|

|

Posted By IIAW Staff,

Wednesday, July 13, 2022

|

Happy Wednesday! In this week's Big I Buzz, we have news about WCRB's rate changes and a new way to get involved in the IIAW. On July 12, 2022, WCRB (Wisconsin Compensation Rating Bureau announced an -8.47% rate change (8.47% decrease). This rate change will take effect October 1, 2022. Read the full Circular Letter announcing this change here. Get Involved: Volunteer to Serve We're looking for volunteers to serve on the IIAW's councils and task forces. your participation is invaluable, and your input and feedback will help drive thee work we do in the coming year and beyond. Councils & Task Forces for 2022-2023 Personal Lines Task Force - for individuals who are interested or who have a role in Personal Lines insurance Commercial Lines Task Force - for individuals who are interested in or who have a role in Commercial Lines insurance Employee Benefits Task Force - for individuals who are interested in or who have a role in Employee Benefits Industry Relations & Operations Council - for insurance professionals who have an operational or leadership role within an agency or insurance company Government Affairs Council - for individuals interested in staying informed and providing feedback to the IIAW's Board on Wisconsin & national legislative and political happenings Emerging Leaders - for insurance professionals looking to cultivate their skills for a successful career by engaging in association activities, professional develop, education and events Each council and task force will act as a sounding board for the IIAW and will only have three virtual meetings per year. Participating in the IIAW task forces and councils gives you access to industry experts, exclusive networking events and FREE CE opportunities during most virtual meetings when content allows. Make sure you fill out this survey to receive communications about an IIAW Councils & Task Forces kick off event on September 21st and other task force/council communications. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Additionally, we send out monthly newsletters with content curated just for you and your role. Make sure you're on the list to receive our communications by heading to bit.ly/industrynewsforyou to stay in the loop!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, July 12, 2022

Updated: Thursday, July 21, 2022

|

By: Carey Wallace, Business Consultant at AgencyFocus This has become an all too familiar story. An agency owner reached out several weeks ago and asked me to meet with him and the owner of an agency in his town that he was looking to purchase. They had been talking for several years. They had a handshake agreement that someday he will buy the agency when the time is right. Those conversations were consistent over time, but had never turned into any action. The selling agency owner was now in his early 80s, but the time didn’t seem right just yet. Until it was.

Some serious health issues caused the conversation between the two owners to change from someday into a reality. I was introduced to the selling agency owner and together with the buyer we went through what to expect in the valuation process. He was charming, funny and full of stories. It was obvious that the last thing he wanted to talk about was his career in insurance coming to an end. Instead, he preferred to reminisce about his favorite clients, brag about his amazing staff and tell me the story of how he started in this incredible industry of ours. Our 30-minute call tripled in length, but I didn’t mind at all. I loved getting to know him and honestly, I loved listening to his stories.

As our call came to an end, we agreed that the completing the valuation was the next logical step. The seller expressed concern about letting his staff know he was contemplating selling, so he asked that I mail him the proposal and confidentiality agreement and send the data sheets that were required for the valuation in an email that does not mention the purpose. He planned on confiding in his office manager as she would need to help him completed the information. The proposal was sent, agreement was signed, and the data sheets were emailed. We were on our way.

Two weeks later first thing Monday morning I received a call from the buyer. I answered with a chipper Good Morning and was met with an unexpected somber voice. He fumbled his words and struggled to share the news that the seller’s health had taken a turn for the worse, he was hospitalized a few days ago and passed away the previous evening. Then there was silence.

I cannot even begin to tell you how much I dread this kind of call. My heart sank and you could tell his heart was breaking as well. We both were quiet for what seemed like forever. I broke the silence with a question, “Tell me what I can do to help?” He then shared his thoughts and plan to help the sellers widow navigate the next days, weeks and months. She is now faced with taking care of the affairs for an agency she has never been a part of and had no idea where to begin.

When something like this happens, the focus goes from planning to “rescue”. Worse than that, someone who is mourning the loss of the greatest love of their life is forced to make decisions that they have no experience handling. They are forced to think about details and logistics that are in many cases completely foreign.

We started discussing things like:

Who has the logins and ability to access the carrier portals? How do we ensure that we keep the appointments in place and take care of the customers? Who has the logins to the accounting system, bank accounts? Is there any life insurance? Does someone know how to run payroll? What do we tell the staff? Clients? Carriers? How do we reassure the staff?

It is completely overwhelming. The business that was a lifetime of work and the main source of income in their retirement is now in jeopardy.

The reality is for many agency owners the time will never be right and sadly they will put planning for the transition of their agency off until there is no time left.

This can happen to anyone at any age.

You do not have to exit your agency to have a plan.

