|

|

Posted By Kaylyn Zielinski,

Wednesday, May 19, 2021

Updated: Wednesday, May 19, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing how the Wisconsin DMV is looking to adjust their road test, the latest updates in the CDC COVID-19 recommendations and why nearly 800 residents of French Island are planning to sue the city

of La Crosse, WI.

Wisconsin DMV Looking to Make Road Test Waiver Program Permanent

The Wisconsin Department of Transportation began to pilot a program that would allow 16 and 17-year-olds to skip the road test requirement in Wisconsin. With over 49,000 waivers being signed since the program started last year, the DMV believes that the

waiver option has been beneficial and they're looking to have the program be made permanent.

According to WEAU, "Instead of actually getting behind the wheel to get their license, parents of the teens can go online and choose to waive the road test for their child. Officials with the Department of Motor Vehicles said teenagers are required to

hold a drivers permit for at least six months, required to complete the approved driver education courses with third-party schools or with their high school, and have to log at least 30 hours of driving with their parent or sponsor in a variety of

conditions. Then, the teenagers can receive a probationary driver's license online, where distractions are limited in the car by requiring them to only have one person in the vehicle that's not related to them, and then there are limited hours that

they can operate the vehicle." Read more here.

CDC Says: Fully Vaccinated People No Longer Need to Wear a Mask or Physically Distance in Any Settings

On May 13, the CDC made changes to the public health recommendations for fully vaccinated people. The CDC released these recommendations: "

"Fully vaccinated people can:

• Resume activities without wearing masks or physically distancing, except where required by federal, state, local, tribal, or territorial laws, rules and regulations, including local businesses and workplace guidance

• Resume domestic travel and refrain from testing before or after travel or self-quarantine after travel

• Refrain from testing before leaving the United States for international travel (unless required by the destination) and refrain from self-quarantine after arriving back in the United States

• Refrain from testing following a known exposure, if asymptomatic, with some exceptions for specific settings

• Refrain from quarantine following a known exposure if asymptomatic

• Refrain from routine screening testing if feasible"

In light of the CDC's guidance saying that fully vaccinated people can stop wearing masks outdoors in crowds and in most indoor settings, some businesses are lifting face mask requirements for customers who are vaccinated. This has raised questions about

medical privacy, leaving many to wonder whether asking for proof of a COVID vaccine is a HIPAA violation. Multiple news outlets have reported that non-health-care businesses don't violate HIPAA if they ask for proof of a COVID-19 vaccine. HIPAA is

applied within people in the medical-related fields, including insurance and medical providers. However, HIPAA doesn't protect personal health information in every situation. According to Kayte Spector-Bagdady, a medical ethics researcher at the University of Michigan, said, "HIPAA only governs certain kinds of entities - your clinician, hospital or others in the health care sphere. It does not apply

to the average person or to a business outside health care. It doesn't give someone personal protection against ever having to disclose their health information."

Nearly 800 Residents to Sue Wisconsin City Over PFAS Contamination

Following contamination of private drinking water wells from chemicals known as PFAS, nearly 800 residents of French Island plan to sue the city of La Crosse, Wisconsin. This could expose the city to up to more than $39 million in claims.

According to Insurance Journal, "The Wisconsin Department of Natural Resources last year launched an investigation that includes the city of La Crosse regarding contamination on the island stemming from the La Crosse Regional Airport. The DNR flagged

two city wells for the presence of PFAS, which have since been taken out of service, Wisconsin Public Radio reported." Read more here.

For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Don’t forget you can stay up-to-date on other industry news as its happening on our Online Community. You can join the Online Community (exclusive to IIAW members)

here . We hope that everyone has a great rest of their week.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Friday, May 14, 2021

Updated: Wednesday, May 12, 2021

|

You may have noticed the recent buzz surrounding ADA and Fair Housing Act (FHA) violations as it relates to website accessibility requirements. Law firms in Florida, California, Colorado and Massachusetts have been targeting insurance agency websites

for ADA or FHA violations. Different law groups will send demand letters looking for quick financial compensation for the allegation that the website is not meeting federal accessibility guidelines.

