|

|

Posted By IIAW Staff,

Wednesday, August 10, 2022

|

Happy Wednesday! In this week's Big I Buzz we are discussing your last call to register for the event of the summer, new requirements for TPMO when selling Medicare Advantage and/or Part D Plans and findings from the Big "I" 2022 Market Share Report! Last Chance to Register Don't miss out on this year's Sales & Leadership Summit happening in Neenah, WI on August 23-24. MarshBerry instructors will deliver an action-packed 1.5-day workshop filled with topics focused on building your strong sales culture. To know where your agency stands, you need to benchmark your sales culture in four key areas: sales leadership, performance management, people development and technology. PLUS your registration includes access to the 1.5-day workshop, meals and ticket to a Timber Rattlers baseball game on August 23rd! Registration closes tomorrow at 5 p.m. Save your spot before registration closes now: https://bit.ly/SalesLeadershipSummit. New Requirements for TPMO When Selling Medicare Advantage and/or Part D Plans Recently, the Centers for Medicare & Medicaid Services (CMS) issued a final rule that will affect all agents & brokers who sell Medicare Advantage and Part D plans. The IIAW has put together an informative brochure created by your team at the IIAW to help you navigate these mandatory requirements. The agency will need to update disclaimers (written and verbal) and will also be required to record specified phone conversations as part of this change. All requirements must be implemented by October 1st, 2022. View the brochure outlining the necessary steps to become compliant with the new requirements here. Independent Agents Place Majority of U.S. P&C Insurance: Big I Big "I" has released their 2022 Market Share Report, and the findings show that the independent agency channel places 63% of all property-casualty insurance written in the U.S. According to Insurance Journal, "Based on 2021 data, this year's report points to independent agencies' dominance in commercial lines, finding that nearly 88%% of all commercial lines written premium is placed by the independent agency channel. The Big "I"'s 2022 Market Share Report summary emphasizes direct premiums, direct losses and the associated direct underwriting results before reinsurance. Read the article from Insurance Journal here. IIAW members have access to the 2022 Market Share Report. If you need assistance with your login information to access the report on the independentagent.com, please feel free to reach out to info@iiaw.com and we would be happy to assist you with getting access! For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Additionally, we send out monthly newsletters with content curated just for you and your role. Make sure you're on the list to receive our communications by heading to bit.ly/industrynewsforyou to stay in the loop!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, August 3, 2022

|

Happy Wednesday! In this week's Big I Buzz we have news about an actuary's guide on where things stand with auto insurance in 2022 and a reminder to get involved with the IIAW!

As the U.S. personal automobile insurance market combined ratio ends 2021 over 100% for the first time since 2017, many companies reported significantly worse combined ratios in the fourth quarter of 2021 and Q1 2022 compared to prior periods (e.g., Kemper’s Specialty Property & Casualty Insurance reported a 119% combined ratio in Q4 2021 and 109% in Q1 2022).

Additionally, the prior period reserves of many companies are displaying adverse trends, and their current periods are experiencing tumultuous spikes in severity. Therefore, U.S. personal auto insurance companies will face significant challenges for the rest of 2022 and 2023.

Allstate cites the main contributors to increased auto claim severity to be increased used car prices, higher parts and labor costs, medical inflation, and greater attorney representation. Kemper and Progressive also mention an increase in auto claim severity as a driving force in their fourth-quarter results. These factors appear to be affecting trends throughout the entire industry with no end in sight.

