|

|

Posted By IIAW Staff,

Wednesday, February 16, 2022

|

Happy Wednesday! In today's Big I Buzz we are discussing how to participate in today's social media challenge #DayInTheLife, the percentage of people using at-home COVID tests and how much inflation accelerated in January. #DayInTheLife Social Challenge Your insurance career is more than meets the eye, and that's why we're encouraging all IIAW members to participate in this year's #DayInTheLife social challenge. How do you participate? Share a photo or video of your work day. We want everyone to see how varied, interesting and fun an insurance career is! The IIAW is participating, head to our social channels on Facebook, Instagram or LinkedIn to see a glimpse of what we are up to! Inflation Accelerates 7.5% in January, Hitting a Fresh 40-Year High January saw another hike in inflation, as the consumer price index rose 7.5% from a year ago, according to a new Labor Department report. Fox Business reported that economists had originally expected the index to show prices surged 7.3% in January from the previous year and 0.5% on a monthly basis. After the report was released, stocks declined with tech leading the broad market selloff. January's report marks the eighth consecutive month the inflation gauge has been above 5%. Read more from Fox Business here. TMJ4 Twitter Poll: 84% Not Taking Advantage of Health Insurance Coverage of At-Home COVID Tests TMJ4, a Milwaukee news station, ran a poll on their Twitter page asking followers, "Since January 15, insurance companies and group health plans have been required to cover the cost of 8 at-home COVID-19 tests per person per month. Have you taken advantage of this?" They received 122 responses and an overwhelming number of respondents said they hadn't taken advantage of the coverage. Read more here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, February 9, 2022

|

Good morning and happy Wednesday! In this week's Big I Buzz, we are discussing our new monthly newsletters and changes to Big I Buzz, emerging risks to watch this year and how to keep homeowners covered this Super Bowl Sunday. Don't Miss Out on our Monthly Newsletters Starting next Monday, the IIAW will be sending out monthly newsletters with content curated just for you and your job role. We'll be putting together four monthly newsletters, and you can choose which newsletters best fit your role! You can choose from the following areas to receive our monthly newsletter: personal lines, commercial lines, employee benefits or industry relations and operations. Make sure you and your team are on our list to receive these communications here. We'll be including information tailored specifically to you and your job role, education opportunities that matter to you and other industry insights that you won't see anywhere else. We'll continue to send out our weekly Big I Buzz, but with a twist. Now, we'll be segmenting the Action News section between these four categories. You'll get the same news stories you know and love, but instead of in one jumbled section, you can read the news that matters to you! Then, in each of the monthly newsletters, we'll highlighted the most-read news article from your interest area in case you missed it the first time. Don't forget to sign up today! The first Personal Lines monthly newsletter will go out next Monday, February 14th, Commercial Lines will receive their newsletter on Monday, February 21st, Employee Benefits on Monday, February 28th and Industry Relations & Operations will receive their newsletter on Monday, March 7th. Emerging Risks to Watch this Year Insurance Journal has examined 10 industry sectors to identify new and emerging risks for the year ahead and beyond. Watch these sectors and read more about why you should keep an eye on these risks: 1. Cyber - with an increase in ransomware attacks, there are more cyber threats to be expected throughout 2022. 2. Political Risk - Social media users taking to social media has increased large-scale demonstrations and protest movements, which could lead to an increase in property damage losses. Additionally, larger and more frequent natural disasters due to climate change can displace vulnerable populations and disrupt economics, which could lead to more political instability and violence, according to Insurance Journal. 3. Telemedicine - As more and more patients turn to telemedicine, plus an expected increase in telemedicine in 2022, health care providers can expect to see an increase in medical professional liability claims. According to RPS, these claims related to telemedicine has been "historically low", but the broker expects growth in the telemedicine segment will lead to more incidents." 4. Product Liability -A report from Willis Towers Watson's "Insurance Marketplace Realities 2021 Spring Update" stated "The pandemic has dramatically increased then umber of companies manufacturing, distributing and selling COVID-19 products, which has in turn increased the demand for life sciences insurance coverage.... Underwriters in the life sciences space have been "inundated" with policy submissions. And while capacity hasn't changed, carriers are being more selective about which risks they will entertain." 5. Mobility & Transport - Transportation continues to change as it's disrupted by the pandemic and technology. According to Insurance Journal, "The emergence of new digital companies that provide “wheel-based” services has accelerated the demand and growth of gig workers during the pandemic, Marsh said in a recent report titled “Mobility in a post-pandemic world: From evolution to revolution.”