In the past couple years, insurance agency websites have been brought into the mix. The attorneys are looking for a quick settlement outside of a court for violating the ADA or FHA guidelines. An important fact to point out is that zero of these cases

have been decided in a court of law and very few turn into a lawsuit. However, that doesn’t mean they won’t be in the future; it just means there is no case law surrounding this issue.

So you may be wondering, what is ADA website accessibility? Well, nobody knows as there is no case law and no legislation regarding website accessibility rules and the American’s with Disabilities Act was created before the internet was a thing.

All that is known is that the ADA applies to websites.

While there are no clear accessibility guidelines, the generally accepted level of care to follow is the Web Content Accessibility Guidelines (WCAG). WCAG 2.1 is the most recent version to follow. These guidelines have the goal of making web content

perceivable, operable, understandable and robust.

The issue with WCAG 2.1 is that to be 100% compliant, it likely means to redesign and rewrite an entire website.

The cost associated with redesigning a website to be “ADA compliant” is likely thousands, if not tens of thousands, to meet every WCAG 2.1 requirement. The full WCAG 2.1 guidelines can be found here - it's only 83 pages long.

While 100% compliance may be difficult, other solutions exist to become up to 95% compliant. Enter the world of Accessibility Widgets. These are text/website overlays that require you to add a short line of code into your website that creates a small

button in the corner for web visitors to click on and modify the webpage to meet their needs.

With these widgets, you have options:

• Free, most basic widget, likely not close to 95% compliance. - UserWay

• Starting at $348/year – Neilson Marketing Services

• Starting at $490/year - AccessiBe

• Starting at $490/year – UserWay with AI

Of course, there are many other options out there. These are just a few of the most popular widgets. Regardless of what path or option you decide, you should take action to make your website more accessible to reduce the risk of an ADA demand letter

or lawsuit.

Lastly, it is important to note that more than 7 million people in the U.S. are blind or have a visual impairment.

Website accessibility is not something to consider merely from a legal standpoint, it is also a customer service for many Americans looking for insurance.

If you have been contacted by an attorney regarding ADA compliance, we ask that you reach out to the IIAW. The earlier we can learn that this may be becoming an issue in the state, the faster we can not only monitor but also respond.

Tags:

ADA compliance

insuring Wisconsin

Risky Business

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, May 12, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing an upcoming opportunity to earn a FREE Wisconsin CE credit, the struggle to make pandemics insurable and rising gas prices in Wisconsin.

How-To: Earn a FREE Wisconsin CE credit

Join the IIAW at 10 a.m. on Thursday, June 17th for our upcoming Agency Leadership Webinar. This webinar will cover the 2020 WI Property and Casualty Marketplace Summary. Our featured speaker, Paul A. Buse, Principal at Real Insurance Solutions Consulting

will give a deep-dive into the insurer industry data for the state of WI from an independent agent's point-of-view. In addition to receiving great information from Paul during the webinar, the class also qualifies for one WI CE Credit. All webinars

within our Agency Leadership Webinar Series are free for IIAW members, meaning you'll receive a FREE CE credit for attending! Click here to register for the upcoming webinar.

Behind the Struggle to Make Pandemics Insurable

According to a Reuters report, COVID-19 caused more than $100 billion losses which is leading many insurers to move to strike pandemic coverage from all new business policies. "The Reuters report noted, that while a firm project's risks are contained

over a finite amount of time, industries like airlines have much higher potential losses which could prove more difficult to insure. This has led many insurers sayin that extensive cover will only be possible if governments provide backstops." The

process of developing a plan where commercial insurers would be backed by government reinsurance programs moves slowly. Learn more about the struggle to make pandemics insurable here.

Gas Prices Rising in Wisconsin, But Not Because of Pipeline Cyberattack

Things are opening back up throughout Wisconsin and more people are traveling. However, with more movement across the state, gas prices are rising. According to GasBuddy.com, "The average price of a gallon of gas in Wisconsin now stands at $2.84, which