The time is always right to make a plan. For more information about planning for your agency please visit www.agency-focus.com or contact Carey Wallace at Carey@agency-focus.com.

Tags:

agency management

insuring Wisconsin

leadership

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Society Insurance,

Friday, July 8, 2022

Updated: Thursday, July 21, 2022

|

By: Rebecca Freiberg, Society Insurance

Workplace politics can be a delicate subject. Workplace politics is the manifestation of power dynamics amongst employees. At its best, you’ll feel like you’re walking on eggshells each time you set foot in the office and at its worst, you can ruffle a few feathers, making each day feel miserable. Every office has some form of politics; what matters is whether or not they are toxic. Here we’ll go over ways you can overcome workplace politics, or at the very least stay on the right side of issues, to avoid becoming embroiled in drama.

Know the Ins & Outs of the Organization The first way to overcome workplace politics is to understand different functions of the organization. This means understanding the company’s organizational structure, who reports to who. It’s also important to understand who within the organization has influence. You might ask yourself questions such as, “who are the true influencers? Who is respected? Who mentors others?” Embrace Transparency Stress the importance of open communication among and between teams, especially if you manage people. Your team members should feel at ease coming to you with problems they’re having without repercussion. Open communication leads to effective communication which then leads to an efficient workflow. When employees feel comfortable discussing workplace problems with co-workers, it leads to the potential resolution of problems. Implement a Realistic Code of Conduct Simply having a definition for what establishes acceptable behavior is a major step in avoiding workplace conflict. Making a system for decision making, encouraging open collaboration, team building, leadership training and development, and careful hiring will all help avoid workplace conflict. It’s important to have clearly defined responsibilities so everyone knows what’s expected from them. It is equally important to have a clearly laid out chain of command to allow for effective communication. In other words, define workplace rules clearly and make it known what will or will not be tolerated. Removing assumptions will drastically reduce the risk of conflict in the workplace. Don’t Add Fuel to Fire

Behaviors to avoid include: • Spreading gossip • Choosing sides • Taking part in the rumor mill • Becoming jealous Become Swiss and Don’t Take Sides It is vital that employees remain neutral during conflicts, even if you like someone more than another. Your position may be a trusted authority figure, meaning that your actions and words have significant meaning. Think about what is best for the company, not for personal satisfaction. Remaining neutral allows you to make great decisions and stay separate from workplace politics. Once a side is taken it is difficult to overcome.

Get Level: Cooler Heads Prevail Similar to remaining objective, don’t lose your cool and become aggressive with someone or you’ll gain a negative reputation for it. This is relevant advice for all workplace situations. If you do not remain cool, your reputation and career is at risk. Even though workplace politics may upset you, staying cool has its benefits. Keeping cool prevents you from saying or doing anything in the moment that you may regret later. Practice What You Preach: Political Behavior Comes From The Top Owners and managers influence behavior. If they promote or facilitate a toxic political atmosphere, it may be time to search for a new job. Leaders in the organization must take steps to eliminate political behavior immediately. How Managers Can Quash Negative Workplace Behavior • Share the goals that you are trying to achieve and reward those who help achieve them. When the collective goal is clear, it is less likely that people will prioritize their own interests first. • Keep every employee in the organization involved so no one employee feels more important than another. • Make connections within the organization and develop strong interpersonal communication between individuals via lunches, happy hours, kickball leagues, etc. When employees are connected and respect one another, workplace politics begin to diminish. Conflict in the workplace is inevitable, even with the most agreeable personalities. The average American spends well over 2,000 hours at work over the course of a year. When employees of various backgrounds and different work styles are brought together to work on the same project with the same goal, conflict could be a natural byproduct. Not all conflict is bad, however all conflict can and should be managed and resolved. If handled correctly, confronting conflict head-on will result in a stronger culture and closer teams.

Tags:

human resources

insuring Wisconsin

Society Insurance

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

workplace politics

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, July 5, 2022

|

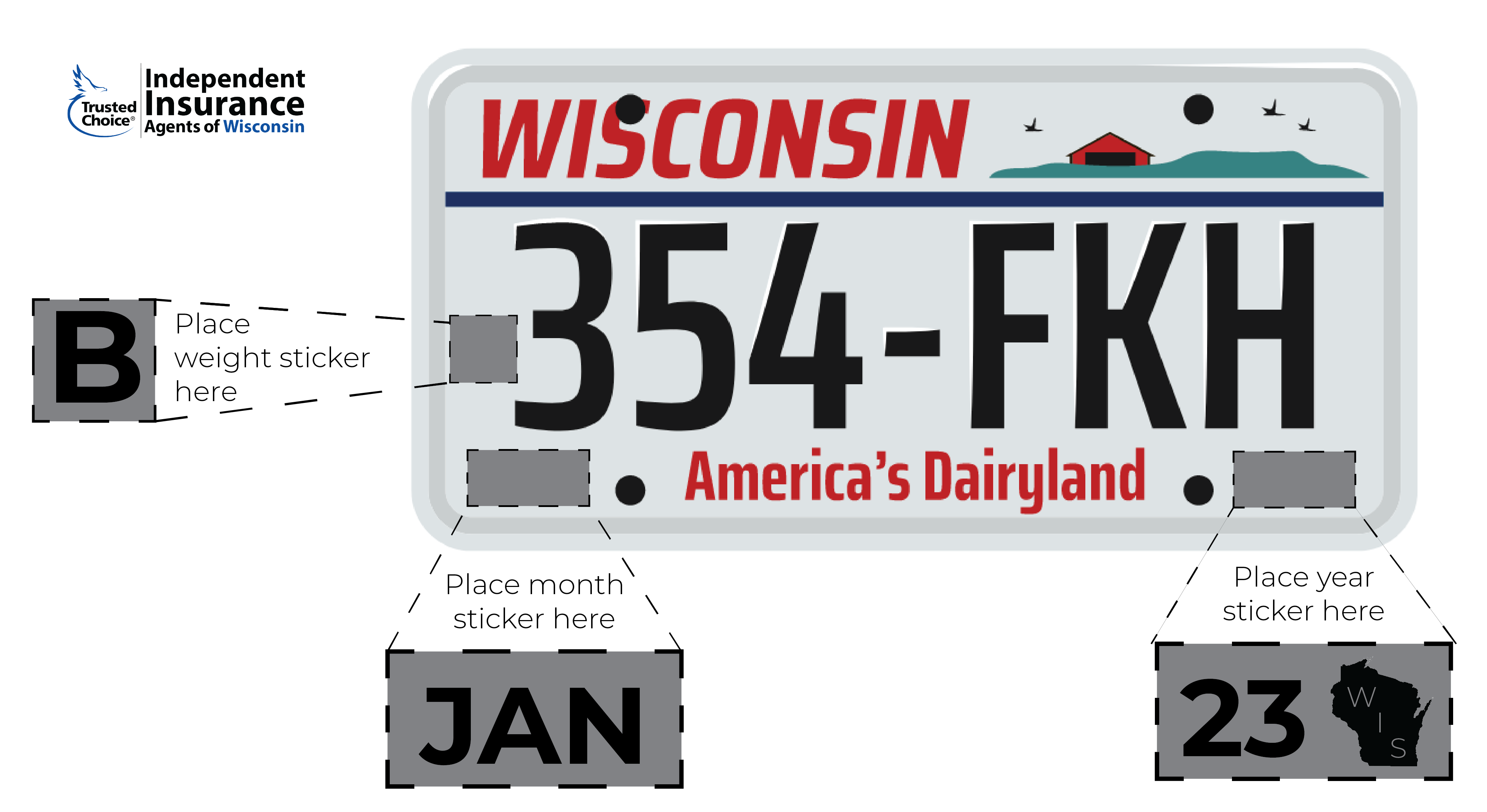

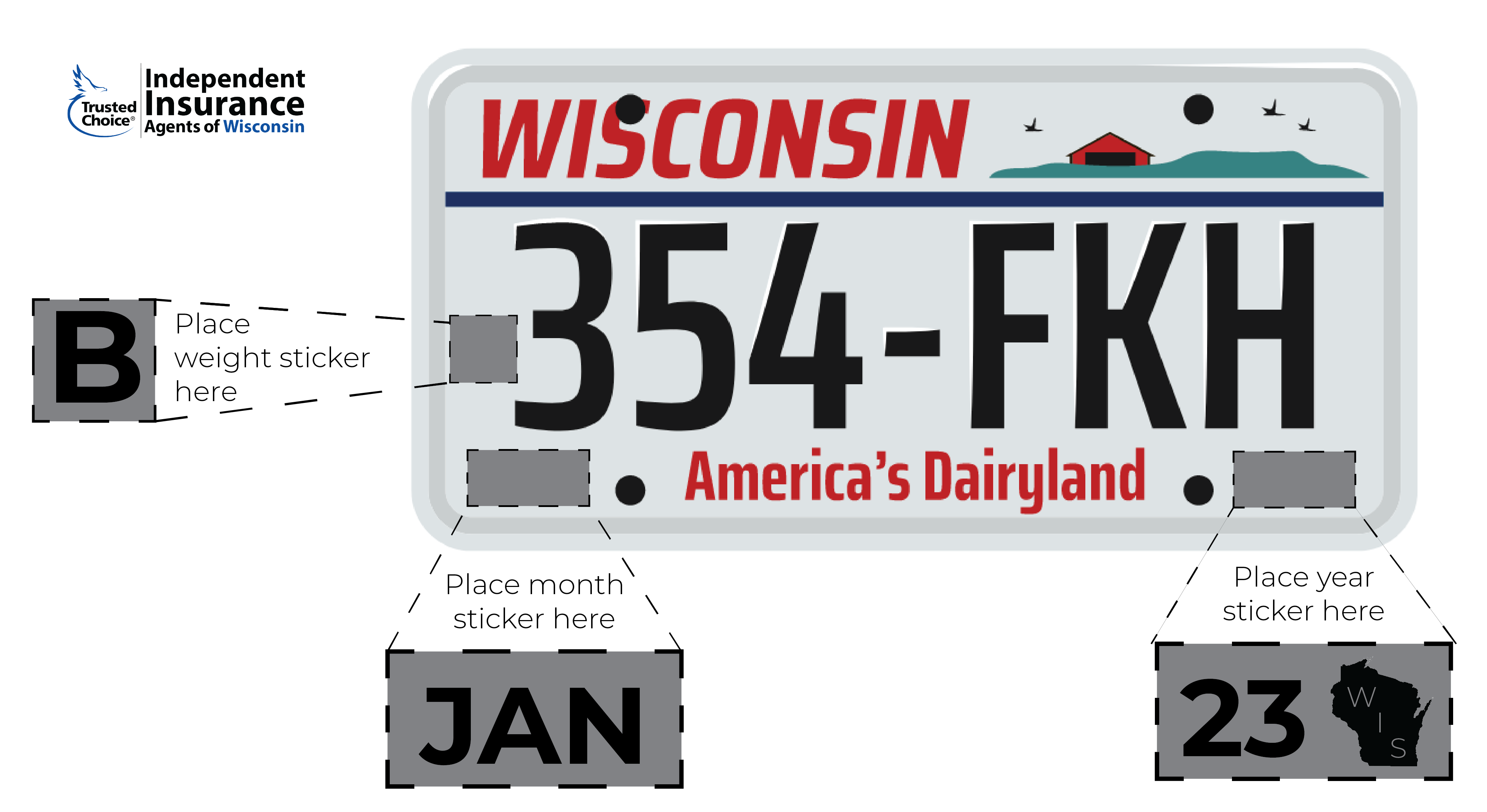

Happy Wednesday! We hope that everyone enjoyed their Fourth of July weekend and using information last week's Big I Buzz, you were able to avoid some of the holiday travel! This week we are sharing information about Wisconsin State Law license plate regulations, what's driving the cyber insurance market and how the federal interest rate hike can affect the insurance industry. License Plate Reminder Now is a great time to remind your clients about Wisconsin State Law license plate regulations to help them avoid unnecessary tickets. Feel free to share the below image and copy on your social media pages.

Did you know that per Wisconsin State Law if you are issued two license plates you must attach both to your vehicle? Your license plate must be kept in a legible condition, which means no plate covers. This also means that your registration plate lamps, wiring and connections must be maintained in a proper working condition. Finally, if you are given two license plates you must attach the validation sticker to the rear plate as shown below. Connect with your local Trusted Choice independent insurance agent to make sure you've got the coverage you need when it comes to your vehicle! Evolving Risk is Driving Cyber Insurance According to the 2021 NetDiligence Cyber Claims Study, the top five causes of loss for samll and medium-sized enterprises over the last five years based on number of claims was: ransomware, hackers, business email compromise, staff mistakes and phishing. The increase in ransomware attacks since 2016 has encouraged underwriters to focus on cybersecurity