Marsh said these trends will rapidly evolve for at least the next year, but insurance products designed to protect the income of these workers are lagging behind." 6. Entertainment -2020's overwhelming amount of event cancellations led to major losses for insurers and rates have risen across the board. While we are seeing a return for live entertainment, there's a shortage of experienced workers which could increase the potential for accidents and cancellations, according to a recent report by HUB International. 7. Commercial Real Estate - The future of office real estate is largely unknown and the insurance market for some multifamily classes remain a challenge, according to Insurance Journal. 8. Management Liability - In 2021, the overall public company D&O marketplace continued to stabilize due to a significant decrease in federal securities class actions. "While pricing challenges remain for many D&O buyers, new capacity and new competition are finally on the way with new entrants to the D&O insurance market, according to Woodruff Sawyer's 2022 D&O Looking Ahead Guide." 9. Employer Liability - "Another situation to watch: in the face of resistance to vaccine mandates in the U.S., there may be an increase in retaliation and discrimination claims under the Americans with Disabilities Act and Civil Rights Act of 1964 (specifically, for religious discrimination), USI stated in its recent 2022 Commercial Property & Casualty Market Outlook. 10. Nonprofits - Nonprofits have experienced overstretched resources due to the pandemic. Their workforce took a significant hit but researches estimate the sector may not see a full return to pre-pandemic workforce levels until fall 2022. Read more here. Super Bowl Sunday - Keeping Homeowners Covered Super Bowl Sunday is almost here and we are ready for football (and commercials)! Ken Gregg, CEO and founder of insurtech platform Orion180 shared that the biggest risk for party hosts surrounds liability. "Guests can potentially fall down the stairs, trip on something, or worse, get in their car to drive home under the influence," he said. "Many homeowners don't consider their exposures when hosting a party." Ken suggests that brokers and agents should focus on communicating liability risk mitigation strategies with their clients. You can use your social media channels to get the message out to some clients. Share information about guest safety when hosting parties and encourage homeowners to reach out so they know what their insurance will cover. Read more here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, February 2, 2022

|

Happy Groundhog Day! We are receiving mixed signals from Punxsatawney Phil and Sun Prairie's Jimmy the Groundhog again this year. Punxsatawney Phil has predicted six more weeks of winter after seeing his shadow this morning in Philadelphia. However, if you prefer to stick to local groundhog news, you're in luck! Sun Prairie's Jimmy the Groundhog predicted an early spring. We'll keep our fingers crossed that Jimmy the Groundhog has some inside knowledge into Wisconsin's spring start. In this week's Big I Buzz, we are discussing our Member Benefit of the Month, the increasing rate of drivers switching car insurance and the results from a new Thrivent Survey. Member Benefit of the Month: Trusted Choice Marketing Reimbursement Program As a member of the IIAW, you're eligible for Trusted Choice's Marketing Reimbursement Program! This program offers multiple options for reimbursement. 1. Cobranding with Trusted Choice When you use traditional cobranding on physical marketing materials you can receive up to $750 for use of the Trusted Choice logo on any consumer facing items such as store signage, advertisements, business cards or sponsorships branded with the Trusted Choice logo alongside your agency logo are all eligible! Under this same option, you can use digital cobranding to receive a reimbursement. All members can access an additional $750 for Digital Marketing efforts (TV, web, social media, etc.) that include the Trusted Choice logo. 2. Digital Upgrade All member agencies (one per agency) are eligible to receive $500 for creating a new website with any of the Trusted Choice Preferred Partners. These partners include: ITC, Agency Revolution, Forge3, Titian Web, Advisor Evolved and Marketing 360. This is a flat reimbursement of $500 and all website must include the Trusted Choice logo on their homepage to be eligible for this reimbursement. Click here to see more information about these marketing reimbursement programs. Drivers Switching Car Insurance at Increasing Rates, Study Finds A new study from J.D. Power and TransUnion shows that an increasing rate of consumers are finding alternatives when shopping for car insurance. According to Fox Business, "The number of drivers shopping for new insurance has remained relatively steady, with 11.4% of consumers obtaining new insurance quotes in the fourth quarter of 2021, the study showed. But the rate that drivers are switching providers is up, rising from 3.3% in the fourth quarter of 2020 to 3.5% in the fourth quarter of 2021. At the beginning of last year, the switch rate had dropped as low as 3.2%." In the spring of 2021, the studies have shown that high-risk drivers are the most likely to shop for new insurance.Michelle Jackson, TransUnion director of personal lines market strategy has attributed these results to the increased usage of telematics which allows insurance companies to collect information about mileage and driving habits. Additionally, the survey stated that consumers want personalized auto insurance. They're looking for alternative programs beyond traditional time-based insurance. Read more here. Thrivent Survey: 70% of Americans Have No Extended Care Plan InsuranceNewsNet.com has reported that, "Despite the COVID-19 pandemic, a survey from Thrivent found that perceptions toward extended care planning haven't changed, and a significant percentage of Americans have not documented their plans, should the need for extended care arise." The survey found that 51 percent said that COVID-19 has not changed their approach to extended care planning at all and only 18% said that COVID-19 has made them realize that having a plan is more important than ever. Alongside these results, it also found that there are very few men and women who have talked about or have documented their extended care plan with their families. The survey found that a majority of those who haven't documented a care plan are women at 77% of women haven't documented for themselves or loved ones compared to the 64% of men who have. This is a great reminder for everyone to consult with their financial advisors about their extended care plans. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, January 26, 2022

