermediary firm shall, within 30 days, notify the commissioner of insurance in writing any change in the intermediary’s name, residence address, contact email address, business address, or mailing address. You may also refer to the following link for specific guidance on license/registration changes: https://oci.wi.gov/Pages/Agents/UpdateLicenseInformation.aspx#AgentAddress Please note: some emails may go into your spam or junk mail folder. Make sure you check those folders so you do not miss the email reminder and risk your license/registration becoming inactive. If you have any questions, please reach out to the OCI office at ociagentlicensing@wisconsin.gov or call their agency licensing team at 1-800-236-8517.

Tags:

insuring Wisconsin

OCI

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, January 6, 2021

|

Happy New Year! We hope everyone had a happy holiday season. On this week's Big I Buzz, we are discussing what agencies can learn from Amazon's entry into auto insurance, six tips to start 2021 off the right way and our upcoming Agency Leadership Webinar Series. Amazon's Entry into Auto Insurance Holds Valuable Lessons for Agencies According to Insurance Business Magazine, "Last month, Amazon made its entrance into the Indian insurance market when it partnered with Acko General Insurance to sell auto insurance products for two- and four-wheeled vehicles in the country. The move reflected a broader trend of technology giants showing increased interest in the insurance industry." US insurance agents don't need to worry about Amazon's entrance just yet, as experts say that Amazon is far from taking over the auto insurance market in this part of the world. So what can this teach US agencies? "Insurance companies need to focus on meeting the needs of consumers who want a frictionless buying experience, like the one provided by Amazon. If they instead make customers go through a lot of hoops, such as long claims processing and lots of paperwork, they are bucking the trend of the easy, quick, and frictionless service that consumers are looking for. This is a critical misstep considering when it comes to selling insurance, agencies' competitive advantage lies in how they engage with the client." Read more here. Agency Leadership Webinar Series - Agency Technology Join us at 10 a.m. on Tuesday, January 19th for our next installment of our Agency Leadership Webinar Series. Our featured speaker is Steve Anderson, author of "The Bezos Letters - 14 Principles to Grow Your Business Like Amazon" and world-renowned agency technology expert.You won't want to miss this webinar - register here. 6 Tips to Start Your New Year the Right Way 2020 was a very long year, and now it's time to clean the slate and start anew. For 2021, here's a few tips that you can follow to start the year off right: 1. Do a self-review According to News12, "Despite 2020 being full of unexpected moments, hopefully, you were still able to find time to accomplish some goals that you had set for yourself at the beginning of the year. Ask yourself what personally went well and what you'd like to improve as the new year begins. What skills or relationships did you develop that were a bright point in your year? What caused you stress this year? A self-review like this can help you to better understand the highs and lows of the last year and set a precedent for a great year ahead." 2. Finish Tasks You may have ended 2020 with a to-do list of things that you didn't have time to finish. Start crossing them off now to free up your list for new things you want to accomplish in 2021. 3. Reach out to loved ones We may still be facing COVID-19 and its restrictions, but 2021 is the perfect time to reach out to your loved ones (virtually for the time being.) 4. Clean Up A tidy space can help you mentally prepare for the new year. Whether you choose to do a quick tidy or a deep clean, studies show that a clean space is associated with more positive emotions like happiness, satisfaction and calmness. 5. Set New Goals Create your 2021 goals but make sure these are SMART goals (specific, measurable, achievable, realistic and time-based). 6. Put Yourself at the Top of the List Make yourself a priority this year to help you reach your own goals! For more news, check out the Action News section of our weekly e-newsletter Big I Buzz. If you aren't subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Monday, January 4, 2021

|

By: Matt Banaszynski | CEO of IIAW

Congratulations! You made it to 2021. 2020 will almost surely be defined by the COVID-19 pandemic. Despite the challenges presented by the pandemic, I see 2020 as the year I gained new perspectives, discovered five years’ worth of innovation in one year,

and came to appreciate the little things in life that in a normal year often get overlooked. Recently, I was sitting in my office and was reminded of an article I read back in April titled, “What Hard Times Teach Us: 5 Pandemic-Inspired Lessons That Will Make You Better For The Long Term” by Tracy Brower. I thought I would combine some of her advice with my own words of wisdom that came to mind when I introspectively

examined what I learned from this past year. I thought I would share them with you before I file away 2020 in hopes of making 2021 the best year yet!