is up more than 4 cents from last week and 11 cents since last month." Experts had expected a rise in gas prices this spring, as more people are planning to travel this year after being vaccinated. TMJ4 a Milwaukee news outlet stated, "Gas prices in Milwaukee area are on the rise, a trend analysts blame on the cyberattack that shut down the Colonial Pipeline late last week." Milwaukee gas prices are averaging $2.84 a gallon on Monday. Compared to other nearby cities: • Rockford, IL: $3.11/g up 1.9 cents per gallon from last week's $3.09/g • Madison, WI: $2.77/g, up 3.6 cents per gallon from last week's $2.73/g • Chicago, IL: $3.31/g, up 1.1 cents per gallon from last week's $3.29/g Compared to the same time last year, Wisconsin gas prices are up 11.4 cents higher than last month and $1.17/g higher than this time last year. Patrick De Haan, head of petroleum analysis from Gas Buddy stated, "While average gas prices jumped last week as the nation continues to see COVID-19 recovery, all eyes are now on the Colonial Pipeline and the fact a cyberattack has completely shut all lines, leading to what could become a major challenge for fuel delivery. The situation is growing more intense each day that passes without the pipeline restarting, and motorists are advised to show extreme restraint or exacerbate and prolong the challenges. If the pipeline returns to service in the next day or two, the challenges will be minimal, but if full restart doesn't happen by then, we're likely to see a slight rise in gas prices, but more importantly, challenges for motorists needing fuel in Georgia, Tennessee, the Carolinas, Virginia, Northern Florida and surrounding areas. I'm hopeful the situation will quickly improve as multiple levels of government are involved, this may become a nightmare should it continue just ahead of the start of the summer driving season." The current national average gas prices

sit at $2.95 a gallon, putting Wisconsin below the national average at this time. Read more here.

For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Don’t forget you can stay up-to-date on other industry news as its happening on our Online Community. You can join the Online Community (exclusive to IIAW members)

here. We hope that everyone has a great rest of their week.

Tags:

big i buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, May 5, 2021

|

Happy Cinco de Mayo! In today's Big I Buzz, we are discussing how COVID impacts insurance, the cause for most on-the-job vehicle accidents and the 2020 tourism decline in Wisconsin. How COVID Impacts Insurance in Unforeseen Ways The COVID-19 pandemic has impacted virtually all aspects of the insurance industry, most of the impacts will continue to alter the insurance landscape for years to come. In personal auto lines, claim frequency plummeted due to the lockdown, as many people who ventured out during the first six months of the pandemic were greeted with mostly abandoned roads and highways compared to pre-pandemic traffic. According to Insurance Information Institute estimates, property damage frequency was down more than 30%, while severity was up by almost 20%. While personal auto lines claim frequency plummeted, dog ownership spiked. Insurance Journal states that this a growth opportunity for the pet insurance market, but at the same time it could cause an increase in dog-related liability claims. "The pandemic has also changed the way insurers do business, from underwriting to claims. While digitization was an industry priority before COVID, the pandemic accelerated the transition," according to Insurance Journal. If you're looking for tech guidance, head to Catalyit.com. Catalyit simplifies technology for insurance agencies. While you wait for Catalyit to launch, get on their email list to receive Catalyit's Top 10 Tech Tips in your inbox. You'll also be one of the first to know when their free assessment is available! Distracted Driving at Hand in Most On-the-Job Vehicle Accidents Motus, a workforce platform and software provider reports the top three causes for accidents on the job. 1. 74% of vehicle accidents on the job were caused by distracted driving 2. 31% of on the job incidents were caused by speeding 3. 18% of on the job incidents were caused by driving under the influence According to Property Casualty 360, "Motus noted in its report that while discouraging the use of mobile devices among workers should be an easy step in reducing risk, at times, upper management will argue that salespeople should be engaging clients on sales calls and teleconferences during long drives. This effectively "encourages more screen time," the report stated." Read more about the report here. Wisconsin's Tourism Industry Sees 30 Percent Spending Decline in 2020 Due to COVID-19 Wisconsin's tourism industry was hit particularly hard by COVID, causing a nearly 30% direct spending decline. In 2019, statewide tourism was about a $13.6 billion dollar industry, but in 2020, that number had dropped to about $4 billion dollars, according to the Wisconsin Department of Tourism. Despite the tourism decline in 2020, officials are optimistic about a rebound in 2021, reporting the first four months of the year are shaping up to be better than 2019. Wisconsin Public Radio reports, "National research shows 87 percent of Americans plan to travel in the next six months and plan to spend more money, Acting Tourism Secretary Anne Sayers said. Dane and Milwaukee counties, which rely heavily on tourists for sports, cultural events, conventions and business travel, were the hardest hit in the state. Direct spending was down last year 39 percent in Dane County and 42.5 percent in Milwaukee County, compared to 2019, according to the Department of Tourism." For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Don’t forget you can stay up-to-date on other industry news as its happening on our Online Community. You can join the Online Community (exclusive to IIAW members) here. We hope that everyone has a great rest of their week.