|

Happy Wednesday! In this week's Big I Buzz, we are discussing the in-person IIAW Emerging Leaders event happening in February, new travel insurance regulations and the new update on Biden's COVID-19 shot-or-test rule for workers at large employers. IIAW Emerging Leaders Broken Bat Beer, Pizza and Wiffleball Event Come meet the IIAW Emerging Leaders and learn more about how this committee values professional development, networking and giving back to the community. Join us February 24 from 3:30 to 7 p.m. at the Broken Bat Brewery in Milwaukee! We'll be enjoying Broken Bat beer, ordering pizza, networking and playing wiffleball. From 3:30 to 5:30, we'll be renting out their indoor wiffleball field and through the entire event, we'll have their private "Outfield" available for our networking event. All agents, carriers, brokers, vendors and other working int he independent insurance agency channel are welcome! Register for the event here: https://www.iiaw.com/event/wiffleball Biden's Shot-or-Test Rule Abandoned After Supreme Court Loss (2) On January 13, the U.S. Supreme Court in a 6-3 decision stated that OSHA could not enforce the shot-or-test mandate. OSHA's temporary mandate would have required most employers with 100 or more workers to either require employees be fully vaccinated or pass at least weekly COVID-19 tests. An announcement on Tuesday noted that the Biden administration is withdrawing its COVID shot-or-test rule for workers at large employers following the block from the Supreme Court on January 13th. Now that this withdrawal has been announced, OSHA has stated that they will continue to work on permanent COVID-19 standards. According to Bloomberg Law, "The decision to withdraw the temporary standard doesn't prevent OSHA from continuing to pursue a permanent version of the vaccination and testing standard, said Alka Ramchandani-Raj, a shareholder with Littler Mendelson P.C. in Walnut Creek, California, and co-chair of the firm's workplace safety and health practice. For permanent rule, OSHA wouldn't need to prove there was a "grave danger" since the grave danger threshold only applies to emergency temporary standards." Read more about the regulation update here. Wisconsin Updating Travel Insurance Regulations Starting March 1, 2022, Wisconsin's travel insurance law will put regulations in place for 'travel retailers'. According to NU Property Casualty 360, "Wisconsin's travel insurance law will classify travel insurance as part of inland marine lines as well as accident and health lines if the policy includes sickness and disability coverage, according to the state's office of insurance." The OCI reported that the law will prohibit the use of "negative option" or opt-out processes that require a traveler to take an affirmative action to decline coverage when buying a trip. NU Property Casualty 360 lists these as the rules for 'travel retailers': "Business entities that offer travel services can now "offer and disseminate" travel insurance in Wisconsin under the licenses of a travel insurance producer if they adhere to the following guidelines: - The purchaser of travel insurance is provided required information such as a description of the material terms and the process for filing a claim.

- The limited lines travel insurance producer keeps a register of each travel retailer that offers and disseminates travel insurance on the producer’s behalf.

- The limited lines travel insurance producer designates an employee who is a licensed producer as the person responsible for compliance with the statutes and rules of this state.

- The designated responsible employee, the officers of the limited lines travel insurance producer, and any other person who directs or controls the limited lines travel insurance producer’s insurance operations complies with insurance intermediary fingerprinting requirements.