Inflation and War Create Upward Cost Pressure

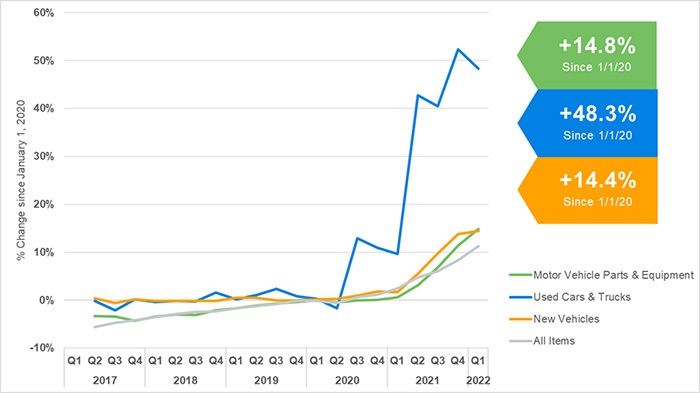

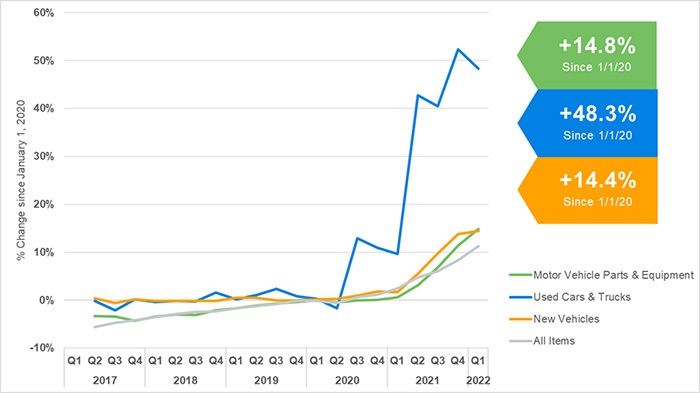

We are all feeling the effects of inflation at the pump and in the grocery store, so it seems only natural that insurers are feeling its effects through an increase in claim severity. A look at the table in Figure 1 shows that the consumer price index (CPI) for all items has increased 11.2% since the beginning of 2020. By comparison, the price of motor vehicle parts and equipment has increased by nearly 15% during the same time period.

You can read the entire article here!

Get Involved with IIAW's Task Forces & Councils

Educate • Network • Plan

The IIAW is excited announce new Task Forces and Councils! Each Task Force or Council will have 3 virtual meetings per year and act as a sounding board for planning IIAW education, events and other member benefits.

All agency employees and the following Supporting Company Members: Silver, Gold, Diamond & Exclusive are welcome to participate in one or more groups!

Learn more here!

Tags:

big i buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Evan Leitch,

Wednesday, July 27, 2022

Updated: Wednesday, July 27, 2022

|

Happy Wednesday! In this week's Big I Buzz we have news about what sports analytics & insurance have in common and a new way to get involved with the IIAW.

In 2002, the Oakland Athletics were an underdog to long-standing industry titans

like the New York Yankees and San Francisco Giants. The odds were stacked against the franchise, but the A’s were still intent on trying to win. To do so, they had to get creative and consider defying convention.

What does this have to

do with insurance? Every industry starts somewhere with data.

What General Manager Billy Beane and Assistant General Manager Paul Depodesta (“Peter Brand” in the movie) unlocked was the true power in the data as it came to the object of the game — scoring more runs than the opponent. The vast majority of what they

believed in aligns with conventional wisdom (home runs are good), but some of it did not and it was in those margins, through the data, that Oakland won.

Twenty years later, we have reached commercial insurance’s Moneyball era. Like baseball,

insurance is also a tremendous generator and consumer of data, with some information dating back more than a century. It has legacy titans and legacy thinking that are ripe for disruption. It even has “losses.”

There are three ways commercial

insurance is primed for its Moneyball era. 1. The principle of 'one number'. 2. Every attribute matters. 3. Start with the box score.

You can read the entire article here!

Get Involved with IIAW's Task Forces & Councils

Educate • Network • Plan

The IIAW is excited announce new Task Forces and Councils! Each Task Force or Council will have 3 virtual meetings per year and act as a sounding board

for planning IIAW education, events and other member benefits.

All agency employees and the following Supporting Company Members: Silver, Gold, Diamond & Exclusive are welcome to participate in one or more groups!

Learn more here!

2022 Sales & Leadership Summit

Who: Insurance professionals, agents, company and other industry employees.

When: August 23-24th, 2022

Where: Bridgewood Resort Hotel & Conference

Center, Neenah, WI

MarshBerry instructors will deliver

an action packed 1.5-day workshop filled with fantastic topics you won't want to miss! Our 2022 Sales & Leadership Summit will be

led by Don Folino, MarshBerry Sales Performance Consultant, and Eric Kuhen, MarshBerry Senior Strategy Consultant. Register Here!

