|

|

Posted By Kim Fiene,

Wednesday, February 26, 2025

|

Happy Wednesday! In this week's Big I Buzz: It's Flood Safety Awareness Week in Wisconsin—get tips to stay prepared. Plus, a reminder from the U.S. Department of Agriculture about upcoming crop insurance deadlines.

Wisconsin Flood Safety Awareness Week - February 24-28, 2025 Flooding is one of the most frequent and destructive natural disasters, impacting individuals, families, and communities across Wisconsin. Understanding the risks and taking proactive steps can make all the difference in staying safe. To promote flood preparedness, Governor Tony Evers has declared February 24-28 as Flood Safety Awareness Week in Wisconsin. Stay prepared by: - Checking your sump pump to ensure it’s functioning properly.

- Identifying flood-prone roads and planning alternate routes.

- Elevating items in your basement to prevent damage.

Get more tips here.

USDA: Upcoming Crop Insurance Deadlines The U.S. Department of Agriculture (USDA) is reminding agricultural producers that deadlines to apply for or modify crop insurance coverage for the 2025 crop year are fast approaching. Sales closing dates vary by crop and location, with key deadlines on Feb. 28, March 15, and April 15. Federal crop insurance is a vital tool for managing revenue risks, offering options like Whole-Farm Revenue Protection and Micro Farm coverage. Producers are encouraged to review their policies and meet with their crop insurance agents to ensure they have the right coverage in place. Read more here. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

big i buzz

IIAW news

independent insurance agents

insuring Wisconsin

wisconsin independent agent

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Kim Fiene,

Wednesday, August 21, 2024

|

Happy Wednesday! In this week's Big I Buzz, a look at a recent study on middle-income Americans & life insurance. Plus, growing concerns over investors’ high profits from catastrophe bonds Achieving Life Insurance Success with Middle-Income Americans A recent 2024 Insurance Barometer Study by LIMRA and Life Happens found that middle-income Americans, with household incomes between $50,000 and $149,999, present the biggest market potential for the financial services industry. Two financial experts recently discussed their strategies for successfully selling life insurance to this crucial segment of the U.S. population. Read more here.

The Huge Profits Investors Have Made on Catastrophe Bonds Are Raising Eyebrows Concerns are growing over high profits investors are making from catastrophe bonds, which have been handing double-digit returns. These bonds, issued by insurers, reinsurers, and governments, provide disaster coverage but are under scrutiny due to the high costs for issuers and the narrowly defined conditions for triggering payouts. The popularity of cat bonds has surged recently, driven by factors like climate change, increased population density, and inflation. Read more here.

For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

insuring Wisconsin

wisconsin independent agent

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, May 24, 2022

|

Whether your agency is big or small, the more markets you have access to, the better chance you have to write more business. Wisconsin has made market access an integral part of your membership through our investment in the Independent Market Solutions (IMS) program, a market access solution for any size agency. For new or smaller agencies with few or no direct appointments, IMS can help you gain new carrier appointments as IMS subproducers. As an IMS subproducer, you’ll start building relationships directly with carriers, earn standard commissions, and, once minimum premium thresholds and performance standards are met, gain the opportunity to “graduate” to a direct appointment. Agents can also participate in any earned contingencies as an IMS subproducer. If you manage a mid- to large-sized agency, there are likely times when you’re presented with niche pieces of business. You’ve worked hard to earn your clients’ business, so why turn away a request on a risk that your agency doesn’t currently write? Our IMS program can help satisfy your clients’ needs without taking on additional minimums or referring them elsewhere due to the lack of available markets. No matter the size of your agency, the IMS menu is constantly evolving to include new carriers intended to expand your strike zone. Click here to see which carrier partners might be the right fit for your agency.

Tags:

IMS

Independent Market Solutions

insuring Wisconsin

market access

market access program

wisconsin independent agent

wisconsin independent insurance association

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Monday, January 4, 2021

|

By: Matt Banaszynski | CEO of IIAW

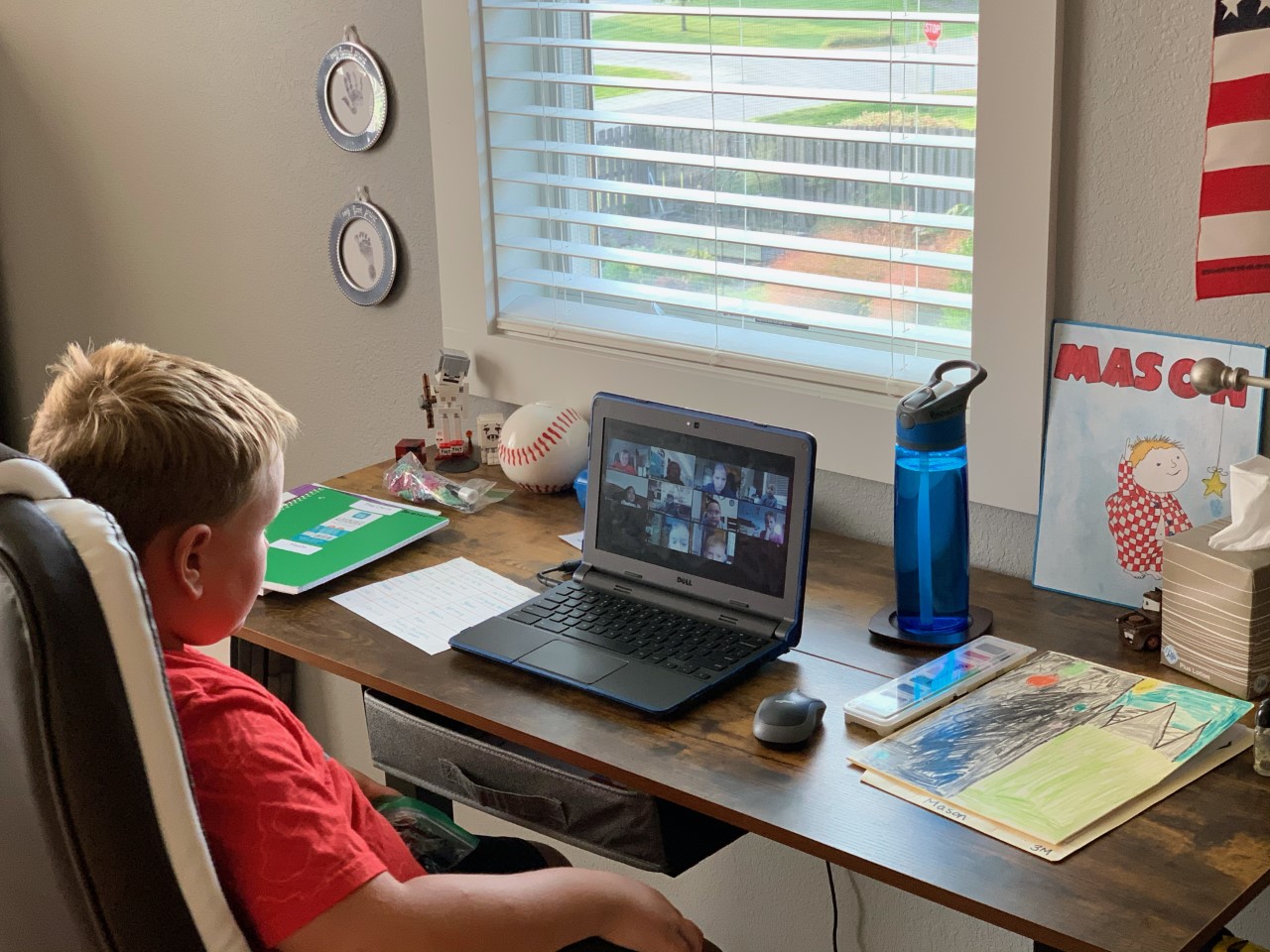

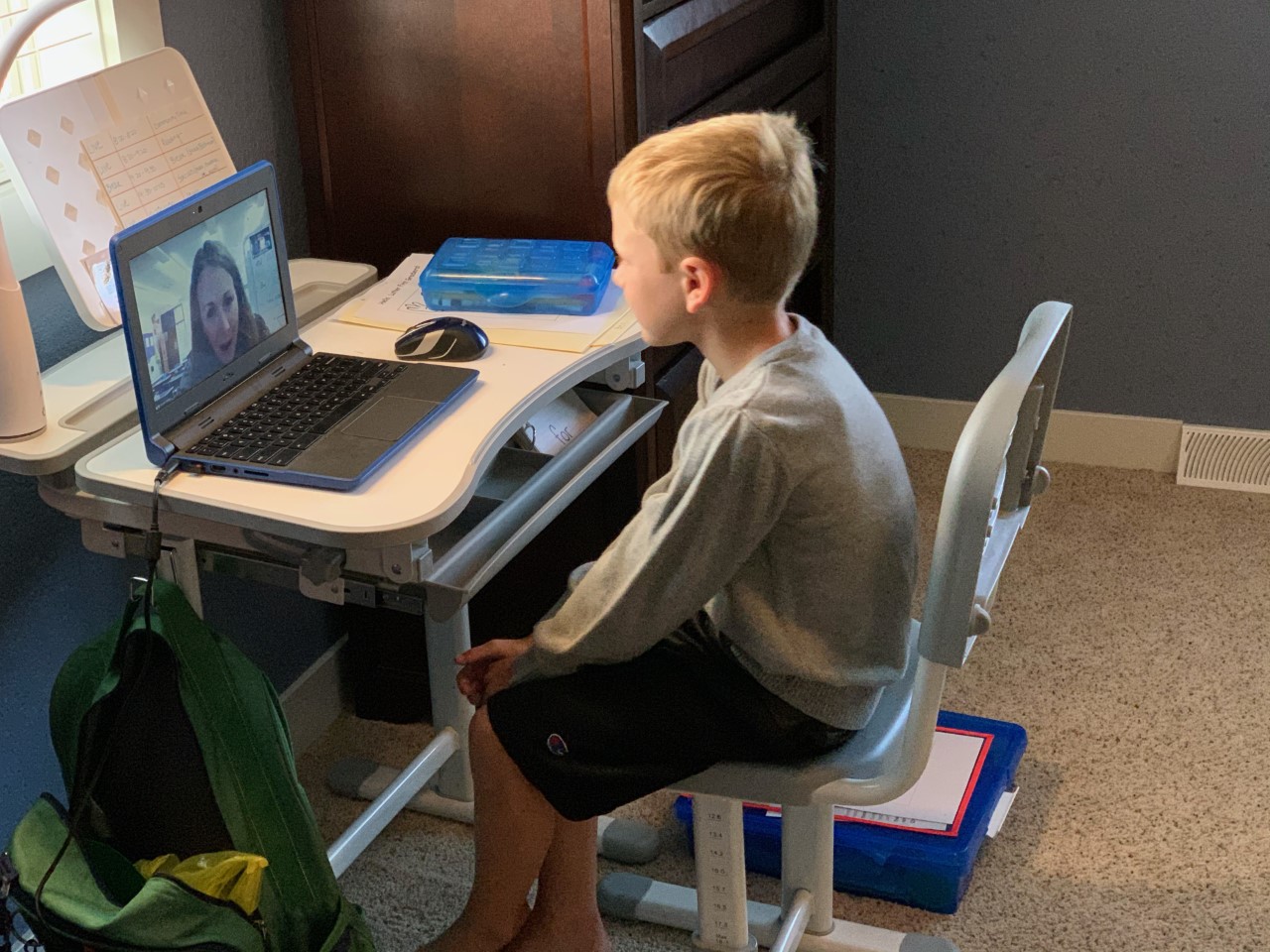

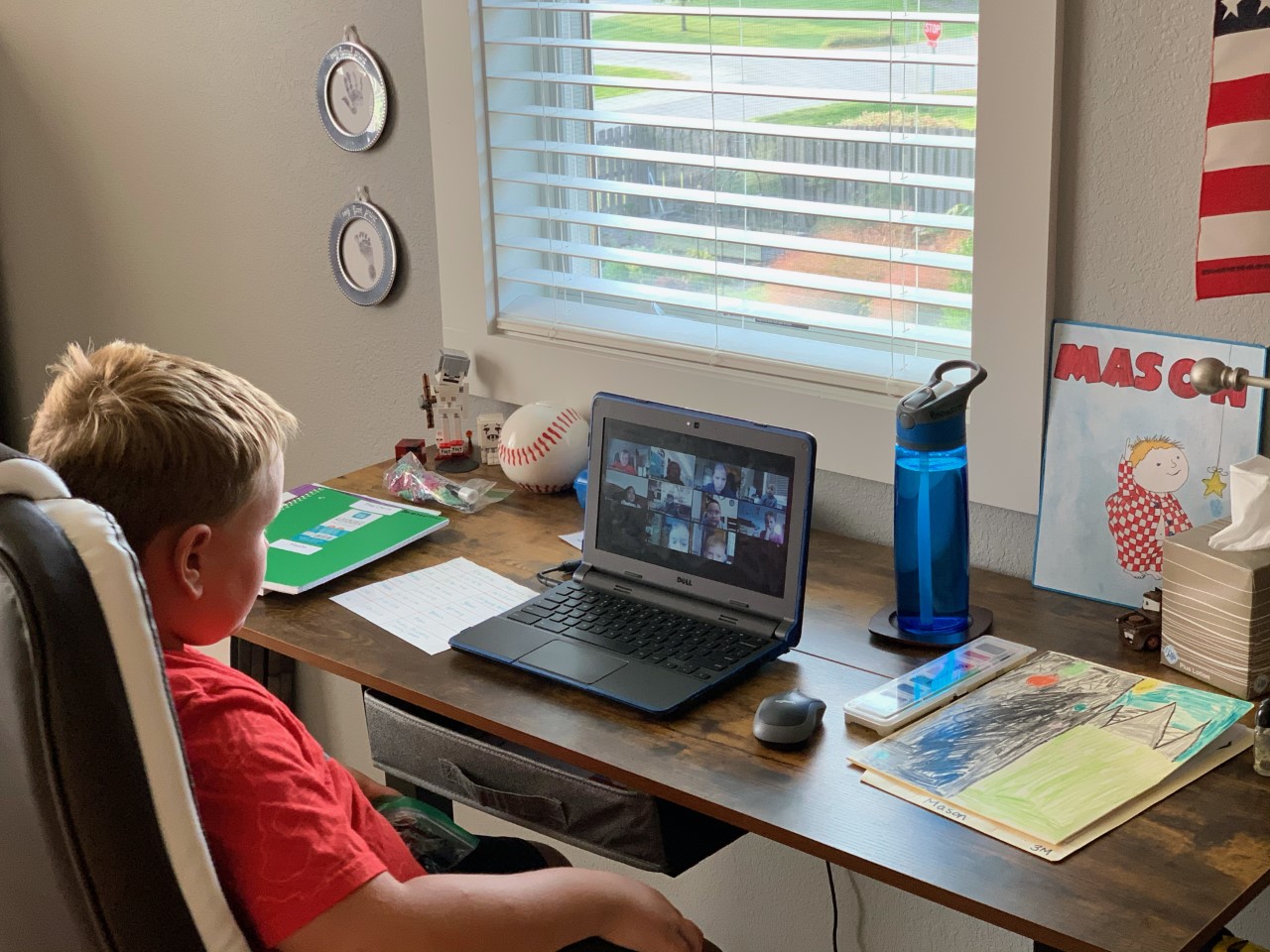

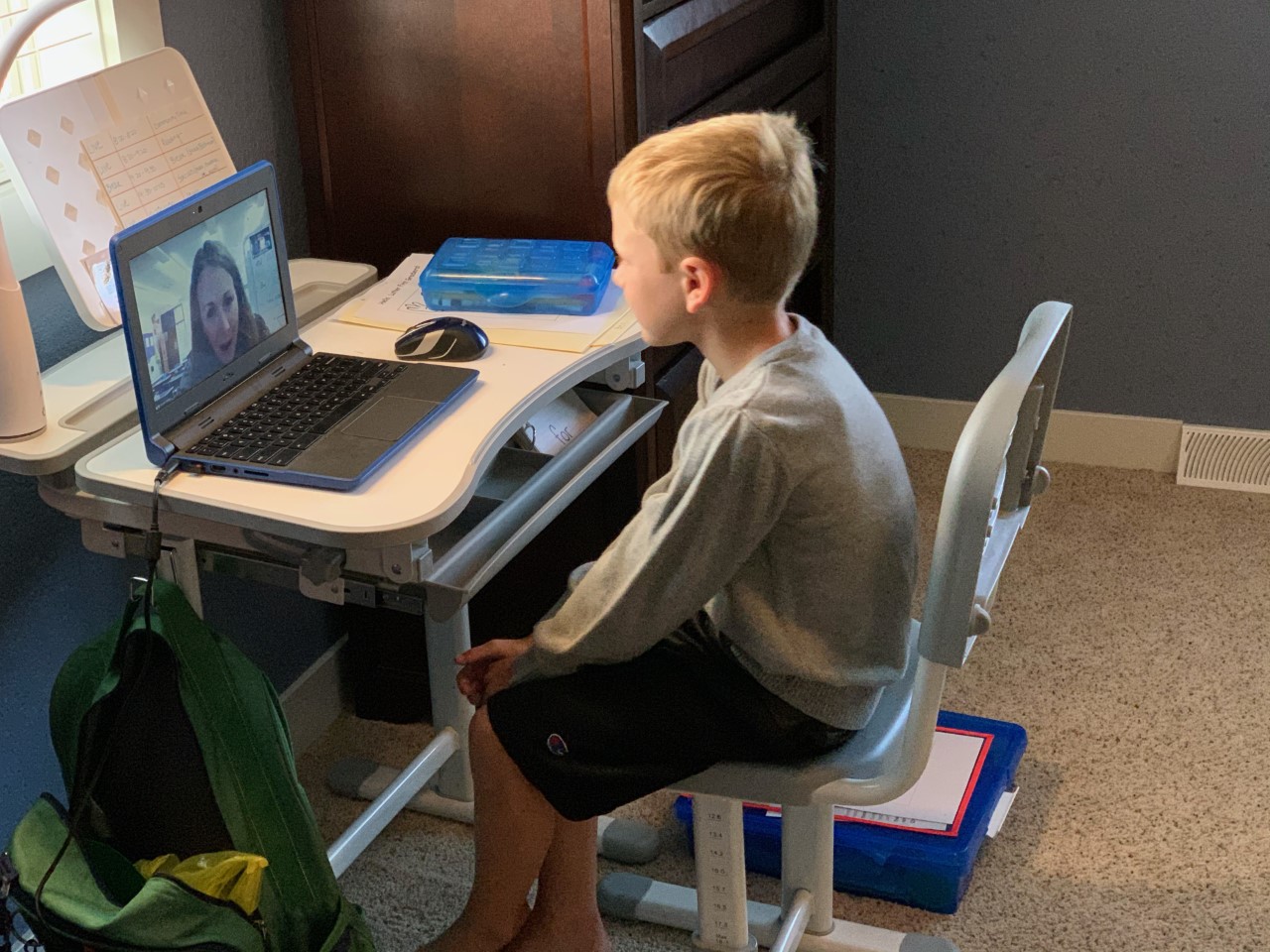

Congratulations! You made it to 2021. 2020 will almost surely be defined by the COVID-19 pandemic. Despite the challenges presented by the pandemic, I see 2020 as the year I gained new perspectives, discovered five years’ worth of innovation in one year,

and came to appreciate the little things in life that in a normal year often get overlooked. Recently, I was sitting in my office and was reminded of an article I read back in April titled, “What Hard Times Teach Us: 5 Pandemic-Inspired Lessons That Will Make You Better For The Long Term” by Tracy Brower. I thought I would combine some of her advice with my own words of wisdom that came to mind when I introspectively

examined what I learned from this past year. I thought I would share them with you before I file away 2020 in hopes of making 2021 the best year yet!

Patience: If you have children, you may have an abundance of patience or lack it

entirely, but one thing is for sure, this pandemic pushed it to its limit. Whether it was/is navigating and balancing the complexities of virtual learning with working remotely, waiting for the quarantine to lift, or anticipating your favorite

restaurants to reopen and spring back to life. One thing was for sure, we are never going back to “normal”.

Finding patience can yield a different perspective and even at times, new appreciations in life. As importance as patience is to your well-being, it is also important to understand and recognize the sign of impatience.