Tags:

big i buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, April 28, 2021

|

Today marks the last Wednesday of April, and we are quickly speeding towards summer. In this week's Big I Buzz, we are discussing InsurCon2021, Tony Evers' bill regarding Workers' Compensation and what the new CDC guidelines mean for vaccinated and unvaccinated

adults.

Register Today for InsurCon2021

Join us August 10-11 at the Kalahari Resorts in Wisconsin Dells for InsurCon2021! We are looking forward to finally seeing everyone in-person, as well as welcome our keynote speaker, Joe Theismann. Along with Joe Theismann, we also are excited to share

that Beth Ziesenis and Bill Pieroni will be featured speakers at InsurCon. If you want to learn more about the speakers and register for InsurCon and the Sunset Dinner Boat Cruise, visit iiaw.com/insurcon!

Gov. Evers Signs Bill to Help Public Safety Officers Struggling with PTSD

Gov. Tony Evers signed into law a bipartisan bill to allow first responders, including police and firefighters, to receive workers' compensation if they've been diagnosed with post-traumatic stress disorder. Prior to the bill, public safety officers must

prove that PTSD was caused by unusual stress compared with what their co-workers regularly experience on the job to claim workers' compensation, according to APG-WI. "The new bill requires a diagnosis from a licensed professional that does not need

to be based on the officer suffering greater stress than co-workers." According to WKOW the bill does the following:

"• Allows payment of worker's compensation benefits if a public safety officer, such as a law enforcement officer or firefighter, is diagnosed with post-traumatic stress disorder by a licensed psychologist or psychiatrist, and the mental injury is not

accompanied by a physical injury if proven by a preponderance of the evidence and the mental injury is not a result of a good faith employment action by the employer; and

• Limits the liability for treatment of such injuries and claims to no more than 32 weeks after the first injury is reported, and restricts compensation for such injuries and diagnoses to three times within an individual's lifetime regardless of change

in employment status."

Learn more here.

CDC Says Many Americans Can Now Go Outside Without a Mask

On Tuesday, the CDC announced its new guidelines for wearing masks outdoors. Americans who are fully vaccinated do not need to wear masks outdoors, unless they are in big crowds of strangers like a concert, festival, etc. Those who are unvaccinated can

also go outside without masks in certain situations too. Originally, the CDC stated that all Americans must wear masks when outside if they are within 6 feet of another person. According to the Associated Press, "The CDC says that weather they are

fully vaccinated or not, people do not have to wear masks when they walk, bike or run alone or with members of their households. They can also go maskless in small outdoor gatherings with fully vaccinated people.

For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Don’t forget you can stay up-to-date on other industry news as its happening on our Online Community. You can join the Online Community (exclusive to IIAW members)

here

. We hope that everyone has a great rest of their week.

Tags:

big i buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, April 21, 2021

|

Happy Wednesday! In this week's Big I Buzz we are discussing how insurance agencies can harness successful email marketing campaigns, how GM is changing the way they make money and what you need to know if you receive a website accessibility demand letter.

Guide to Successful Email Marketing Campaigns for Insurance Agencies

The first action that agencies can take when planning an email marketing campaign is to determine what the emails is going to accomplish, whether that's generating leads, increase awareness of the agency's services or driving better understanding of their

partners.

When planning an email campaign, ask these questions:

• Who You're Emailing

• Why You're Emailing Them

• What You're Communicating

• When You're Going to Send Out the Emails

After outlining this info, you can start writing the content within your email. A tactic that tends to resonate with customers is personalizing emails, including the customer's name (spelled correctly), or by mentioning something relevant to the individual

and keeping the tone conversation by avoiding jargon. Anytime an agency sends out emails, it's important to be reviewing the analytics of the email. It's important after sending an email to be checking the bounce rate (the rate at which emails get

bounced back due to a bad email address), the open rate (how many people actually open the email) and the click-through-rate (the success of the email's Call to Action that prompts receivers to interact with the email leading them to valuable content

or your website. Read more about how to be successful with email marketing campaigns here.