and putting controls in place to help mitigate the impact of cyber events. While there's no way to eliminate cyber risk, insurers are applying minimum requirements on risk controls to obtain cyber coverage like multifactor authentication, endpoint protection and firewalls. Read more about upcoming regulatory enforcement and prevention and resilience here. What Fed's Interest Rate Hike Means for Insurance The Federal Reserve again hiked interest rates Mid-June by 0.75%. Insurance Business reports, that Mark Bernacki, Amwins Chief Underwriting Officer believes, "Insurance agents should be talking to their clients to make sure they have "sufficient insurance" against a backdrop of soaring loss costs as the Fed seeks to dampen the effects of inflation. They should also be educating them on what the interest rate change means for the insurance market." So, what does this mean for the insurance market? Bernacki stated to Insurance Business Mag, "Obviously, there's the expectation that this could have some short-term pain, both for the economy as well as the insurance industry, but long term this should ultimately be good for both the economy and the insurance industry and also strengthen the labor markets that we're seeing." Read more from the report here. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Additionally, we send out monthly newsletters with content curated just for you and your role. Make sure you're on the list to receive our communications by heading to bit.ly/industrynewsforyou to stay in the loop!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Saturday, July 2, 2022

Updated: Thursday, July 21, 2022

|

Members in the News: July 2022

Secura Insurance Promotes Larry Wright to Senior Vice President

Neenah, WI (5/26/22) - SECURA Insurance promoted Larry Wright to Senior Vice President and Chief Claims Officer effective May 23, 2022.