According to Mindtools.com, “Patience is a vital quality in the workplace. It can reduce stress and conflict, lead to better working relationships, and help you

to achieve your long-term life and career goals. Many of us struggle with impatience. Learn to recognize the physical and emotional symptoms associated with it, and to identify the situations that trigger it. When you understand the causes

of your impatience, you can develop strategies to prevent or overcome it. These could include attending to your physical well-being by using deep breathing and relaxation techniques and developing your empathy and emotional intelligence skills”.

Playing the long game: A term often used to describe how taking the necessary

steps now will to set yourself up to long-term success. It means not sacrificing long-term gains for short-term wins. Tracy Bowers says, “With a narrow perspective, current reality can be even more challenging, but by taking a longer-term

view, you can reassure yourself that current realities will shift, and good things will come—ultimately—from today’s experiences and lessons”. Warren Buffet once said, “Someone is sitting in the shade today because someone else planted a tree

a long time ago.” Do not focus on the here and now, especially when the here and now are so tumultuous. Take solace in the fact that this too shall pass, you will get through it and you will be better because of it. The race is long, and in

the end, it’s only with yourself!

Adaptability: A term that most certainly comes to mind when you look to define

2020. You cannot always control what happens, but you can control how you respond. Benjamin Franklin famously proclaimed, “Change is the only constant in life. One’s ability to adapt to those changes will determine your success in life”. This