- The limited lines travel insurance producer pays all applicable licensing fees.

- The limited lines travel insurance producer requires each employee and authorized representative of the travel retailer whose duties include offering and disseminating travel insurance to receive a program of instruction or training.

The law stipulates that travel retailers, or their employees and authorized representatives, which are not licensed limited line travel insurance producers can’t take the following actions: - Evaluate or interpret technical terms, benefits, or conditions of travel insurance coverage.

- Evaluate or provide advice concerning a prospective purchaser’s existing insurance coverage.

- Hold himself or herself out as an insurer, a limited lines travel insurance producer or an insurance expert.

For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, January 19, 2022

|

Happy Wednesday! In this week's Big I Buzz we are discussing how IIAW members can receive 1 FREE WI CE credit, newly-released InsurCon2022 details and 3 key 2022 trends for AI and P&C Insurance. Flood Risk Rating 2.0 Webinar Join us on Thursday, January 20th for our Flood Risk Rating 2.0 webinar. This webinar is free for IIAW members, and the webinar has been approved for 1 Wisconsin CE credit. This webinar has been brought to you by the IIAW in partnership with Selective Insurance Company of America. Register here: https://buff.ly/3Ja7POC InsurCon2022: You will not want to miss this event! Our January 2022 magazine has newly released details about InsurCon2022. This year's convention will welcome our keynote speaker, Hall of Fame basketball legend, Bill Walton! Additionally, this year's format has been inspired by TED talks and will feature eight energizing speakers. Topics range from agency technology, cybersecurity and more. Check out this month's magazine for more information! 3 Key 2022 Trends for AI and P&C Insurance NU Property Casualty 360 has put together a list of three key AI trends that are set to dominate the insurance industry in 2022: 1. Wriggling away from on-premise - As the industry has faced the ongoing effects of COVID and undergone a major digital makeover, this year will be a pivotal year for accelerated movement towards the cloud. 2. Creating value from new sources of data - With the movement towards more digital-based operations, the year will see newer sources of data from increasing ease of storage, access and processing of documents, voice recordings, interaction transcripts, behavioral data and IOT data. According to Property Casualty, all this new data will, "design new products and services, simplify distribution, improve fraud management especially in emerging areas such as cyber risk, reduce customer effort and reimagine business models." 3. Winning the war for talent - our weekly newsletter has been focusing on the increased demand for talent across all industries. The same goes for the insurance industry as all of these trends for AI will need talent to put them into place. "The year ahead is set to be one of the headiest years for the insurance industry yet. However, through continuous dedication to digital transformation, insurers can find ways to not just adopt AI but use it in a way that drives incredible value for their business." Read more about these trends here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, January 12, 2022