"Larry is well known for his ability to lead and inspire," said Garth Wicinsky, SECURA President & CEO. "His broad-based thought leadership has done amazing things in our Claims Department, and will continue to help shape the future of SECURA."

Larry began his career at SECURA in 1997 as an IT programmer/analyst. He held progressive positions, including IT supervisor, IT director, workers’ compensation claims representative, workers’ compensation claims supervisor, claims project manager,

casualty representative, litigation coordinator, and vice president – claims. Most recently he was promoted to Vice President and Chief Claims Officer in 2018.

Larry earned a bachelor's degree in business administration from the University of Wisconsin–Eau Claire and an MBA from the University of Wisconsin Oshkosh. He earned his Chartered Property Casualty Underwriter (CPCU), Certified Insurance Data Manager

(CIDM), Associate in Insurance Services (AIS), and Associate in Claims (AIC) designations. He also earned a Master’s Certificate in project management from the University of Wisconsin–Madison School of Business.

SFM Releases 2021 Annual Review

Bloomington, MN (5/31/22) - SFM recently released its 2021 annual review, which highlights SFM's 2021 accomplishments.

For SFM, 2021 represents a story of remarkable success. Our written premium soared to a new high of $212 million and we are now serving more customers than ever, following a record $30 million in new premium last year.

Other 2021 highlights include:

• Combined ratio of an exemplary 90%, which is a

key measure of financial performance (and

marks a tenth straight year under 100%)

• 96.6% policyholder retention rate, which

demonstrates unsurpassed customer loyalty

• -4% pricing reduction, which means lower

premiums for policyholders year over year

At SFM, our commitment to service drives our results – not the other way around. Always at the center of the target is our dedication to doing the next right thing – for policyholders, their employees, independent agents and the community around us.

Acuity Wins 2022 BBB Torch Award for Ethics

Sheboygan, WI (6/9/22) - Acuity is named a 2022 Better Business Bureau (BBB) Torch Award for Ethics Winner. A Torch Award is the most prestigious honor BBB presents to businesses that demonstrate an outstanding

commitment to integrity and ethical practices.

“We are tremendously honored to be recognized by BBB with a Torch Award for Ethics and hope that our ethical business practices are an inspiration to others,” said Acuity President and CEO Ben Salzmann. “The BBB’s focus on ethics is vital for the

world today. We all must kindle an even stronger focus on ethics to support all positive aspects of humanity. This focus must start at the community level, in daily life, and rise to a global inspiration. We can make a difference.”

Acuity’s selection as a winner from the BBB was based on an independent panel of judges comprised of business and community leaders who evaluated the insurer’s commitment to ethics across the areas of character, culture, customers, and community.

Since 2003, BBB has honored businesses and nonprofit organizations of all sizes that meet the highest standard of ethics and trust among their employees, customers, and local communities, embodying BBB's mission to advance marketplace trust.

“This year, we had more applicants than in the past five years,” said Julie Albrecht, Executive Director of the BBB of Wisconsin Foundation. “These organizations should be immensely proud of their commitment to ethics in their day-to-day operations.”

Acuity Insurance, headquartered in Sheboygan, Wisconsin, insures over 125,000 businesses, including 300,000 commercial vehicles, and nearly a half million homes and private passenger autos across 30 states. Rated A+ by A.M. Best and S&P,

Acuity employs over 1,500 people.

Society Insurance Donates $100,000 To St. Katharine Drexel Shelter

Society Insurance has pledged a $100,000 capital gift to the St. Katharine Drexel Shelter, a new resource serving people experiencing homelessness in the Fond du Lac area.

Society will make its gift in four annual payments of $25,000 from 2021 to 2024.

In recognition, the St. Katharine Drexel Shelter named its singles dining area the Society Insurance Dining Room.

The shelter, made possible by a partnership between St. Vincent de Paul of Fond du Lac County and Solutions Center, opened in May. This year-round facility offers food, lodging, clothing and basic necessities in a safe, stable environment.

Inside the 20,000 square-foot building are bedroom, dining and common spaces for up to 15 families and 36 adult singles. Dedicated family and adult wings allow the shelter to serve those in need without separating families; children

are able to stay in their home community and continue attending their school.