guiding principle is one that has propelled the American spirit forward for generations and will continue to do so. Some consider this soft skill the most important. As Bob Dylan famously sang, “The times, they are a changin’.” Being adaptable

allows you to take control and chart your own course, instead of just letting things happen around you. Remember, change is constant, even without global pandemics, our industry is undergoing a significant amount of change. Be empowered in

the face of change.

In his article in Forbes entitled, “14 Signs of an Adaptable Person,” Jeff Boss identifies the following traits of

adaptable people: they experiment, they see opportunity where others see failures, they are resourceful, they think ahead, they don’t whine, they talk to themselves, and they don’t blame others. They also don’t claim fame, they are curious,

they open their minds, they see systems, and they stay current.

If you do not possess these traits or would like to refine them, there are ways you can train yourself to be more adaptable. Consider reading, “How to Survive Change . . . You Didn’t Ask for: Bounce Back, Find Calm in Chaos, and Reinvent Yourself”

by M.J. Ryan.

Resilience: Research shows that resilience is enhanced by having a clear view

of reality, a sense of meaning and an ability to improvise. In addition, according to Professor de Weerd-Nederhof of the University of Twente, resilience is both a personality trait

and a skill. Hard times may be easier if it is part of your character, but it’s also a competence you can develop through today’s challenging times. The American Psychological Association has a great short read on “Building your Resilience” that is worth checking out.

If you would like to become more resilient, consider these tips:

• Get connected.

• Make every day meaningful.

• Learn from experience.

• Remain hopeful.