Tags:

big i buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, July 19, 2022

|

Happy Wednesday! In this week's Big I Buzz we are highlighting tips you can share with your clients for BBQ Safety Month and information on today's virtual event that you won't want to miss. Barbecue Safety Tips for National Grilling Month July is National Grilling Month and it's the perfect time to remind your clients about grilling safety tips to keep them and their belongings safe. According to the U.S. Fire Administration, "There are around 5,700 grill fires on residential property each year, causing around $37 million in damages, 100 injuries and 10 fatalities." NU Property Casualty 360 has listed these 8 safety tips: 1. Always operate your barbecue on a level surface. 2. Keep a fire extinguisher nearby when grilling. 3. Don't move the grill once it is lit. 4. Keep children and pets away from the grill. 5. Protect whoever is grilling with a heavy apron and oven mitts that extend over the forearm. 6. Only use lighter fluid specifically designed for grilling. 7. Never grill indoors or in enclosed areas. 8. Wait until the grill has cooled before storing/covering it. You should also soak charcoal briquettes with water to ensure they are inactive before disposing of them. 2022 Sales & Leadership Summit Preview Webinar Today at 1 p.m. MarshBerry's Don Folino will give a preview of what you can expect when you attend the 2022 Sales & Leadership Summit in Neenah, WI on August 23-24. Don will highlight how the summit focuses on the skills and knowledge needed to maximize your potential and start generating more revenue. In addition, Don will highlight MarshBerry's proprietary tool that's designed to enable your leadership team to increase sales, provide perspective on what's working and help drive predictable, profitable organic growth in your organization. Don't miss this preview webinar and learn more about the 2022 Sales & Leadership Summit. Click here to register. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Additionally, we send out monthly newsletters with content curated just for you and your role. Make sure you're on the list to receive our communications by heading to bit.ly/industrynewsforyou to stay in the loop!

Tags:

big i buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, July 19, 2022

Updated: Thursday, July 21, 2022

|

By: Misha Lee, IIAW Lobbyist Get ready Wisconsinites for yet another closely watched, competitive election year. That’s according to the latest results from a new Marquette University Law School poll released earlier this month. The poll of 803 registered voters suggests that the high profile primary races among Republicans for the job of Governor and for the coveted position of United States Senator among Democrats are equally shaping up to be tight contests with just less than a month and a half to go until the August 9 primaries and the general election to follow on November 8. These two races, in particular, are important politically because they could ultimately decide who controls the U.S. Senate and/or whether the state of Wisconsin will continue with split party governance or have one party control of the legislative and executive branches next session. In the now, five-way Republican gubernatorial primary that determines who will face off against first-term, incumbent Democrat Governor Tony Evers, business owner Tim Michels and former Lieutenant Governor Rebecca Kleefisch are running in a neck-and-neck race with Michels having a slight lead of 27 percent among Republicans and Independents who say they will vote in the GOP primary. Kleefisch received support from 26 percent of primary voters, Kevin Nicholson had 10 percent, Tim Ramthun 3 percent, and relative unknown Adam Fischer with less than .5 percent. Tim Michels’ candidacy is a late entry into the race since April 22 and yet already he has made a name for himself (aside from his well-known Wisconsin construction business - Michels Corporation), most notably receiving the much-sought-after endorsement of former President Donald Trump, who continues to carry significant sway in Wisconsin and nationwide among Republican voters. Michels returns to the political stage having last ran for public office nearly two decades ago in 2004 when he won a four-way Republican primary for U.S. Senate. He ultimately lost in the general election to former U.S. Senator Russ Feingold. Kleefisch, who is most known for serving alongside former Governor Scott Walker for two full terms as Lt. Governor from 2011 to 2019, has been campaigning for the better part of a year now and leads slightly in favorability ratings among her GOP rivals with 44 percent favorability versus 10 percent who had an unfavorable view of her. Candidate Michels was close behind with 42 percent favorability and 7 percent unfavorable; Nicholson at 27 percent; and Ramthun with 3 percent. The most noteworthy statistic in this race taken from the latest poll results is that a substantial 32 percent (nearly one third) of Republican primary voters remain undecided in this contest, meaning this race is a toss-up as each of the candidates try to convince the large swath of undecided voters to support them as the Republican nominee. For someone like Kleefisch, who is a pretty well-known commodity among GOP voters and who has been campaigning longer and harder than the rest of the field, it will likely be more difficult for her to pick up significant votes from this group of undecideds unless her campaign is able to convince them that she is the only candidate in the GOP field that can defeat Evers in November. The Marquette poll also revealed a close race in Wisconsin’s Democratic U.S. Senate primary that will determine who will challenge incumbent U.S. Senator Ron Johnson who is running for another 6-year term despite having initially said that he wouldn’t run again. Current Lt. Governor Mandela Barnes, who is widely seen as the primary race’s frontrunner, leads the rather large, eight-person field with 25 percent of Democratic primary voters who say they would vote for him. Milwaukee Bucks executive Alex Lasry, received 21 percent with the four-point differential between him and Barnes falling within the poll’s margin of error making the race a virtual tie. In a distant third and fourth place and not gaining much ground from previously conducted polls is Wisconsin State Treasurer Sarah Godlewski who received just 9 percent and Outagamie County Executive Tom Nelson who received 7 percent support. The other remaining candidates received 1 percent or less. At some point it is possible one or both of these primary candidates (Godlewski and Nelson) may decide to suspend their campaigns due to lack of momentum and possibly throw their support behind another candidate which could dramatically alter who leads the field. Similarly as in the Republican gubernatorial race, a significant 36 percent of Democratic U.S. Senate primary voters still have not made up their minds on who to support in this wide open contest. More than one-third of primary voters are still up for grabs in this primary battle. It will be a close race to the August 9 finish line for sure, but the campaigns for Mandela Barnes and Alex Lasry have clearly established themselves as the two leading Democratic candidates in this Senate primary. The poll also previewed early head-to-head general election matchups between incumbent Governor Tony Evers and his potential Republican challengers, as well as U.S. Senator Ron Johnson against his potential Democratic rivals. The poll results revealed some initial positive news for Evers in that he leads all of his potential challengers regardless of who might emerge in the primary. While it is still very early to make any assumptions about these results and the mood of the electorate is certainly volatile heading into November, Evers’ lead over his potential challengers highlights the advantages of incumbency and having the bully pulpit, especially if the incumbent hasn’t given voters a real strong reason to send him packing. The closest general election matchup in the poll is between Evers and Kleefisch where he has a slight lead of 47 percent to 43 percent and it was the only matchup that fell within the poll’s margin of error. However, unlike Evers, U.S. Senator Ron Johnson trailed all but one potential challenger in a head-to-head matchup, according to the poll revealing his vulnerability as an incumbent seeking re-election. The only candidate where Johnson led was against Alex Lasry by just three percentage points and all matchups fell well within the poll’s margin of error meaning this will be a very tight race in November no matter who emerges from the Democratic side. Some observers highlight that Sen. Johnson is the number one target nationally for Democrats as a seat to pick up in November. Johnson has trailed in the polls before and somehow managed to win. It remains to be seen whether or not he can continue that streak in an off-presidential election year where turnout and how independent voters break will be a determining factor. The Marquette Law School poll interviewed 803 registered Wisconsin voters by landline or cell phone from June 14-20, 2022. The margin of error is +/-4.3 percentage points for the full sample. The margin of error for 369 Democratic primary voters is 6.2 percentage points and for 372 Republican primary voters is 6.3 percentage points. See the official poll results at bit.ly/MarquettePollResults.