GM Sees Insurance As Part of Growing Its Business Beyond Cars, Trucks

GM is looking for new enterprises to expand their sources of revenue. Beyond vehicle sales, GM is looking into incubating ventures from commercial delivery services to vehicle insurance. These new ventures could add tens of billions to their future revenue,

according to GM's Chief Executive Mary Barra.

According to Insurance Journal, "Insurance, a new arena for GM, is led by outside hire Andrew Rose, who previously worked for auto insurance powers Progressive and Britain's Admiral Group. Rose says GM dealers could offer policies to owners when they

buy or lease a vechile. OnStar could offer discounts to better drivers, as well as quicker claims service after an accident, and eventually, could offer home insurance as part of the package." Read more about how GM is looking to expand here.

Website Accessibility Demand Letters

Since at least last year, insurance agencies in Florida, California and parts of Massachusetts have been targeted with demand letters from plaintiffs' attorneys alleging that their agency websites are not accessible to sight-impaired consumers, therefore

violating federal law accessibility requirements. Several law firms had been sending these letters to businesses in various industries for years, but now there's been an increase in independent agencies receiving them. The law firms reaching out are

seeking quick settlements in exchange for a conditional release, and so far, have not been actively filing lawsuits against agents.

In September, IIABA sent a letter to a D.C. law firm, The Portell Law Group, demanding

that they stop harassing agents with their letters.

The IIAW has put together a Quick Guide to ADA Compliance to help you in checking that your site is ADA compliant. If you receive one of these letters, please reach

out to the IIAW so we can connect you with our legal counsel.

For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Don’t forget you can stay up-to-date on other industry news as its happening on our Online Community. You can join the Online Community (exclusive to IIAW members)

here. We hope that everyone has a great rest of their week.

This post has not been tagged.

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, April 14, 2021

|

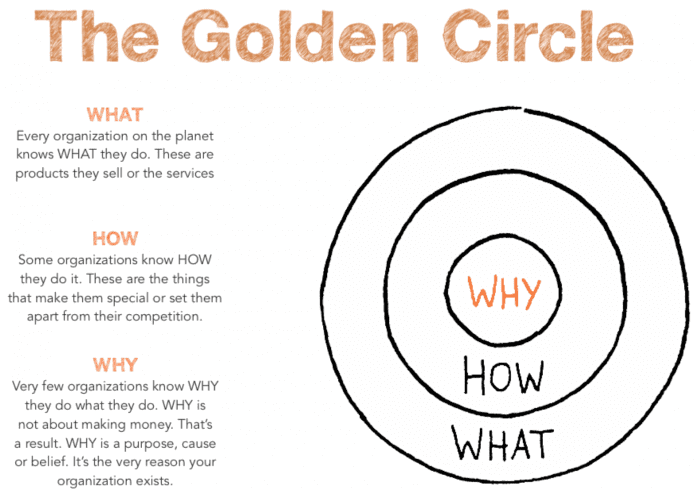

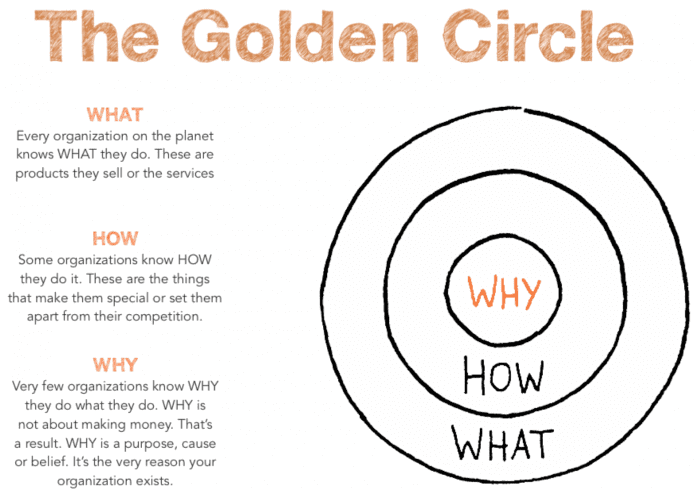

The all-inspiring Simon Sinek asks, “How do you explain when things don’t go as we expect, or how do you explain when others are able to achieve things that seem to defy all of the assumptions?”