|

Happy Wednesday! In this week's Big I Buzz we are discussing predicted telehealth risks for the year, how to get an at-home over-the-counter COVID test and cryptocurrency crimes. Viewpoint: Telehealth Risks and Predicted Impacts for 2022 COVID-19 has changed the way we do a lot of things and healthcare is at the top of the list. Many doctors' offices adopted telehealth. Claims Journal defines telehealth as, "The delivery and facilitation of health-related services via telecommunications and digital communication technologies." Despite the conveniences of telehealth, there are some risks involved. According to Claims Journal, "Legal experts predict that the volume of virtual care lawsuits will increase as telemedicine becomes and increasingly common way for patients to access healthcare... For example, a report from Quest Diagnostics said that 67% of the primary care physicians they surveyed were concerned that they missed signs of patient drug abuse during the pandemic. Only 50% of survey respondents were confident they could recognize signs of drug misuse during telehealth visits, compared to the 91% that said the same of in-person patient interactions." Claims Journal checked in with malpractice experts' to get their prediction of telehealth impacts for the year: their prediction was that as telehealth becomes more prominent, we will see an increase in claims resulting from lack of clarity around provider accountability, missed and delayed diagnosis and missteps in care transitions. Read more about the risks and predictions for 2022 here. How to Get Your At-Home Over-the-Counter COVID-19 Test for Free As the omicron variant causes COVID spikes across the country many people are looking to get tested. Testing facilities are facing longer lines than usual, which can make the wait for a COVID test and results longer than hoped for. So, how can you get your at-home over-the-counter COVID-19 test for free? Starting January 15, mots people with a health plan can go online, or to a pharmacy or store to purchase an at-home over-the-counter COVID-19 diagnostic test authorized by the FDA at no cost, either through reimbursement or free of charge through insurance. Do you have to submit your test for reimbursement or can you walk in and pick up at-home OTC tests for free? It depends on your plan. If you are charged for an at-home OTC test after January 15, you can keep your receipt and submit a claim to your insurance company for reimbursement. According to CMS.gov, "If your plan has not set up a network of preferred stores, pharmacies and online retailers at which you can obtain a test with no out-of-pocket expense, you will be reimbursed the amount of the cost of the test. For example, if you buy a two-pack of tests for $34, the plan or insurer would reimburse $34. If your plan has set up a network of preferred stores, pharmacies and online retailers at which you can obtain a test with no out-of-pocket expense, you can still obtain tests from other retailers if you buy them outside of that network. Your plan is required to reimburse you at a rate of up to $12 per individual test (or the cost of the test, if less than $12). Save your receipt(s) to submit to your plan for reimbursement at a rate of at least $12 per individual test (or the cost of the test, if less than $12). You can read more about getting an at-home over-the-counter COVID test here. Cryptocurrency Crime Hit Record $14 Billion in 2021: Research Blockchain researcher Chainalysis said that crime involving cryptocurrencies hit an all-time high of $14 billion in 2021. According to their report, Crypto received by digital wallet addresses linked to illicit activity including scams, darknet markets and ransomware jumped 80% from a year earlier. The activity represented just 0.15% of total crypto transaction volumes, its lowest ever. Overall volumes soared to $15.8 trillion in 2021, up over five-fold from a year earlier. Insurance Journal reported that, "Driving the increase in crime was an explosion of scams and theft at decentralized finance - DeFi - platforms, Chainalysis said. DeFi sites - which offer lending, insurance and other financial services while bypassing traditional gatekeepers such as banks - have been plagued by problems that include flaws in underlying code and opaque governance." Read more about cryptocurrency crime in 2021 here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, January 4, 2022

|

Big I Buzz is back, and we hope that everyone enjoyed their holiday season! We are back and covering all the news stories that you need to know about as we jump into the new year. In this week's Big I Buzz, we are discussing our new member benefit of the month, P&C predictions for 2022 and buying trends anticipated for the new year. Spotlight on Member Benefits - January 2022 Every month we feature a new member benefit that all IIAW members have access to! This month's spotlight focuses on our 2021 Q3 P-C Marketplace Report. Members receive the report for free (a $99 value) and the report highlights top lines of business trends, growth rates, percentage of surplus lines and the biggest writing insurers. You can access the report here. If you're not an IIAW, you can purchase this report for $99. Members can also access Q1 and Q2 results. Stay tuned in the next few months for the 2021 Q4 report. P&C Insurance Industry Predictions for 2022 NU Property Casualty 360 has put together their list of five things to look for in the year ahead, including supply chain issues and a property price 'reckoning'. 1. Electric vehicles to emerge as a growth segment for insurers. According to Property Casualty 360, "The global market for electric vehicles is expected to grow from $171 billion in 2020 to $725 billion in 2026 - a compound annual growth rate (CAGR) of more than 27%. By 2030, we expect there to be 115 million electric fleet vehicles globally. 2. Sustained supply chain & inventory management risk will accelerate product reinvention. It's likely that the supply chain issues we've seen occurring throughout the end of 2021 will continue into 2022. NU Property Casualty 360 says that we can expect to see more insurers apply risk mitigation and management solutions more broadly and go beyond indemnification to help their customers address core operating risk. 3. A property pricing and profitability reckoning is coming.The US annual inflation rate reached the highest in four decades in November. NU Property Casualty 360 reports that, "The next two decades are expected to bring steep increases in both premiums and concentration of risk from catastrophic events linked to climate change and greater urbanization in emerging markets. The year ahead will be one with a pricing and profitability reckoning within property markets." 4. Insurance operating models will adjust to seismic shifts. Between COVID and the "Great Resignation", the pressures and shifts these are causing will force insurers to disrupt long-standing apprenticeship models that the industry has relied on for skilling in essential functions like claims and underwriting. 5. Resetting the underwriting workflow. "Insurers are ready to see their digital transformation and cloud platform investments of the last two years pay off in the form of cost reduction and new business. In 2022, we will see transformation programs aimed at reducing expense ratios and boosting profitability through increased process efficiency and 'decisioning' effectiveness in underwriting," NU Property Casualty writes. You can read more about their predictions for the year here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, December 15, 2021