• Take care of yourself.

• Be proactive.

Responsiveness: Reacting quickly and positively is an art and an interquel part

of good customer service. Responsiveness is a must-have in your communication and customer service toolbox. You show responsiveness through prompt attentiveness when asked for something. This term likely took on new meaning during 2020. Perhaps

you found it more important than ever to be responsive to the needs of your loved ones, co-workers, customers, and other business partners. Being responsive creates an opportunity to build trust and respect by acting quickly and proactively,

thus eliminating concerns and anxiety during a time of uncertainty. Being responsive during these turbulent times meant the opportunity to create a deeper, more meaningful connection. Consider these 7 ways to be more responsive to your customers

according to SmallBizDaily:

1. Ask your customers what they want.

2. Manage customer expectations.

3. Develop procedures.

4. Educate your employees.

5. Provide self-service options.

6. Use technology.

7. Stay human.

Gratitude: Being grateful for the people and things in your life that have a

positive impact is critical to happiness. Whether you’re appreciating the companionship of friends, extended time with family, or the bond you’re building with coworkers through shared struggles, there is a lot to be thankful for. Be sure

to share your gratitude to those that have contributed towards it and do not be afraid to

“pay it forward”.

Happiness: Happiness is a mindset that can be difficult to explain or define.

Much like beauty is in the eye of the beholder, it’s different for everyone. Happiness is an important component to a meaningful life - it can provide a sense of purpose. It’s also something that doesn’t come easy and needs to be earned.

Regularly indulging in small pleasures, getting absorbed in challenging activities, setting and meeting goals, maintaining close social ties and

finding purpose beyond oneself all increase life satisfaction. It isn’t happiness that promotes well-being, it’s the actual pursuit that’s crucial.

If you want to learn how to boost your wellbeing with strategies from groundbreaking research, visit happify and read through the resources on The Science of Happiness and How to be Happy.

Self-discipline: Self-discipline is about controlling your feelings to overcome

your weaknesses - something many of us may have found challenging in 2020. Sure, you can binge-watch your favorite tv show instead of working remotely from home, but as Tracy Bower puts it, “This is a great time to learn new approaches to

managing your behavior and building new habits”. Self-discipline is an essential quality, and it’s a key differentiator between people who are successful in life and those who struggle to be.

Make sure that you take time to continually develop it!

According to MindTools.com: To develop self-discipline, follow these steps:

1. Choose a goal.

2. Find your motivation.

3. Identify obstacles.

4. Replace old habits.

5. Monitor your progress.

Instituting and refining self-discipline won’t always go according to plan. You will have ups and downs, successes and failures. The key is to keep moving forward. When you have a setback, acknowledge what caused it and move on. It is easy to

get wrapped up in guilt, anger, or frustration, but these emotions will not help build or improve self-discipline. Instead, use the setbacks in your plan as learning experiences for the future.

Self-care: Taking care of your physical, mental, and emotional health is

more important than ever during these stressful times. Develop a process of purposeful engagement in strategies that promote healthy functioning and enhance your well-being. Physically speaking, be sure to get enough sleep, eat healthy

and exercise. Social and mental self-care can be difficult in times of isolation. Find ways to get face-to-face (virtually and physically), nurture your relationships with friends and family, make time for activities that mentally stimulate

you and find ways to proactively invigorate your life. Set goals to realize your ambitions or aspirations. Develop methods and outlets to allow you to process and recognize your emotions.

Incorporate activities that help you recharge. Assess which areas of your life need attention and as your situation changes your self-care should as well. Self-care is vital for building a resilience toward those stressors in life that

you can’t eliminate or predict.

Enhancing Your Community: You have probably heard the phrase, “It takes a

village…” The truth is that it takes a village to achieve just about any meaningful change in your life. This term took on much more meaning in 2020. You leaned on your various communities, tribes, networks, cliques, associations or whatever

you want to call it for support, and you worked harder to provide help and assistance to those that need it in your community. Your community may have evolved to include more people or it may have shrunk to focus more of your efforts on

those who needed it most. Building, supporting, and connecting with your community is as important as it has ever been.

Tracy Bowers perfectly concluded her article (far better than I can for this one) by saying, “You’ve pushed yourself beyond your limits—not by choice—but by necessity. The good news is these hard times can be the catalyst for new habits, behaviors

and lessons. You’re finding perspective by learning to operate your patience button (or just find it) and taking the long view. You’re learning more about resilience and your response by expanding your adaptability and coming up with creative

hacks. You’re reinforcing your appreciation for community by connecting with others and embracing gratitude. And you’re managing yourself in new ways with self-discipline and self-care. Perhaps best of all, you’re finding new paths toward

happiness. All of these will pay off for you today, but also in the new normal of tomorrow.”

My concluding opinion: advice is a form of nostalgia, and dispensing it is

a way of fishing the past from the disposal, wiping it off, painting over the ugly parts and recycling it for more than it’s worth! If I can offer you one tip for the future, it is this…

Whatever you do, don’t congratulate yourself too much or berate yourself either. Your choices are half chance, so are everybody else’s!

Tags:

insurance bartender

insuring Wisconsin

wisconsin independent agent

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Thursday, October 22, 2020

|

By: Misha Lee | IIAW Government Affairs

This article was originally published in our October Wisconsin Independent Agent. Read the full October issue here.

State Senator Chris Kapenga (R-Delafield), Representatives Mark Born (R-Beaver Dam) and Dan Knodl (R-Germantown) recently unveiled a legislative proposal that would shield Wisconsin businesses, schools,

universities, and otherentities from the threat of lawsuits alleging

liability for COVID-19 exposures. Many are still struggling amid the prolonged pandemic and some lawmakers are actively seeking ways to keep the economy moving despite the

Legislature not being in session.

Under the proposal, such liability protections would only apply to those entities that take adequate precautions to keep their premises safe for their employees and customers.