Patience: If you have children, you may have an abundance of patience or lack it

entirely, but one thing is for sure, this pandemic pushed it to its limit. Whether it was/is navigating and balancing the complexities of virtual learning with working remotely, waiting for the quarantine to lift, or anticipating your favorite

restaurants to reopen and spring back to life. One thing was for sure, we are never going back to “normal”.

Finding patience can yield a different perspective and even at times, new appreciations in life. As importance as patience is to your well-being, it is also important to understand and recognize the sign of impatience.

According to Mindtools.com, “Patience is a vital quality in the workplace. It can reduce stress and conflict, lead to better working relationships, and help you

to achieve your long-term life and career goals. Many of us struggle with impatience. Learn to recognize the physical and emotional symptoms associated with it, and to identify the situations that trigger it. When you understand the causes

of your impatience, you can develop strategies to prevent or overcome it. These could include attending to your physical well-being by using deep breathing and relaxation techniques and developing your empathy and emotional intelligence skills”.

Playing the long game: A term often used to describe how taking the necessary

steps now will to set yourself up to long-term success. It means not sacrificing long-term gains for short-term wins. Tracy Bowers says, “With a narrow perspective, current reality can be even more challenging, but by taking a longer-term

view, you can reassure yourself that current realities will shift, and good things will come—ultimately—from today’s experiences and lessons”. Warren Buffet once said, “Someone is sitting in the shade today because someone else planted a tree

a long time ago.” Do not focus on the here and now, especially when the here and now are so tumultuous. Take solace in the fact that this too shall pass, you will get through it and you will be better because of it. The race is long, and in

the end, it’s only with yourself!

Adaptability: A term that most certainly comes to mind when you look to define

2020. You cannot always control what happens, but you can control how you respond. Benjamin Franklin famously proclaimed, “Change is the only constant in life. One’s ability to adapt to those changes will determine your success in life”. This

guiding principle is one that has propelled the American spirit forward for generations and will continue to do so. Some consider this soft skill the most important. As Bob Dylan famously sang, “The times, they are a changin’.” Being adaptable

allows you to take control and chart your own course, instead of just letting things happen around you. Remember, change is constant, even without global pandemics, our industry is undergoing a significant amount of change. Be empowered in

the face of change.

In his article in Forbes entitled, “14 Signs of an Adaptable Person,” Jeff Boss identifies the following traits of

adaptable people: they experiment, they see opportunity where others see failures, they are resourceful, they think ahead, they don’t whine, they talk to themselves, and they don’t blame others. They also don’t claim fame, they are curious,

they open their minds, they see systems, and they stay current.

If you do not possess these traits or would like to refine them, there are ways you can train yourself to be more adaptable. Consider reading, “How to Survive Change . . . You Didn’t Ask for: Bounce Back, Find Calm in Chaos, and Reinvent Yourself”

by M.J. Ryan.

Resilience: Research shows that resilience is enhanced by having a clear view

of reality, a sense of meaning and an ability to improvise. In addition, according to Professor de Weerd-Nederhof of the University of Twente, resilience is both a personality trait

and a skill. Hard times may be easier if it is part of your character, but it’s also a competence you can develop through today’s challenging times. The American Psychological Association has a great short read on “Building your Resilience” that is worth checking out.

If you would like to become more resilient, consider these tips:

• Get connected.

• Make every day meaningful.

• Learn from experience.

• Remain hopeful.

• Take care of yourself.

• Be proactive.

Responsiveness: Reacting quickly and positively is an art and an interquel part

of good customer service. Responsiveness is a must-have in your communication and customer service toolbox. You show responsiveness through prompt attentiveness when asked for something. This term likely took on new meaning during 2020. Perhaps

you found it more important than ever to be responsive to the needs of your loved ones, co-workers, customers, and other business partners. Being responsive creates an opportunity to build trust and respect by acting quickly and proactively,

thus eliminating concerns and anxiety during a time of uncertainty. Being responsive during these turbulent times meant the opportunity to create a deeper, more meaningful connection. Consider these 7 ways to be more responsive to your customers

according to SmallBizDaily:

1. Ask your customers what they want.

2. Manage customer expectations.

3. Develop procedures.

4. Educate your employees.

5. Provide self-service options.

6. Use technology.

7. Stay human.

Gratitude: Being grateful for the people and things in your life that have a

positive impact is critical to happiness. Whether you’re appreciating the companionship of friends, extended time with family, or the bond you’re building with coworkers through shared struggles, there is a lot to be thankful for. Be sure

to share your gratitude to those that have contributed towards it and do not be afraid to

“pay it forward”.