The shelter’s design reflects a community approach to reducing homelessness, which starts with short-term crisis intervention and progresses to long-term goal planning for self-sufficiency. Partnerships with more than one dozen local non-profit

and government organizations and spaces devoted to employment advocacy, counseling and housing searches are key additional resources available to guests.

For more information regarding the St. Katharine Drexel Shelter or to donate, visit skdsfdl.org

Tags:

acuity

insuring Wisconsin

Members in the News

secura

SFM The Work Comp Experts

society insurance

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Thursday, June 30, 2022

|

Independent Market Solutions (IMS) was established in 2007 with the goal of creating greater market access for member agents. Wisconsin made the investment to be a part of IMS and we have grown market availability in Wisconsin to include nine participating carriers that offer personal, commercial and various specialty lines. The purpose of IMS is to provide member agents access to quality insurance markets and alternatives that may be otherwise unavailable. IMS creates marketplace leverage through its negotiated contracts, which can be particularly helpful for smaller or rural agents. IIAW membership allows your agency to sign up for the program and gain carrier appointments as an IMS sub-producer at no additional cost. Agencies are paid competitive commissions, enjoy 100% ownership of expirations and can participate in earned contingencies. Additionally, several IMS markets feature the opportunity to "graduate" to a direct appointment once certain production goals are met - again, at no additional cost to your agency. Ultimately, our mission is to add to the success and prosperity of independent agencies by providing viable market access through IMS. Wisconsin is a proud owner of IMS, along with our association colleagues in other states. To learn more about the carriers IMS could help connect you with, click here.

Tags:

IMS

Independent Market Solutions

insuring Wisconsin

market access program

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Thursday, June 30, 2022

Updated: Thursday, July 21, 2022

|

By: Clay Fuchs & Grant Bryant, Risk Placement Services Since the end of 2021, the geopolitical landscape in the energy market has dramatically changed and continues to do so. The current conflict in Ukraine; China's continued implementation of its zero-COVID-19 policy; coordinated releases from the U.S. Strategic Petroleum Reserve; and oil producers' decisions to limit any increases in production are all having an impact. Meanwhile, oil prices remain volatile and oil executives have argued against ratcheting up output, unconvinced that demand will be there when the wells come online. Their focus, like any business, is returning value to shareholders, reducing debt and providing consistent growth into the future. Yet, we are seeing signs of increased production activity. From the end of 2021 to April 2022, rig counts rose 17.5%. This increase indicates a corresponding increase in all ancillary oil and gas activity. With major oil production companies committed to sustained growth and focused on profitability, the growth in rigs is primarily being driven by more nimble private operators who haven't seen a favorable economic environment for their businesses in many years. We're likely to see this expansion continue. However, economic uncertainties could result in a supply glut if certain geopolitical events lead to less demand or an increase in supply. We're also continuing to see a continued drop in drilled but uncompleted (DUC) well counts, which is another indication of increased production activity. So, what does this mean for the insurance industry? We've seen insureds of all sizes—from an oil and gas consultant to a major drilling company—increase projected revenues by at least 20%, with some growing by as much as 300%. Increased activity in the field comes with increased claims, which we're also seeing. The auto line of business is generating much of the activity as more oilfield drivers, many of whom are recent hires, may not have much experience. Many energy underwriters are requesting additional information regarding fleet controls and are also limiting when and where they're choosing to deploy capacity in the umbrella space. Therefore, it's important to look ahead on accounts with large losses or a large fleet to develop a game plan in advance of the renewal. Success can be found in placing difficult, wheels-driven accounts in the energy sector by leveraging underwriter relationships in the environmental, transportation and energy marketplace. Collaborating on renewals early and getting the information to market in a timely manner can help decrease the turnaround time for underwriters. Though auto and umbrella lines of business remain challenging to place, we're starting to see rates level out in these areas, as well as in general liability. Over the last few years, underwriters have focused on securing rate increases or non-renewing undesirable accounts and their efforts have resulted in a semblance of calm after the storm. We continue to see underwriters seek up to 10% rate increases on accounts with steady exposure growth while loss-free accounts within an underwriter's targeted business lines can see increases under 5%. Not all energy carriers are in a great spot. We have been monitoring some carriers regarding questionable renewals on certain accounts. This includes both carriers in the excess & surplus and admitted markets across transportation, environmental and casualty lines within the energy industry. Our advice is to proactively communicate with underwriters early to get a better picture of the renewal. Underwriters remain focused on account retention—and with exposures growing throughout the industry, this focus is even more critical.

This article was originally published on iamagazine.com in June.