Specifically, the bill protects from the threat of litigation by providing “safe harbor” to owners, lessees, occupants, or other individuals/entities in control of a premises so long as they follow public health orders and take reasonable precautions to protect the public. This liability exemption does not protect bad actors who knowingly violate public health orders or act in a manner that is reckless, willful, or wanton. Passage of this

legislation would put Wisconsin among a growing list of states that have taken the commonsense step of protecting businesses, schools and other entities against predatory lawsuits as a result of COVID-19. As Wisconsinites look to reboot our economy and return to some sort of normalcy in an extremely challenging environment, passage of liability protections are also essential to ensure that people do not fall victim to predatory

lawsuits by some unscrupulous plaintiff’s attorneys who view the pandemic as an opportunity.

In early September, a broad and diverse coalition of 70 groups, including the

Independent Insurance Agents of Wisconsin (IIAW), Wisconsin Manufacturers and Commerce (WMC), National Federation of Independent

Businesses (NFIB-Wisconsin), Wisconsin Civil Justice Council (WCJC), Wisconsin Association of School Boards (WASB), Wisconsin Builders

Association (WBA), Wisconsin Restaurant

Association (WRA), Midwest Food Products Association (MFPA), many local chambers of

commerce and Associated Builders and Contractors of Wisconsin (ABC), sent a memo urging the Legislature to co-sponsor and take

action on the bill with committee hearings and floor votes in both houses. Unfortunately, the Legislature is not in session as lawmakers are in full campaign mode with the November fall elections approaching quickly. There is a slight possibility that the Republicans would convene a extraordinary session following the election to act on this and other targeted issues related to the pandemic. It appears more likely that any action on liability reforms will happen in early 2021 when the Legislature convenes its 2022-23 session. However, it also is unclear whether or not

Governor Tony Evers would support such a

measure.

See a copy of the proposal LRB-6434 relating to COVID-19 Safe Harbor Liability Reform at

http://bit.ly/OctGovAffairs.

Tags:

COVID-19

government affairs

insuring Wisconsin

legislation

wisconsin independent agent

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Monday, August 10, 2020

Updated: Monday, July 20, 2020

|

This article was recently published in the August issue of Wisconsin Independent Agent magazine. Read more from Wisconsin Independent Agent here. Recently, we have seen an E&O claim trend around insurance limits based on values. The customer’s property has not been properly evaluated, but who should be responsible for determining the value? The advice from Swiss Re Corporate Solutions has long been that the customer is responsible for determining the value of the property. The agent should then take the value provided by the customer and provided insurance based on that amount. Many times, the agent takes on the role of the advisor and a customer will look to the agent to assist with the valuation. In this situation, the agent is likely creating a “special relationship” and has greatly increased their standard of care. If agents are using valuation tools, they must realize the answers they provide are only as good as the information that is entered into them. The agent also then assumes the responsibility of making sure the values are regularly updated to reflect any changes to the property. Here is an example of what can go wrong and what an agency can do to avoid a $2 million E&O claim. Andrew, an experienced agent at a large insurance agency, placed Commercial Property coverage for his client who was a real estate developer. Among the properties he owned, the real estate developer owned a shopping center. The agent and his client had verbal discussions when the policy was initially placed regarding the value of the property. According to the agent, the value of the building was ultimately determined by the real estate developer, but nothing was put in writing by the agent to reflect how the value was determined or whether the client agreed with the valuation. The agent procured a replacement cost property policy with $2.5 million in replacement cost for the building. The policy was then renewed each year for 5 years. During this time period, neither the agent nor the client re-visited the issue of the valuation of the property or considered or discussed possible increases in the value of the property. The shopping center then burned to the ground. When the client submitted the claim, the carrier paid the limit of the policy. However, the property owner claimed that the replacement cost of the property was actually $7MM and claimed that the property was undervalued. The real estate developer admitted receiving the renewals each year but not reading them. He further claimed that he completely relied on his agent to determine the appropriate insurance coverages, that it was the agent that set the initial value of the property and that the agent never recommended an appraisal at any point. The real estate developer proceeded to file suit against Andrew and his agency. What are the major issues in this case? · Agent’s failure to document property valuation process in writing · Agent’s undertaking to set the value of the property when that is potentially outside his/her area of expertise and the agent may not have a duty to undertake this task. In addition, the property owner is in a superior position to know the value of his/her own property · An insurance broker is not required to ascertain the levels of coverage for a risk. However, if the agent assumed this obligation even though he didn’t have to, he thereby created a special relationship that obligated him/her to exercise a greater degree of care and diligence. · Agent’s failure to consider and discuss increases in value of the property over time i.e. by not performing a yearly analysis of coverages and making necessary modifications to the level of coverage. What could have been done differently by the agency? · Yearly review of property values with sign off by client · Written documentation of valuation with client sign-off · Written recommendation that the client have the property appraised What do you think was the outcome? The case was tried and the agent paid almost $2MM in damages for taking on the responsibility of valuing the property and not doing it properly as well as failing to review the value If your agency needs to review internal processes such as property valuations, please call IIAW Vice President Mallory Cornell. There could even be E&O premium savings for your proactive E&O Risk Management!

Tags:

insuring Wisconsin

risky business

wisconsin independent agent

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, August 4, 2020

|

2020 has become the year of the remote worker, courtesy of the coronavirus pandemic. Is your business one of the many that has transitioned to remote operations? Have you considered how that change affects your insurance liabilities as a business owner?

Your Trusted Choice Independent Insurance Agent® can help you reassess your risk picture. Managing a remote workforce may be new to you, but independent agents have rich expertise in helping business owners manage risk — whether employees work from home

or on-site. And because they represent multiple insurance companies, Trusted Choice agents can offer you and your business customized coverage based on your unique and changing needs.