Happiness: Happiness is a mindset that can be difficult to explain or define.

Much like beauty is in the eye of the beholder, it’s different for everyone. Happiness is an important component to a meaningful life - it can provide a sense of purpose. It’s also something that doesn’t come easy and needs to be earned.

Regularly indulging in small pleasures, getting absorbed in challenging activities, setting and meeting goals, maintaining close social ties and

finding purpose beyond oneself all increase life satisfaction. It isn’t happiness that promotes well-being, it’s the actual pursuit that’s crucial.

If you want to learn how to boost your wellbeing with strategies from groundbreaking research, visit happify and read through the resources on The Science of Happiness and How to be Happy.

Self-discipline: Self-discipline is about controlling your feelings to overcome

your weaknesses - something many of us may have found challenging in 2020. Sure, you can binge-watch your favorite tv show instead of working remotely from home, but as Tracy Bower puts it, “This is a great time to learn new approaches to

managing your behavior and building new habits”. Self-discipline is an essential quality, and it’s a key differentiator between people who are successful in life and those who struggle to be.

Make sure that you take time to continually develop it!

According to MindTools.com: To develop self-discipline, follow these steps:

1. Choose a goal.

2. Find your motivation.

3. Identify obstacles.

4. Replace old habits.

5. Monitor your progress.

Instituting and refining self-discipline won’t always go according to plan. You will have ups and downs, successes and failures. The key is to keep moving forward. When you have a setback, acknowledge what caused it and move on. It is easy to

get wrapped up in guilt, anger, or frustration, but these emotions will not help build or improve self-discipline. Instead, use the setbacks in your plan as learning experiences for the future.

Self-care: Taking care of your physical, mental, and emotional health is

more important than ever during these stressful times. Develop a process of purposeful engagement in strategies that promote healthy functioning and enhance your well-being. Physically speaking, be sure to get enough sleep, eat healthy

and exercise. Social and mental self-care can be difficult in times of isolation. Find ways to get face-to-face (virtually and physically), nurture your relationships with friends and family, make time for activities that mentally stimulate

you and find ways to proactively invigorate your life. Set goals to realize your ambitions or aspirations. Develop methods and outlets to allow you to process and recognize your emotions.

Incorporate activities that help you recharge. Assess which areas of your life need attention and as your situation changes your self-care should as well. Self-care is vital for building a resilience toward those stressors in life that

you can’t eliminate or predict.

Enhancing Your Community: You have probably heard the phrase, “It takes a

village…” The truth is that it takes a village to achieve just about any meaningful change in your life. This term took on much more meaning in 2020. You leaned on your various communities, tribes, networks, cliques, associations or whatever

you want to call it for support, and you worked harder to provide help and assistance to those that need it in your community. Your community may have evolved to include more people or it may have shrunk to focus more of your efforts on

those who needed it most. Building, supporting, and connecting with your community is as important as it has ever been.

Tracy Bowers perfectly concluded her article (far better than I can for this one) by saying, “You’ve pushed yourself beyond your limits—not by choice—but by necessity. The good news is these hard times can be the catalyst for new habits, behaviors

and lessons. You’re finding perspective by learning to operate your patience button (or just find it) and taking the long view. You’re learning more about resilience and your response by expanding your adaptability and coming up with creative

hacks. You’re reinforcing your appreciation for community by connecting with others and embracing gratitude. And you’re managing yourself in new ways with self-discipline and self-care. Perhaps best of all, you’re finding new paths toward

happiness. All of these will pay off for you today, but also in the new normal of tomorrow.”

My concluding opinion: advice is a form of nostalgia, and dispensing it is

a way of fishing the past from the disposal, wiping it off, painting over the ugly parts and recycling it for more than it’s worth! If I can offer you one tip for the future, it is this…

Whatever you do, don’t congratulate yourself too much or berate yourself either. Your choices are half chance, so are everybody else’s!

Tags:

insurance bartender

insuring Wisconsin

wisconsin independent agent

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|