For example, how are some insurance agencies so innovative? How do they seem to thrive, grow and expand at a pace that is greater than the vast majority of others? Why do they appear to have something different?

If you ask someone why their product, service or company failed, people will always give the same three answers:

1. Under capitalized

2. The wrong people/employees

3. Bad market conditions

Simon, in one of his famous Ted Talks asks, “Why is it that the Wright brothers were able to figure out controlled, man-powered flight?” When there were other teams who were better qualified to achieve man-powered flight, better funded and all around

better equipped, the Wright brothers beat them to it. Simon goes on to discuss that there is something bigger at play.

He codified it in his very simple, yet revolutionary idea titled the Golden Circle and the theory, “Start with Why”. This theory explains why some organizations are able to inspire where others aren’t.

Photo: Smart Insights

You see, people do not buy what you do, they buy why you do it. What is your purpose? What is your cause, your belief? Why does it exist and why should anyone care?

As an independent agent, you should strive to do business with people who believe what you believe. Insurance is vital to one’s economic security and that you are not just selling them an insurance policy, but peace of mind. Price is not a determining

factor in what policy they purchase. What drives the decision is the superior coverage, the value of working with an independent agent and the ancillary benefits the insurance company offers. How all of these factors come together to support their

American dream is what drives the passion within the industry.

When it comes to hiring individuals or companies to work for you, your goal should be to not just hire people who need a job, but to hire those who believe in what you believe as it relates to the products and services you sell and offer.

Simon Sinek says, if you hire people just because they can do a job, they will work for your money, but if you hire people who believe what you believe, they’ll work for your dream.

Nowhere else is there a better example of this than with the Wright brothers. In Simon’s famous talk, he goes on to tell a story of Samuel Pierpont Langley. Samuel was given $50,000 (which was a lot of money back in the late 1800’s and early 1900’s) by

the United States government to figure out and create a flying war machine or airplane.

He had, what everyone would assume to be, the recipe for success. He was well capitalized, had access to some of the best and brightest minds money could afford and the perfect market conditions to achieve their intended objective.

How come very few people today have ever heard of Samuel Pierpont Langley?

That’s because two brothers, Orville and Wilbur Wright, beat him to it. You see, the Wright brothers didn’t have any money, not a single person on the Wright Brothers’ team had a college education. The difference was that Orville and Wilbur were driven

by a cause, by a purpose, by a belief. That if they could develop this flying machine it would change the course of history. Those around them believed in the same cause driven by the same belief. Samuel Pierpont Langley was driven by the pursuit

of fame and fortune and so were the people around him. The people who believed in the Wright Brothers did so with blood, sweat and tears and not for the paycheck.

As a result, on December 17, 1903, the Wright Brothers took flight and very few people were there to experience it. The irony is that on December 17, 1903, Samuel Pierpont Langley quit. He wasn’t getting rich or famous as he had hoped so he quit.

Simon finishes this story be saying if you talk about what you believe in, you will attract those that believe in what you believe, whether that be your customers or employees.

Here at the Independent Insurance Agents of Wisconsin, we founded Catalyit with the belief that we were founded for you, to support you, and to work for you with blood, sweat and tears! We understand

that working hard for something we don’t care about is called stress but working hard for something we love is called passion. We are enthusiastic towards seeing you succeed and to help you pursue a sustainable competitive advantage for your agency

and its employees. We understand why you do what you do, why your customers respond the way that they do to what you do, and why your employees and co-workers are loyal to you.

At Catalyit we don’t just understand your why, we want you to spend more time finding your why, growing your why, and to come together with others that want to see you, your agency, and your employees/co-workers

be successful. Catalyit was founded by a group of people who believe in you and the work that you do with the understanding that your time is valuable, and resources are limited. Catalyit wants you to be able to focus more on what you do best and take the stress and pain that technology can cause you, away.

Catalyit is more than a company. It’s an enlightening experience that simplifies technology for insurance agencies because with the right tech, agencies will thrive and that is exactly what we are going to help

you do. We believe that with the right experts, solutions, training and community, we can come together to help your agency increase profit, improve its customer experience, cultivate its ethos among its employees all while digitally transforming

itself.