Tags:

Feingold

government affairs

insuring Wisconsin

Kleefisch

Lasry

Marquette University Law School Poll

Michels

Ramthun

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Independent Market Solutions,

Friday, July 15, 2022

Updated: Thursday, July 21, 2022

|

Progressive has one of the strongest brands in the industry and spends billions on marketing and advertising. Why not leverage their brand, purchasing power and experience with Independent Market Solutions (IMS)? With a Progressive appointment, you can use their turnkey programs and services designed to generate leads and increase your closing rates. One of the best parts about these services is they are given at cost and are frequently less costly than similar programs in the marketplace. Below are a few of the programs and services they offer: • Search Engine Optimization (SEO) • Social Media Content • Website Services (building and maintaining your website) • Every Door Direct Mail • Sign Programs (indoor & Outdoor) • Email and Direct Mail Campaigns Learn more about Progressive and IMS here: https://www.imsaccess.com/states/wisconsin/.

Tags:

IMS

independent market solutions

insuring Wisconsin

market access

market access program

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, July 13, 2022

|

Happy Wednesday! In this week's Big I Buzz, we have news about WCRB's rate changes and a new way to get involved in the IIAW. On July 12, 2022, WCRB (Wisconsin Compensation Rating Bureau announced an -8.47% rate change (8.47% decrease). This rate change will take effect October 1, 2022. Read the full Circular Letter announcing this change here. Get Involved: Volunteer to Serve We're looking for volunteers to serve on the IIAW's councils and task forces. your participation is invaluable, and your input and feedback will help drive thee work we do in the coming year and beyond. Councils & Task Forces for 2022-2023 Personal Lines Task Force - for individuals who are interested or who have a role in Personal Lines insurance Commercial Lines Task Force - for individuals who are interested in or who have a role in Commercial Lines insurance Employee Benefits Task Force - for individuals who are interested in or who have a role in Employee Benefits Industry Relations & Operations Council - for insurance professionals who have an operational or leadership role within an agency or insurance company Government Affairs Council - for individuals interested in staying informed and providing feedback to the IIAW's Board on Wisconsin & national legislative and political happenings Emerging Leaders - for insurance professionals looking to cultivate their skills for a successful career by engaging in association activities, professional develop, education and events Each council and task force will act as a sounding board for the IIAW and will only have three virtual meetings per year. Participating in the IIAW task forces and councils gives you access to industry experts, exclusive networking events and FREE CE opportunities during most virtual meetings when content allows. Make sure you fill out this survey to receive communications about an IIAW Councils & Task Forces kick off event on September 21st and other task force/council communications. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Additionally, we send out monthly newsletters with content curated just for you and your role. Make sure you're on the list to receive our communications by heading to bit.ly/industrynewsforyou to stay in the loop!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, July 12, 2022