Tags:

commercial lines

commercial property

energy sector

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Monday, June 27, 2022

Updated: Thursday, July 21, 2022

|

By: WAHVE (Work at Home Vintage Experts) It’s no secret that today’s job candidate is looking for a different work-life balance. The pandemic and the subsequent onset of the Great Resignation has pushed employees to re-evaluate everything. Amid the pandemic fatigue and feelings of being overwhelmed and stuck, one thing emerged: employees want more. And organizations should be paying attention. As about 4 million workers quit their jobs monthly (US Bureau of Labor Statistics), employers need to find ways to not only attract new hires but also keep the employees they have. That’s created a virtual feeding frenzy among companies across the country. In many cases, it’s an unfair fight – smaller organizations are left with finding ways to compete with big-city salaries and perks while still trying to operate on very local budgets. Yet while salary is the main reason employees are leaving for greener pastures, employees want more. According to Jobvite data, remote work flexibility ranks right up there with flexible work days and company culture as the things most important to job seekers. That means your company, no matter what size, can easily compete for the best candidates. By offering remote work and a flexible workday (allowing employees to work during the hours when they’re most productive), your organization can keep the valued talent you have and attract talent from anywhere in the country to your operations. But there are other reasons for wanting to offer remote work. Researchers in Houston analyzed the data from 264 employees to understand the impact of remote work on the business. The company was closed due to hurricane flooding. Researchers found that during a seven-month period of remote work, employees work behaviors matched the pre-hurricane production levels, even though they were not logged on to their computers as often. The study also revealed that both company and employee resiliency improved as a result of remote work. As many of us discovered when forced to scale back (or close) operations amid the worst of the pandemic lockdowns, remote management can work. Our own company, WAHVE, has been fully remote since its inception. It takes reimagining your operations – and your approach – for remote operations to be successful. We suggest restructuring the workday to fit the employee’s best hours, not the standard eight-hour, nine-to-five drill. Measure by outcomes achieved, not hours put in. Set goals and expectations with employees, and trust them to deliver. Above all, provide open channels of communication. Your employee should be able to reach you and feel able to discuss issues, struggles, and receive performance feedback as well as any training or mentoring support. As your organization looks to compete in a tight labor market, you can attract candidates and even retain key employees by offering remote work and flexible work arrangements. Organizations everywhere have discovered that remote work is possible. Giving job candidates and your talent the option to work remotely gives them an important component of a healthy work-life balance, and allows you to find top talent no matter where they are located.

Tags:

Agency Operations

insuring Wisconsin

remote work

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, June 22, 2022

|

Happy Wednesday! In this week's Big I Buzz, we are discussing the educational opportunities available for IIAW members, home renovation risks and the number of Americans facing health care debt.

IIAW Educational Opportunities The IIAW is an honored recipient of the Big "I" National 2022 Excellence in Insurance Education (EIE) Diamond Award. This award recognizes state associations and staff who have made significant contributions to insurance educations for their members and the industry. The IIAW offers various traditional and cutting-edge professional development programs! IIAW members have access to our educational opportunities. First, we offer in-person and online prelicensing options for Wisconsin insurance professionals. The in-person and online insurance licensing course is led by Gabrielle O'Brien, who has taught more than 20,000 prelicensing students! The IIAW prelicensing course is designed to help you pass your state licensing exam by the quickest method of meeting the WI educations hours requirement. Next, we offer online continuing education courses. The WI OCI requires insurance agents in Wisconsin complete 24 hours of continuing education credits with three of those being in ethics every two years. The IIAW provides unique and attention-grabbing courses through our partnership with ABEN. ABEN offers high-quality CE and professional development online webcasts. Now through the end of the month, you can receive 20% off online CE through ABEN with code SUMMERCE. Last, but certainly not least, we offer employee training through MyAgencyCampus. MyAgencyCampus offers employee training ranging from insurance basics, specific job roles or even specific business skills. A few bundles we'd like to mention are the Commercial Lines Coverage Basics which includes 25 courses in one bundle, their Introduction to Employee Benefits Insurance Basics and the Personal Lines Coverage Basics. MyAgencyCampus has these bundles and so much more (four pages worth of courses) that you can take to enhance onboarding new employees. To learn more about the educational opportunities we offer IIAW members, visit iiaw.com/education. Insureds Need Help Avoiding Home-Renovation Risks According to NU Property Casualty 360, "Over a third of homeowners in the U.S. and Canada embarked on renovations during the last year." With the number of homeowners starting home renovations, it's a great time to help them avoid the risks of renovation. [Home renovation projects] "are a chance for home insurance agents to step up for their clients, who may not realize the high chance that their property may sustain water damage during a renovation, or that certain updates, such as finishing a basement or installing a swimming pool, will require additional coverage. One great way to put yourself front-of-mind for your clients is by utilizing your social media sites. IIAW members have access to Trusted Choice's Content to Share. Trusted Choice puts together graphics and captions that you can use on your social media page, and they have great reminders for your social media followers to reach out to you when considering home renovation. 100 Million People in U.S. Saddled With Health Care Debt Benefits Pro has reported that, "6 in 10 working-age adults with coverage have gone into debt getting care in the past five years, a rate only slightly lower than the uninsured." A nationwide poll from KFF found that about 1 in 7 people said that they've been denied access to a hospital, doctor or other provider because of unpaid bills. "Patient debt is piling up despite the landmark 2010 Affordable Care Act. The law expanded insurance coverage to tens of millions of Americans. Yet, it also ushered in years of robust profits for the medical industry, which has steadily raised prices over the past decade," according to Benefits Pro. This article from Benefits Pro goes in depth about the the KFF Health Care Debt Survey and additional research conducted by the Urban Institute. Read more from this article here. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Monday, June 20, 2022