In world dominated by a lot of Samuel Pierpont Langleys - be the Wright Brothers and let Catalyit help you take flight.

Tags:

catalyit

insuring Wisconsin

insurtech

technology

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, April 14, 2021

|

Happy Wednesday! In today's Big I Buzz, we are discussing how highly digital agencies grow faster than their competition, new OSHA regulations and the Wisconsin Supreme Court's new ruling on capacity limits. Study: Highly Digital Agencies Grow 60% Faster than the Competition According to NU Property Casualty 360, "A recent survey of 600 U.S.-based independent agents from Liberty Mutual and Safeco Insurance sought to understand how independent agencies are evolving to meet new expectations. The results, published in the "Rise of the Digital Insurance Agency" report found that digitally-saavy agencies grow an average of 60% more than their less digital counterparts." The study also found that 44% of high digital adopters experience annual revenue growth of more than 10% compared to just 29% of low digital adopters that also experienced revenue growth. The report noted that agents are finding value in digital marketing, which added that more than 80% of high digital adopters plan to increase their digital marketing efforts within the next year. If you're looking to also increase your digital marketing efforts, check out the IIAW's Digital Marketing Playbook to get some insight into how to get started with digital marketing! OSHA Prepares to Issue Emergency Regulations to Protect Workers from COVID-19 The federal Occupational Safety and Health Administration (OSHA) is preparing to issue new short-term regulations to protect workers from catching COVID-19 on the job, according to lawyers tracking the agency's efforts. The Biden administration appears poised to reinstate masking, as some states are removing their mask mandates. According to Insurance Journal, "Most private-sector employers in the U.S. must follow rules for workplace safety set either by OSHA or by state-run versions of the agency. OSHA and its state counterparts have received over 60,000 complaints about COVID-19 safety issues, according to the agency." During the Trump administration, OSHA did not release virus-specific safety regulations so instead, a handful of states established their own temporary standards. "Employers with jobs that are medium or higher risk must follow specific policies to ensure social distancing and clean air. They must also develop written plans for how they'll respond to an infections disease outbreak and provide training to employees on COVID-19. The question now is what the details of the federal version of this will look like. Vance and Conn anticipate a stringent face-covering requirement, particularily indoors." Read more here. Wisconsin Supreme Court Says Governor Can't Limit Capacity The Wisconsin Supreme Court has now ruled that Gov. Tony Evers' administration does not have the authority to issue capacity limits on bars, restaurants and other businesses without approval of the Legislature. The 4-3 decision was issued Wednesday in Tavern League of Wisconsin v. Andrea Palm and Wisconsin Department of Health Services. It upholds a ruling from the Court of Appeals in favor of the Tavern League. According to the Tavern League, DHS did not follow proper rulemaking procedures and obtained an injunction against the emergency order." Read the full decision here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Don’t forget you can stay up-to-date on other industry news as its happening on our Online Community. You can join the Online Community (exclusive to IIAW members) here. We hope that everyone has a great rest of their week.

Tags:

big i buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, April 14, 2021

Updated: Thursday, April 1, 2021

|

By: Elizabeth Kordek; CPCU, Wahve Placement Specialist

For many of our wahves, a new job in the insurance industry is a lot like getting a new car. If you’ve been in insurance for 15+ years doing the same kind of work, such as retail account servicing, claims,

etc… there’s usually not a lot of difference in how the work should get done from one company to the next. But, just like an experienced driver getting a new car, you still need to understand where

the button is for the trunk release, how to turn the back windshield wiper on, and oh, that new beeping sound…that’s the lane departure warning.

Just because you’ve driven a car for decades, doesn’t mean the newness of the new car is any less, well, new.

And so, getting the same job in a new company is also still new. This is where a solid onboarding program come in to play in a successful wahve engagement. The

wahve is going to need some time to get to know new processes, procedures, software, etc. Our wahves are proud that they have years of experience in the insurance industry and they want to be successful.

They will need resources (a helpful co-worker or manager) and tools (written procedures, for example) to get them on the right track.