Updated: Thursday, July 21, 2022

|

By: Carey Wallace, Business Consultant at AgencyFocus This has become an all too familiar story. An agency owner reached out several weeks ago and asked me to meet with him and the owner of an agency in his town that he was looking to purchase. They had been talking for several years. They had a handshake agreement that someday he will buy the agency when the time is right. Those conversations were consistent over time, but had never turned into any action. The selling agency owner was now in his early 80s, but the time didn’t seem right just yet. Until it was.

Some serious health issues caused the conversation between the two owners to change from someday into a reality. I was introduced to the selling agency owner and together with the buyer we went through what to expect in the valuation process. He was charming, funny and full of stories. It was obvious that the last thing he wanted to talk about was his career in insurance coming to an end. Instead, he preferred to reminisce about his favorite clients, brag about his amazing staff and tell me the story of how he started in this incredible industry of ours. Our 30-minute call tripled in length, but I didn’t mind at all. I loved getting to know him and honestly, I loved listening to his stories.

As our call came to an end, we agreed that the completing the valuation was the next logical step. The seller expressed concern about letting his staff know he was contemplating selling, so he asked that I mail him the proposal and confidentiality agreement and send the data sheets that were required for the valuation in an email that does not mention the purpose. He planned on confiding in his office manager as she would need to help him completed the information. The proposal was sent, agreement was signed, and the data sheets were emailed. We were on our way.

Two weeks later first thing Monday morning I received a call from the buyer. I answered with a chipper Good Morning and was met with an unexpected somber voice. He fumbled his words and struggled to share the news that the seller’s health had taken a turn for the worse, he was hospitalized a few days ago and passed away the previous evening. Then there was silence.

I cannot even begin to tell you how much I dread this kind of call. My heart sank and you could tell his heart was breaking as well. We both were quiet for what seemed like forever. I broke the silence with a question, “Tell me what I can do to help?” He then shared his thoughts and plan to help the sellers widow navigate the next days, weeks and months. She is now faced with taking care of the affairs for an agency she has never been a part of and had no idea where to begin.

When something like this happens, the focus goes from planning to “rescue”. Worse than that, someone who is mourning the loss of the greatest love of their life is forced to make decisions that they have no experience handling. They are forced to think about details and logistics that are in many cases completely foreign.

We started discussing things like:

Who has the logins and ability to access the carrier portals? How do we ensure that we keep the appointments in place and take care of the customers? Who has the logins to the accounting system, bank accounts? Is there any life insurance? Does someone know how to run payroll? What do we tell the staff? Clients? Carriers? How do we reassure the staff?

It is completely overwhelming. The business that was a lifetime of work and the main source of income in their retirement is now in jeopardy.

The reality is for many agency owners the time will never be right and sadly they will put planning for the transition of their agency off until there is no time left.

This can happen to anyone at any age.

You do not have to exit your agency to have a plan.

The time is always right to make a plan. For more information about planning for your agency please visit www.agency-focus.com or contact Carey Wallace at Carey@agency-focus.com.

Tags:

agency management

insuring Wisconsin

leadership

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Society Insurance,

Friday, July 8, 2022

Updated: Thursday, July 21, 2022

|

By: Rebecca Freiberg, Society Insurance

Workplace politics can be a delicate subject. Workplace politics is the manifestation of power dynamics amongst employees. At its best, you’ll feel like you’re walking on eggshells each time you set foot in the office and at its worst, you can ruffle a few feathers, making each day feel miserable. Every office has some form of politics; what matters is whether or not they are toxic. Here we’ll go over ways you can overcome workplace politics, or at the very least stay on the right side of issues, to avoid becoming embroiled in drama.