|

Happy Holidays! This is the final Big I Buzz for the year, and we are covering a LOT! First, as a reminder, we will be closed on December 24, December 27, December 30 and December 31 for the holidays. If you have any questions arise during this time, feel free to send an email to our general inbox, info@iiaw.com. Sign up for Catalyit Now Before the Subscription Window Ends! Access to Catalyit's Full Access Subscription is only available 4 times a year, and their subscription window closes THIS FRIDAY and won't open again until next year. Sign up now at catalyit.com. IIAW members get a free basic subscription. What's Catalyit? Catalyit.com is a website created by Steve Anderson and several Big I state associations that bring all the agency tech guidance you need... in one place. Behind the login button, you'll enter a world crafted to help you discover, evaluate, select and implement tech. This includes: • Tools - The Catalyit Success Journey™, and our in-depth tech assessment, provide you with a custom roadmap for success. • Guides & Reviews: Our topic guides share insights, help you compare solutions in minutes, and include reviews. • Training: From live coaching and Q&A sessions to our on-demand video vault, you'll be able to get the most out of your tools. • Community: Discuss trends, best practices and challenges with peers, experts and providers. • Consulting: Need custom, one-on-one support? Our team of experts can work directly with your agency. Your new basic subscription grants you access to a lot of this great content. once you're ready, upgrade to Full Access to unlock everything! But don't wait too long - the option to subscribe to Full Access closes on Friday, December 17th. Learn more at catalyit.com. Holiday Social Media Posts: As you're preparing for time off, we've put together a few social media graphics that you can share on your own pages to make your holiday marketing a little easier! How to save: right-click and save image as to save it to your desktop.

Suggested Copy: Merry Christmas from the _____ team!

Suggested Copy: The New Year is the perfect time to review your insurance policies to make sure you have the coverage you need. Need help? Contact us at ___________.