In addition, your Trusted Choice agent can offer you resources and advice for developing your company’s remote work program. It should address, at a minimum:

1. Safety guidelines for a home office setup.

2. Designated work, break, and lunch times.

3. Safety training.

4. Physical inspections of remote workers’ home offices.

5. The workers’ compensation rules for your state as they apply to remote workers.

Here are a few insurance questions your Trusted Choice agent can help you answer:

Does my commercial general liability policy cover remote employees?

As part of your business insurance package, general liability protects your business against financial loss resulting from bodily injury, advertising injury, and property damage caused by your business or employees. Your Trusted Choice agent can review

your policy to be sure that you are still adequately covered while employing remote workers.

If your remote employee must meet business clients from home, it will be your commercial general liability policy that must cover any injury, not the employee’s homeowners insurance. Your agent may suggest additional coverages such as management liability

insurance to protect you and your workers from this and other risks not covered by your commercial general liability policy.

Business property insurance protects the physical location of your business and any tools, equipment and inventory. Your business property policy may exclude or limit the coverage for property that is not located at your business premises. Your agent

can help you determine if you need additional coverage for property used off-premises by remote workers.

An employee’s own homeowners policy usually will not cover the loss of business-owned equipment that is damaged or stolen in their home.

Are my remote workers covered by the workers’ compensation insurance my company purchases?

It is incumbent on you as an employer to ensure a safe working environment for your employees — whether they work at your business location or from their homes. In general, your workers’ compensation insurance covers all of your workers

for illness or injury arising out of or in the course of employment — no matter where they physically work.

However, ensuring a safe working environment for remote workers increases your responsibilities as an employer.

In addition, it is more difficult for a remote worker to demonstrate that an injury or illness “arises out of” or occurs “in the course of” employment — your telecommuting policies and procedures will be of critical importance. Will my cyber liability

insurance cover remote employees? The answer to that question is not simple because cyber policies vary greatly and may contain exclusions that would affect remote workers. And a remote worker using a public or a poorly secured home network could

put your entire business at risk and expose your customers’ private information. Your Trusted Choice agent can help you be sure you have appropriate cyber liability coverage. In addition, you must ensure that every device an employee uses is protected

from cyber breaches. First, require that employees use only your business-owned devices for work; second, set every employee up with a secure connection from their home office to your business network. You may have to engage the help of an IT specialist,

but the investment pales beside the potential costs of a cyberattack.

Let Trusted Choice help you keep your business and employees safe … anywhere they work.

For more help with your telecommuters, consult these articles:

Inspiring Productivity and Connection with Remote Workers

Ways to Keep Remote Workers Connected and Engaged

Tags:

COVID-19

IIAW

remote work

wisconsin independent agent

wisconsin independent insurance association

wisconsin insurance agency help

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, July 8, 2020

Updated: Tuesday, June 23, 2020

|

By: Chris Boggs | Big "I" Virtual University Executive Director

This article was originally featured in our July Wisconsin Independent Agent Magazine. Read the full issue here.

An insurtech firm I prefer not to name, other than to say they think they are geniuses when it comes to policies, was founded by two people who believed purchasing insurance was too frustrating. In fact, their website specifically states, “Navigating the world of insurance is confusing, stressful and a step backward in time....”

Because the founders were “consultants to the top insurance companies,” they knew there had to be a better way for consumers to purchase insurance. Their stated mission is help consumers get the insurance they need and feel good about what they got. Sort of sounds like something an agent does, but that’s not the point of this article.

Towards this goal, the firm publishes consumer-facing articles. I recently read through several of the articles and felt they were relatively well written for consumer consumption and largely correct. What disappointed me was the “level” of credit they gave the writers; each writer was listed as, “Insurance Expert.”

The title “insurance expert” caught my eye - in a big way. It stands to reason that obviously these writers have many years of insurance experience since they are “experts” Uh, they didn’t. Here are partial bios as examples:

• [Author’s name redacted[ is an Insurance Editor at [Insuretech name removed] in New York City and an expert in homeowners insurance. Previously, he was working as a freelance writer for the New York State Nurses Association and wrote for the Michigan

Information Research Service. [Writer] has a B.A. in journalism from [University Name Redacted.]

• [Author’s name redacted] is the Associate Director of SEO Content at [Insuretech] in New York City. His writing on insurance and personal finance has appeared on Betterment, Inc, Credit Sesame, and the Council for Disability Awareness. [Writer] has a degree in English from the [University name removed].

• [Author’s name redacted[ is the co-founder of [Website name removed], a groundbreaking personal finance site for millennials that was named one of Time’s 25 Best Blogs of 2012. [Author’s] work has been published in New York Magazine, Glamour, The Guardian, BuzzFeed and more.

Am I missing something? Would the background of ANY of these writers qualify them to be considered an “insurance expert”? I don’t think it does, but the public doesn’t know any better. Calling yourself an expert doesn’t make it so.

Unfortunately, the combination of missing or incorrect policy information and the misappropriation of the title “insurance expert” pushed me to send a rather

“snotty” email to this group. As of this writing, I have not received a response. Would you like to see what I wrote? Before you read it, remember, I’ve already

acknowledged I was a bit pompous. With that as prologue, what follows is a slightly edited version of my email.

I was reading through several of your homeowners’ and personal auto insurance coverage articles today and wanted to get in touch with you.

Yes, insurance can be confusing to those not in the business, but there is a way to explain it so the uninitiated can easily and quickly grasp its concepts and realities.

Secondly, I would be very careful calling anyone an “insurance expert” unless he/she has many years of experience in the insurance business - and is well-versed in insurance coverages and concepts. Writing ABOUT insurance in newspapers and blogs doesn’t make someone an insurance expert; neither does being in the financial and investment business. Property and casualty insurance is far more complicated than can be known just writing about insurance. You have to be “covered in the mud of an insurance policy,” you have to have actually read the policy from cover to cover, several times, and you have to know how deep the depths of insurance really are before you can begin to be considered an expert.