Know the Ins & Outs of the Organization The first way to overcome workplace politics is to understand different functions of the organization. This means understanding the company’s organizational structure, who reports to who. It’s also important to understand who within the organization has influence. You might ask yourself questions such as, “who are the true influencers? Who is respected? Who mentors others?” Embrace Transparency Stress the importance of open communication among and between teams, especially if you manage people. Your team members should feel at ease coming to you with problems they’re having without repercussion. Open communication leads to effective communication which then leads to an efficient workflow. When employees feel comfortable discussing workplace problems with co-workers, it leads to the potential resolution of problems. Implement a Realistic Code of Conduct Simply having a definition for what establishes acceptable behavior is a major step in avoiding workplace conflict. Making a system for decision making, encouraging open collaboration, team building, leadership training and development, and careful hiring will all help avoid workplace conflict. It’s important to have clearly defined responsibilities so everyone knows what’s expected from them. It is equally important to have a clearly laid out chain of command to allow for effective communication. In other words, define workplace rules clearly and make it known what will or will not be tolerated. Removing assumptions will drastically reduce the risk of conflict in the workplace. Don’t Add Fuel to Fire

Behaviors to avoid include: • Spreading gossip • Choosing sides • Taking part in the rumor mill • Becoming jealous Become Swiss and Don’t Take Sides It is vital that employees remain neutral during conflicts, even if you like someone more than another. Your position may be a trusted authority figure, meaning that your actions and words have significant meaning. Think about what is best for the company, not for personal satisfaction. Remaining neutral allows you to make great decisions and stay separate from workplace politics. Once a side is taken it is difficult to overcome.

Get Level: Cooler Heads Prevail Similar to remaining objective, don’t lose your cool and become aggressive with someone or you’ll gain a negative reputation for it. This is relevant advice for all workplace situations. If you do not remain cool, your reputation and career is at risk. Even though workplace politics may upset you, staying cool has its benefits. Keeping cool prevents you from saying or doing anything in the moment that you may regret later. Practice What You Preach: Political Behavior Comes From The Top Owners and managers influence behavior. If they promote or facilitate a toxic political atmosphere, it may be time to search for a new job. Leaders in the organization must take steps to eliminate political behavior immediately. How Managers Can Quash Negative Workplace Behavior • Share the goals that you are trying to achieve and reward those who help achieve them. When the collective goal is clear, it is less likely that people will prioritize their own interests first. • Keep every employee in the organization involved so no one employee feels more important than another. • Make connections within the organization and develop strong interpersonal communication between individuals via lunches, happy hours, kickball leagues, etc. When employees are connected and respect one another, workplace politics begin to diminish. Conflict in the workplace is inevitable, even with the most agreeable personalities. The average American spends well over 2,000 hours at work over the course of a year. When employees of various backgrounds and different work styles are brought together to work on the same project with the same goal, conflict could be a natural byproduct. Not all conflict is bad, however all conflict can and should be managed and resolved. If handled correctly, confronting conflict head-on will result in a stronger culture and closer teams.

Tags:

human resources

insuring Wisconsin

Society Insurance

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

workplace politics

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, July 5, 2022

|

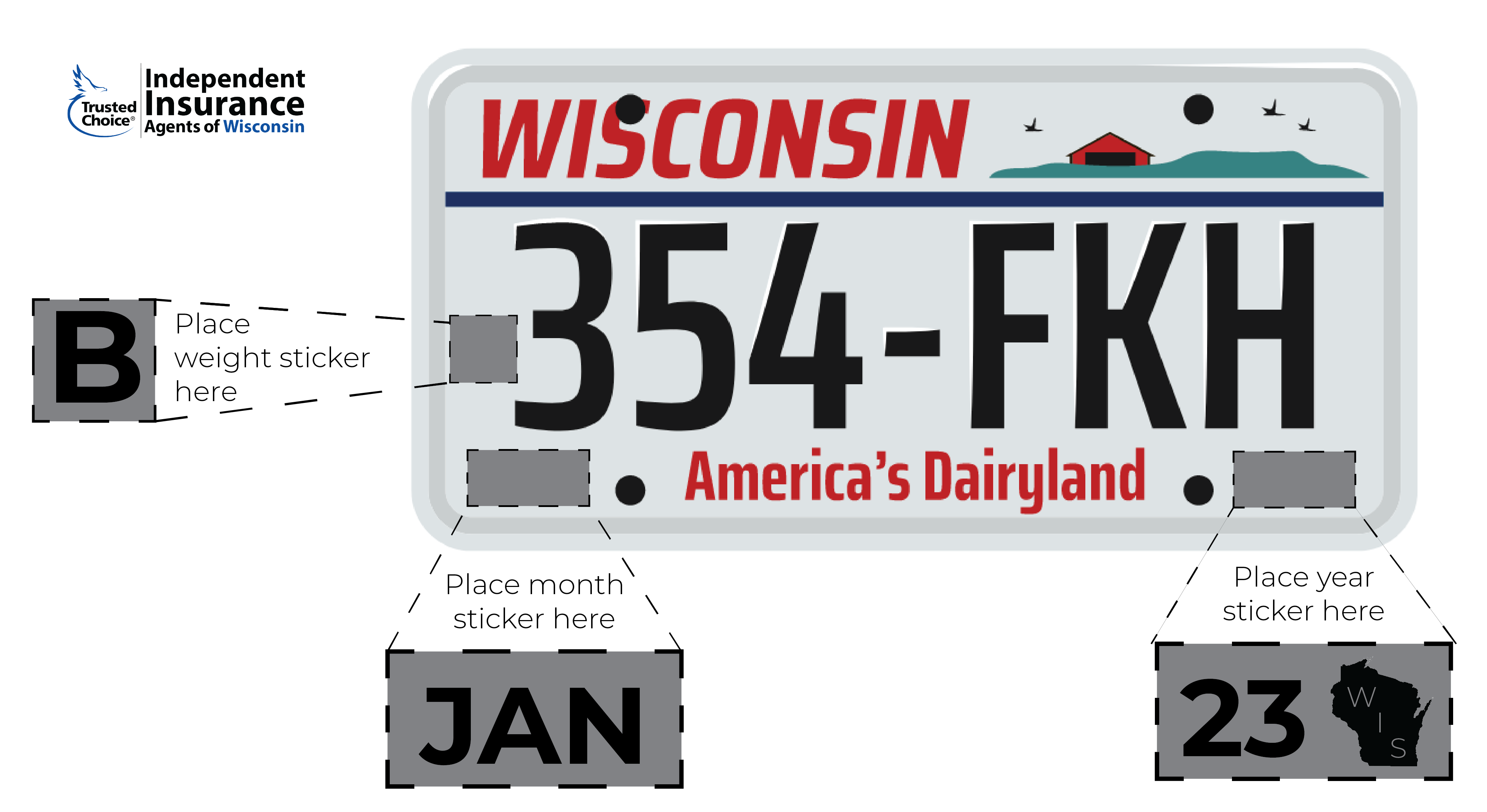

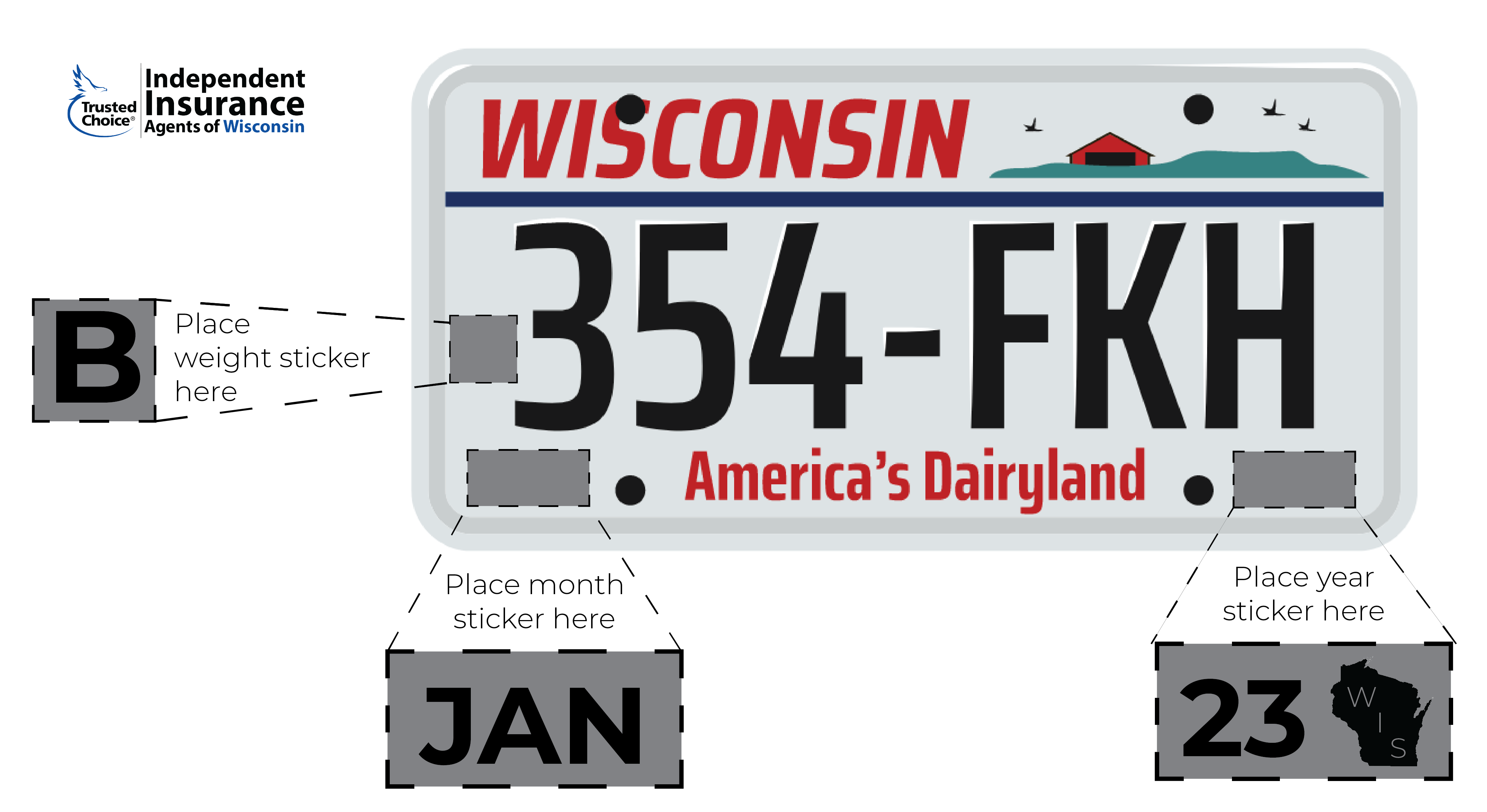

Happy Wednesday! We hope that everyone enjoyed their Fourth of July weekend and using information last week's Big I Buzz, you were able to avoid some of the holiday travel! This week we are sharing information about Wisconsin State Law license plate regulations, what's driving the cyber insurance market and how the federal interest rate hike can affect the insurance industry. License Plate Reminder Now is a great time to remind your clients about Wisconsin State Law license plate regulations to help them avoid unnecessary tickets. Feel free to share the below image and copy on your social media pages.

Did you know that per Wisconsin State Law if you are issued two license plates you must attach both to your vehicle? Your license plate must be kept in a legible condition, which means no plate covers. This also means that your registration plate lamps, wiring and connections must be maintained in a proper working condition. Finally, if you are given two license plates you must attach the validation sticker to the rear plate as shown below. Connect with your local Trusted Choice independent insurance agent to make sure you've got the coverage you need when it comes to your vehicle! Evolving Risk is Driving Cyber Insurance According to the 2021 NetDiligence Cyber Claims Study, the top five causes of loss for samll and medium-sized enterprises over the last five years based on number of claims was: ransomware, hackers, business