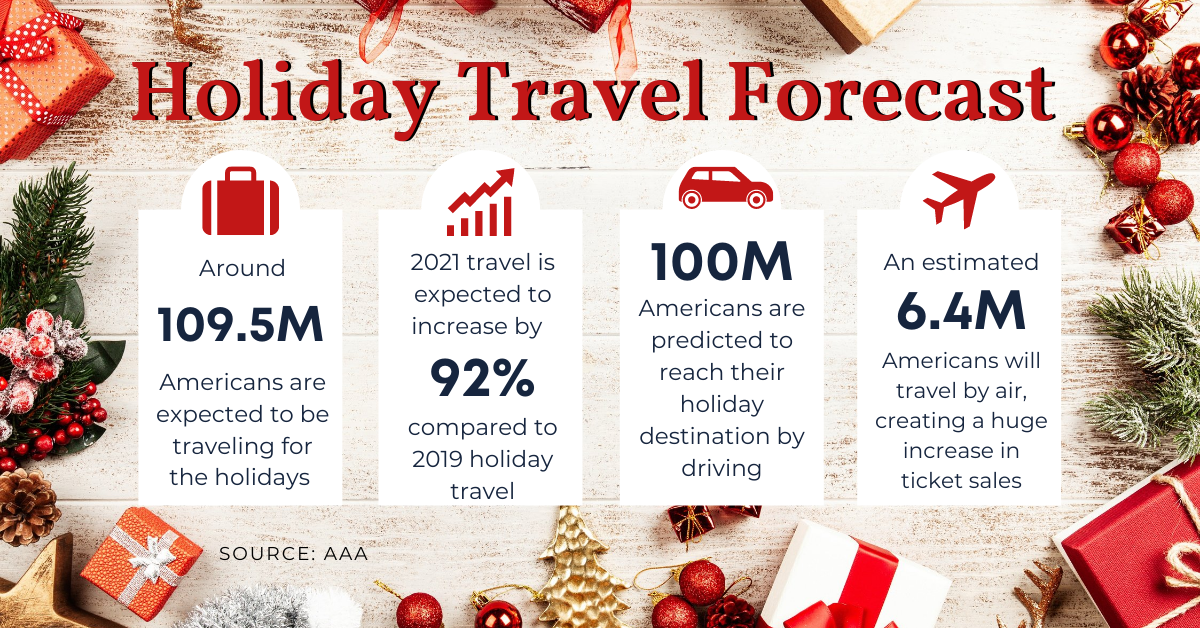

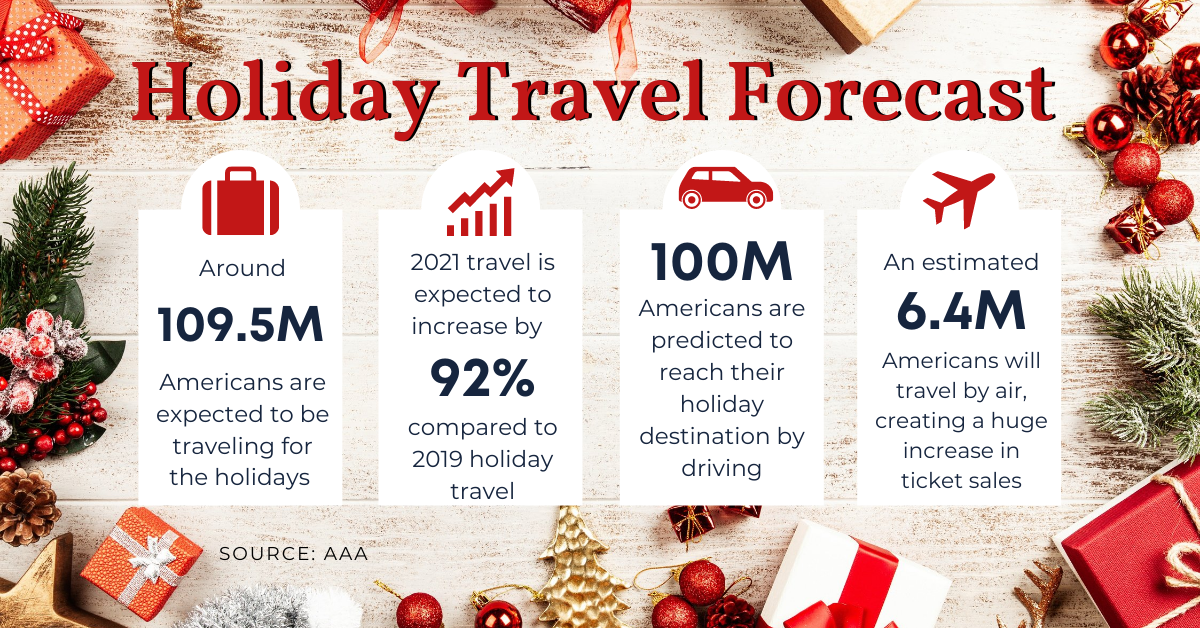

Suggested Copy: Will you be traveling for the holidays? 109.5 million Americans are planning to travel to their holiday destination. We are wishing everyone safe travels as they celebrate the holiday season. In addition to these graphics, you can also use any of the Trusted Choice graphics to help spruce up your social media posts! They have holiday and winter focused graphics that you can download to use on your pages. Head over to the IIAW Facebook page, and feel free to share any of our posts onto your own page too! For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, December 8, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing the annual IIAW Emerging Leaders fundraiser, what P/C insurers can expect in 2022 and newly named "Top D.C. Lobbyists".