While we’re on the subject, let’s talk about training. Just like the new car scenario, for an experienced wahve, training doesn’t necessarily need to be a three-weeks long, all encompassing, bumper-to-bumper overview of everything.

But having no formalized introduction to the infotainment system (I mean, agency management system) is setting the wahve up for potential failure.

Here are some helpful tools to consider having ready for your next wahve hire:

1. Decide on a dedicated person in your office who will get the wahve up to speed quickly.

2. Determine if your written procedures need an overhaul. Are they current and relevant for your current processes? Do they include how to navigate in your software programs?

3. Does the team understand what work the wahve will be doing and how to work with the wahve as part of the team? Does a new workflow need to be developed to avoid any confusion?

While you don’t need to give driving lessons to the wahves (thankfully, they are past that nail biting stage!) you do need to invest in their learning some new car systems to ensure they continue to be successful.

Tags:

agency operations

insuring Wisconsin

wahve

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Friday, April 9, 2021

Updated: Thursday, April 1, 2021

|

By: Society Insurance

Over the past 7 years at Society Insurance, we have published over 400 blogs on our website blog.societyinsurance.com. We’ve touched on a variety of topics that affect the businesses we work with from “Clearing Confusion with Snow Removal Contracts” to “Four Benefits of Encouraging Movement Throughout the Day to Improve Employee Well-Being” to “Safeguarding Your Outdoor Dining Area.”

However, having a company blog is not a secret weapon anymore. According to Zoominfo, 33% of B2B companies use blogs. Content is (still) king. Company blogs that publish timely, valuable and strategic content can support long-term growth for a business by establishing thought leadership, growing website traffic, increasing sales leads and keeping potential customers intrigued.

Below we delve into the four main benefits of having a company blog that will earn you respect, leads and, ultimately, customers.

1. Establish Thought Leadership

Ideally, you want your business to be viewed as an expert in its respective industry. Addressing all possible industry questions and specific tangents, which is made possible through blogging, will establish your credibility with your audience. Leave the comment section open so you can engage with your audience, further building a relationship. “The Seven Habits of Highly Effective People” author Stephen R. Covey sums up why thought leadership is so important: “When the trust is high, communication is easy, instant and effective.”

2. Grow Website Traffic

Blogging will also establish credibility via search engine optimization, defined as the process of improving the quality and quantity of website traffic. If your content is good enough, others might reshare it - like online magazines, other blogs, social media channels, etc. One of the most important ranking factors from Google involves backlinks. The more high-quality backlinks (i.e. links from reputable sites pointing back to yours), the more your site is viewed as credible. The result is a higher ranking when someone searches for “Wisconsin insurance agent,” for example. Additionally, these backlinks can also be seen as free advertising, bringing in referral traffic from other websites to yours.

3. Increase Leads, Sales and Engagement

According to Zoominfo, 47% of buyers view three to five pieces of content before engaging with a sales rep. Once you’ve created your blog posts, post links where your audience hangs out to bring them to your blog. Embed opt-in freebies within your blog content. Opt-in freebies, or “lead generation” pieces, are downloadable content collateral that you can give your audience in exchange for providing their email – pushing them further down the sales funnel.

4. Develop Relationship with Potential, Future Customers

By offering a blog, you are offering users an additional chance to get to know your company and what you offer. For example, if a person isn’t ready to commit to a purchase, they may sign up to receive your blog in their inbox and continue to consume your white papers, delve into your thought leadership pieces and learn about your community involvement through your blog. Congratulations – you’ve now further developed a deeper sales funnel.

When done right, blog posts can generate significant traffic over the course of months and will continue to push even more traffic to the website years after the post is first published. The time and effort you invest in a company blog up front can result in thousands of visitors to your website and new sales in the future. A blog is an easy way to build trust with your audience, increase traffic to your website, and is a part of a long-term strategy to increase company growth.

If you agree that small details like this make a big difference, give us a call at 888.5.SOCIETY or visit societyinsurance.com.

Disclaimer: This information is provided as a convenience and is not professional advice. Links are being provided as a convenience and for informational purposes only; they do not constitute legal advice or an endorsement or approval by Society Insurance of any of the statements, or opinions, or content of the organization. Society Insurance bears no responsibility for the accuracy or content of linked or cited material.

Tags:

blog

insuring Wisconsin

marketing

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|