Updated: Thursday, July 21, 2022

|

By: Nancy Germond, Executive Director of Risk Management & Education, Big "I" Are your clients, both commercial and personal, at a greater flood risk than they know? If your clients rely solely on the Federal Emergency Management Agency (FEMA) flood maps, your clients' property may be at much higher risk than predicted by FEMA maps. According to the New York Times, FEMA maps do not account for intense rainfall-created flooding. Climate challenges change flood risks throughout the US and abroad Until recently, reinsurers considered flood risks “secondary perils." Primary perils are events that generate large losses and are routinely “modeled," such as earthquakes and tropical cyclones. Many carriers had considered flooding a “secondary peril," a smaller or mid-sized event. However, those days are gone, according to one expert in a recent Burns & Wilcox online seminar on flooding risks. Flood risk is a major concern to today's insurers and reinsurers. In the U.S. according to CBS news, over 700,000 commercial real estate buildings, apartments, malls and office complexes face flooding risk in 2022 that could reduce business access and incur economic losses approaching $50 billion yearly. Homeowners, too, face significant flooding risks from rising inland waters, coastal storms, increased rainfall, and other water-related deluges. Add increased urban infill and greater population growth along coastlines to the mix and your insureds may not recognize the risks facing them. A New Tool to Measure Flood and Wildfire Risks A non-profit, First Street Foundation, formed by academics and climate experts, offers a free, online tool that analyzes current flood data to predict a property's flood risk. The tool categorizes flood risk from minor to extreme. After entering an address, you will receive a “Risk Factor™" analysis, with flood-risk categories ranging from minor to extreme. The analysis includes flooding that can occur from swollen rivers, rainfall, tidal flooding, and storm surge. Enter the property location to determine its risk of flooding and wildfire. An article in the New York Times stated that Risk Factor showed a “vast increase in [flood] risk compared with official estimates." Even updated flood maps are “decades old," according to the Times article, and Risk Factor includes areas not yet mapped in some instances. The article went on to say that even though Risk Factor may “overestimate some risks," FEMA welcomed the additional input provided by Risk Factor. Relying Solely on FEMA Flood Maps Can Be Problematic First Street Foundation evaluated the City of Chicago's flood risks. While FEMA maps showed that 0.3% of properties in Chicago were within the 100-year flood zone, First Street found about 13% of the Chicago properties were in danger of flooding. This was more than 75,000 properties than FEMA maps predicted. Put your own property address in at this link to see both flood risk and wildfire risk. For example, I put in our vacation property address located in Skull Valley, Arizona (it's prettier than it sounds), population 350. While our property address did not appear, the 86338-zip code did, and I received this result. As you can see, we're more at risk from wildfire, but flood risks could also be problematic. But wait, there's more. The model also predicts the impact of flooding on roads, commercial buildings, and critical infrastructure in that zip code. Risk Factor is a new tool you can use to help your insureds decide on their need for flood insurance, and to evaluate their wildfire risk. Reminding your insureds about their flood risks and coverage options It is always prudent to remind your insureds that their property coverages do not include the risk of flooding (where applicable). Simply because their lenders do not require flood insurance does not mean their property is not at significant risk of flooding. With the summer monsoon season and hurricane season ahead, reminding your insureds of flood coverage limitations can help protect your agency in the event of a claim involving surface water. Additionally, National Flood Insurance policies may not provide adequate coverage for your clients' property values, especially considering recent greatly increased construction costs. Risks of flooding and wildfire are two great reasons to reach out to your insureds With the increase in flooding risks, you can protect yourself and your agency by recommending flood insurance with every property policy you place, even if the lender does not require flood insurance. Reminding your clients at policy inception and at policy renewal that no flood coverage applies under the homeowners policy, or the commercial property policy, can help guard you against a professional liability claim.

This article was originally published on independentagent.com in May.

Tags:

flood

insuring Wisconsin

personal insurance

personal lines coverage

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|