Annual IIAW Emerging Leaders Fundraiser Last week the IIAW Emerging Leaders kicked off their annual fundraiser to support the Child Life Department at the American Family Children's Hospital. During this fundraiser last year, within the first few weeks of the fundraiser, we surpassed the initial donation goal of $500, donating an incredible total of $5,725! Due to COVID-19, we are still unable to drop off gifts for the children as we had done prior to the pandemic, but we are accepting monetary donations. New this year, you can choose to donate items to the hospital from their 2021 Holiday Season Registry, which ships directly from Amazon to the American Family Children's Hospital. Monetary donations will be accepted through December 22, 2021 and the registry will be open for three more weeks. You can make a monetary donation here or you can purchase from the AFCH registry here. Big 'I' Leaders Once Again Named Among Top D.C. Lobbyists The IIAW and InsurPac, our state and national Political Action Committees, ensure our industry is present and heard in Wisconsin and Washington D.C. Recently, Big 'I' Leaders were once again named among the top D.C. lobbyists by The Hill, a prominent political newspaper. The paper listed Big 'I' leaders, Bob Rusbuldt, Big "I" President & CEO, and Charles Symington, Big "I" senior vice president of external, industry and goverment affairs in the top trade association lobbyists in Washington D.C. According to IA Magazine, "A vital component of the association's advocacy efforts is InsurPac, a multimillion dollar political action committee. It develops and strenghtens relationships with elected officials and candidates for federal office, amplifying the Big "I" brand on Capitol Hill. During the 2020 election cycle, InsurPac disbursed $1,948,000 to a total of 254 federal campaigns, winning at least 237 of them, resulting in a 93% victory rate. In disbursing this money, InsurPac did not look at party affiliation; as always, it gave money to representatives, senators and candidates for federal office that have been friends and advocates of the independent agency system." You can read more from this article here. If you'd like to donate to the national InsurPac, or Insuring Wisconsin PAC, please visit the IIAW website here. Heading Into 2022, P/C Insurers Face 'Massive' Political Risks, Economic Uncertainty During the Insurance Information Institute Joint Industry Forum 2021 in New York City on December 2nd, Michel Leonard, vice president, senior economist and data scientist and Head of the Economics and Analytics Department at III spoke about the "massive" political risks that property/casualty insurers will face throughout 2022. These risks include labor dislocation and the midterm elections, the continued institutional deadlock in Congress, worsening socioeconomic inequality and far right domestic radicalization. According to Insurance Journal, "In the U.S. and around the world, these risks encompass anti-vax radicalization relating to the COVID-19 vaccines, far-left industrial sabotage relating to fossil fuels and conflict with China over Taiwan and Hong Kong. Other flashpoint risks remain or are worsening in North Korea, Ukraine, Belarus, Latvia, India, China and Pakistan, Leonard noted. Beyond that, there are also risks involving weaponized trade policies, state-sponsored cyber terrorism and warfare, and risks involving state and non-state interference in elections both in the U.S. and abroad." You can read more from Insurance Journal here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, December 1, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing our December Member Benefit Spotlight, the changes to A.M. Best commercial property market outlook and where employers stand on the 'new normal'. This Month's Spotlight on Member Benefits December is here, and we are highlighting a new member benefit for the month, Catalyit.You told us harnessing tech in your agency isn't easy. We listened, and did something about it. The solution is here today! Introducing Catalyit: All the agency tech guidance you need... in one place. The number of ways independent insurance agencies can leverage tech to increase profit and serve customers is nearly unlimited. But time, know-how and fear of risk are getting in the way. Catalyit solves it for you. The IIAW partnered with six state associations and industry tech leader, Steve Anderson, to create Catalyit. To super-serve Catalyit subscribers, access to catalyit.com is limited to four windows a year. So, for now, access to Catalyit opened October 14, 2021, and will close December 15, 2021. With a brand new year right around the corner, you won't want to wait. Take advantage of the current sign up window. Your IIAW membership grants you free access to a Basic subscription. You can get a full-access pass (all tools, guides and learning unlocked) for your entire agency with an exclusive IIAW discount. Learn more here. A.M. Best Revises Commercial Property Market Outlook According to Business Insurance, "On Tuesday, A.M. Best updated its outlook for the U.S. commercial property insurance market from negative to stable, citing ongoing rate increases by insurers and a decline in business interruption claims." The report stated that inflationary cost pressures may push rates upward throughout 2022. "Appropriate rate and pricing actions by commercial property insurers as well as ongoing efforts to ensure the adequacy of property valuations will mitigate the effect over time," Best said. Read more here. Where Employers Stand on Vaccines, 'New Normal' Workplace, Remote Work, Travel A recent survey from Willis Towers Watson found that more than half of US employers require or plan to require COVID-19 vaccinations of employees, but their support depends on whether the courts approve the Biden Administration emergency workplace safety rule requiring vaccinations or weekly testing. Originally, the deadline for comments was set for December 6, however as of this morning, it was pushed back to January 19th. Insurance Journal reported that, "About three in 10 respondents (29%) [to the survey] say their organizations have already reached their "new normal" in terms of returning to the workplace and ending pandemic-related policies. Roughly the same amount (28%) say they don't expect their organizations to reach the new normal until the third quarter of 2022 or later. Additionally respondents report that 34% of employees are now working remotely. This is expected to drop to 27% in the first quarter of 2022. Employers that have returned remote workers to the workplace report that public health recommendations (79%), state regulations and recommendations (74%) and business needs (71%) were considerations in their decisions." Read more on the survey findings about business travel, vaccination rates and federal contractors here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

wisconsin insurance blog

Permalink

| Comments (0)

|

|