Further, a true expert doesn’t consider himself or herself an expert. In fact, those who truly do qualify as experts quickly shy away from being called experts; the reason, because they are so well versed in insurance, they know there is far more to know than they already do. Any person who calls or truly believes he or she is an expert doesn’t know what he/she doesn’t know.

Someone holding himself or herself out as an “expert” without the credentials to back it up is dishonest and harmful to those depending on the information the so-called “expert” has provided.

So, my recommendations are: correct the incorrect information; and don’t refer to anyone as an insurance expert who doesn’t have the necessary time and training to qualify as one.

Just my personal recommendations to you; take them or leave them as you so desire.

OK, I realize I let my emotions get the best of me. I also realize nothing I said will change their attitude or actions. And lastly, I know that “insurance expert” is just their way to market their “brilliance.” But it needed to be said.

But this is what I find truly interesting, they note on their site that the information they provide should not be relied upon; in fact, they intimate that agents are the better source of information. Here is the disclaimer:

[Insuretech’s name withheld] editorial content is not written by an insurance agent. It’s intended for informational purposes and should not be considered legal or financial advice. Consult a professional to learn what financial products are right for you.

I take certain satisfaction in this disclaimer. Evidently, their “insurance experts” are not as valuable as insurance agents.

Here are some thoughts about being an “expert” of any kind.

• True experts worry more about what they don’t know than what they do know, continually looking for ways to fill their knowledge gap. Self-proclaimed experts ignore the breadth of what they don’t know and are satisfied (mainly because they don’t know what they don’t know).

• True experts are rarely absolutely certain. Self-proclaimed experts are rarely in doubt.

• True experts admire other experts and desire to learn from them. Self-proclaimed experts don’t see anyone else as an expert, feeling others have nothing to offer.

• True experts listen to and value the opinions and advice of others. Self-proclaimed experts think theirs is the only opinion that matters.

• True experts openly admit when they don’t know the answers. Self-proclaimed experts ALWAYS know the answer - even when they don’t..

• True experts apply the experience learned from past accomplishments to accomplish more. Self-proclaimed experts rest on past accomplishments.

• True experts don’t really like being referred to as experts. Self-proclaimed experts revel in such an introduction.

• True experts desire to give all their knowledge away so others can be better. Self-proclaimed experts hold on to their knowledge so others have to come to them.

• True experts do not proclaim themselves experts - others do. Self-proclaimed experts use the term as a marketing ploy.

• Be wary of anyone who eagerly takes on the mantle of “expert,” they probably aren’t. If you call yourself an “expert,” you probably aren’t.

One last thought, if the word “expert” is used anywhere on your website or in your marketing, you better be one because that is the standard/expectation that you have set. Afterall, who do you expect more from, the apprentice of journeyman electrician or the master electrician? The best course of action is to take the term “expert” off all websites and marketing materials.

When you are an expert, you won’t feel like one. If you feel like one, you aren’t one. The more you know, the more you realize you don’t know. And people who don’t know, aren’t experts - at least in their minds.

Tags:

E&O Risk Management

errors and omissions

insuring Wisconsin

insurtech

wisconsin independent agent

wisconsin independent agent association

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, June 16, 2020

Updated: Tuesday, June 9, 2020

|

By: Donna Asta | Vice President and Claims Expert Swiss Re Corporate Solutions

It shouldn’t be news to anyone that technological advancements are shaping the world around us. But because new technology changes the way we live, work and play, independent agents need to keep up to date.

Here are a three ways technological trends are impacting personal lines coverage:

Cyber threats. From instant application approvals to auto-renewals, the use of technology is changing the insurance industry. With this changing environment come additional risks and new coverages, such as cyber or data breach coverage.

Your clients use technology to make their lives easier, but it also puts them at greater risk of a cyberattack. Victims may find that they downloaded a document that contained ransomware that disabled their computer system, while others may unknowingly find themselves sent to a phishing website. Damages from these types of attacks can cost thousands of dollars. Are your clients covered for such perils?

Also, in the event of a cyberattack, do your customers have adequate coverage and limits? Personal cyber coverage is becoming more

common. But as it grows in popularity, it is also becoming common for cyber coverage to be excluded from standard homeowners policy and only available by endorsement or a standalone policy. Do the standard homeowners policies you write provide cyber coverage? If not, did you offer it?

Teleworking: Another technological trend is telecommuting, which has become the standard operating mode for at least 50% of the U.S.

population, according to Forbes. However, traditional homeowners policies contain broad exclusions for home business pursuits.

Coverage for personal liability arising out of business pursuits is typically excluded, which prompts the question: Is your customer covered for business performed at home? Agencies should determine whether they have clients who telework or run businesses from home and offer endorsements to existing homeowners and renters policies to cover these pursuits.

The gig economy: There are more than 1 million ride-share drivers working for companies like Uber and Lyft in the U.S. Meanwhile, HomeAway offers 2 million global home listings and Airbnb offers 500,000 in the U.S. alone. Other examples of the gig economy include ad hoc food delivery, package delivery and manual laborers.

Do you know whether your clients are participating in the gig economy? If so, are they covered for property damage, personal liability, injuries requiring health care and loss of income? Agents should start asking these questions before a claim comes in.

Recognizing and reacting to these trends will prepare you to satisfy your duties as a 21st-century personal lines agent or broker. Importantly, staying ahead of the curve when it comes to technology leads to better agency achievement, and higher client satisfaction and retention.

Donna Asta is a vice president and claims expert with Swiss Re Corporate Solutions and is associated with the Chicago office.

This article is intended to be used for general informational purposes only and is not to be relied upon or used for any particular purpose. Swiss Re shall not be held responsible in any way for, and specifically disclaims any liability arising out of or in any way connected to, reliance on or use of any of the information contained or referenced in this article.

The information contained or referenced in this article is not intended to constitute and should not be considered legal, accounting or professional advice, nor shall it serve as a substitute for the recipient obtaining such advice.

Tags:

insuring wisconsin

personal lines coverage

technology

wisconsin independent agent

wisconsin insurance

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|