email compromise, staff mistakes and phishing. The increase in ransomware attacks since 2016 has encouraged underwriters to focus on cybersecurity and putting controls in place to help mitigate the impact of cyber events. While there's no way to eliminate cyber risk, insurers are applying minimum requirements on risk controls to obtain cyber coverage like multifactor authentication, endpoint protection and firewalls. Read more about upcoming regulatory enforcement and prevention and resilience here. What Fed's Interest Rate Hike Means for Insurance The Federal Reserve again hiked interest rates Mid-June by 0.75%. Insurance Business reports, that Mark Bernacki, Amwins Chief Underwriting Officer believes, "Insurance agents should be talking to their clients to make sure they have "sufficient insurance" against a backdrop of soaring loss costs as the Fed seeks to dampen the effects of inflation. They should also be educating them on what the interest rate change means for the insurance market." So, what does this mean for the insurance market? Bernacki stated to Insurance Business Mag, "Obviously, there's the expectation that this could have some short-term pain, both for the economy as well as the insurance industry, but long term this should ultimately be good for both the economy and the insurance industry and also strengthen the labor markets that we're seeing." Read more from the report here. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Additionally, we send out monthly newsletters with content curated just for you and your role. Make sure you're on the list to receive our communications by heading to bit.ly/industrynewsforyou to stay in the loop!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|