|

|

Posted By IIAW Staff,

Wednesday, September 8, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing rising alcohol sales in Wisconsin, the end to the federal health insurance subsidy and new FEMA guidance. Report: COVID-19 Pandemic Driving Alcohol Sales in Wisconsin According to The Associated Press, a new report from the nonpartisan Wisconsin Policy Forum released findings that show revenue from state excise taxes on alcohol during the year that ended June 30 increased almost 17 percent over the $63.3 million they brought in the year prior. The increase will likely be the largest percentage jump since 1972 if the preliminary data holds. This 17% jump is huge considering between 2009 and 2020, the increase in alcohol tax revenue exceeded only 2.4 percent in one year. Read more here. The 6-Month Federal Health Insurance Subsidy for Jobless Americans is Ending. Here's What to Do Next: The government's subsidized health insurance coverage for those unemployed during the pandemic through COBRA will end this month. With the end of the Consolidated Omnibus Budget Reconciliation Act, health advocates say it's time for those using COBRA to think about other insurance choices starting in October. According to CNBC, "Those who've been relying on the coverage should get a warning from their former employer or insurer that the subsidy period is ending. In that notice, you'll be able to see what your monthly bill will be without the government's help. If you find the new premium unaffordable, which may be the case for some, you'll be entitled to a special 60-day enrollment period on the Affordable Care Act's marketplace. To avoid a gap in coverage, experts recommend you report your upcoming loss of COBRA coverage as soon as possible." Read more here. Risk Rating 2.0: FEMA Releases More Guidance Ahead of Implementation Risk Rating 2.0 is FEMA's new pricing methodology for the National Flood Insurance Program (NFIP) scheduled to be implemented on October 1st. As the implementation nears, FEMA just released the Risk Rating 2.0 edition of the NFIP Flood Insurance Manual to give guidance for administering NFIP policies under the new pricing methodology. According to IA Magazine, "The Big "I" believes that Risk Rating 2.0, if properly implemented, has the potential to improve the NFIP experience for agents and consumers, but emphasizes that the rollout of the program will be critical in determining the success of the effort. As FEMA continues to provide more information regarding Risk Rating 2.0, the Big "I" will continue to provide members with updates." Read more here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, September 1, 2021

|

Happy Wednesday! It's hard to believe that we are already kicking off the month of September, but here we are! In this week's Big I Buzz, we are discussing how some millennials are changing careers, the new budget resolution passed last week and how bears are becoming a threat in fight against the Minnesota wildfire. These Millennials Are Dumping Their Jobs to Plot New Careers According to The Wall Street Journal, some young professionals are choosing to quit the job post-pandemic without a Plan B. "U.S. workers are quitting their jobs at some of the highest rates in years, a sign of great appetite for change and confidence in better prospects down the line. The share of people leaving jobs reached 2.7% in June, according to the Labor Department, just shy of April's 2.8% rate, the highest level since the government began tracking quit rates two decades ago. Now is a great time to train the right employee who's looking for a switch into the insurance industry. The IIAW has options for employee training through New Level Partners platform, My Agency Campus. My Agency Campus is a great hub for employee training ranging from insurance basics, specific job roles ore even specific business skills. My Agency Campus is an easy-to-access learning tool with training bundles tailored by job role and experience. You can browse the course offerings and help new hires achieve their professional development goals here: https://www.iiaw.com/page/EmployeeTraining. House Democrats Pass $3.5 Trillion Budget Resolution Last week, U.S. House of Representatives Democrats passed a $3.5 trillion budget resolution that unlocks the process known as "reconciliation". While previously passed in the Senate, it did not receive a single Republican vote in either chamber. According to Independent Agent Magazine, "Reconciliation allows the majority party in the Senate to use spending or revenue bills to expedite consideration of certain tax, budget and spending-related legislation. While limited in use, budget reconciliation measures in the Senate require a majority vote and not the normal 60-vote threshold to overcome a filibuster and pass legislations." The reconciliation outlined the spending priorities, it did not outline how it will pay for the spending. "Based on the contours of the budget resolution, the reconciliation package could include up to $1.7 trillion in tax increases... Importantly for agencies that file taxes as a C corporation, which is roughly one-third of Big "I" members, President Biden has suggested raising the corporate tax rate from 21% to 28%. For the two-thirds of Big "I" members organized as pass-through entities, President Biden's proposals earlier this year did not call for any changes to the 20% tax deduction for small businesses that was created in former President Donald Trump's Tax Cuts and Jobs Act. " Read more here. Bears Emerge as Threat in Fight Against Minnesota Wildfire As officials are working to stop the spread of the wildfires in northeaster Minnesota, bears are creating a new threat. Generous donations of food and supplies have out-stripped the need and storage ability. Because the storage space has been filled with donations, extras are needing to be stored out in the open, making them an attractant to bears. While blackbears common in northern Minnesota rarely attack people, food can cause conflicts with the bears. So far, the fire has destroyed 14 "primary structures" - mostly homes and cabins - and 57 outbuildings in a major run last week. it stood at 14% contained as of August 30th with a projected containment date of September 10th. Despite the damage, Superior National Forest officials are appreciative of the donations, however, they do not need any more. For those that would like to continue to donate, officials suggest donations to local food banks and fire departments instead. According to Insurance Journal, "The Forest Service also reported no growth thanks to the rain on two other, smaller wildfires of concern, the John Ek and Whelp fires, which are inside the Boundary Waters Canoe Area Wilderness. Crews have just begun efforts to fight those fires on the ground because they're deep in the wilderness in hard-to-reach places. Fears that the two fires could expand while firefighting resources have already been stretched thin by the Greenwood Lake fire and severe drought conditions led the Forest Service Aug. 21 to entirely close the Boundary Waters through at least Sept. 4." Learn more here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, August 25, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing how material and labor prices are affecting property insurance, the new FDA COVID vaccine approval and why small business insureds are showing drooping satisfaction. How Material, Labor Price Hikes Are Affecting Property Insurance The COVID-19 pandemic has created a sharp increase in the price of materials and labor. These increases have in turn increased property claim costs. According to the Vice President of pricing solutions for Verisk's Xactware, "The price of sheathing materials such as plywood and oriented strand board increased by more than 350 percent from July 2020 to July 2021 and other lumber materials increased by more than 100 percent... A labor shortage is driving up costs as well." Pyle said that guess future prices is a "foggy crystal ball". Previously when COVID-19 appeared to be under control in the US, prices started to level out, however, with the Delta variant's arrival, rates started surging again. Read more here. FDA's COVID Vaccine Approval Makes Challenges to Mandates Tougher to Win This week the FDA approved the Pfizer vaccine. According to Insurance Journal, this change will make it nearly impossible to successfully challenge mandates by employers, legal experts said. According to Reuters, "Legal experts said there already was a growing consensus that employers could mandate an emergency vaccine. During the pandemic, both the Equal Employment Opportunity Commission and the Department of Justice issued guidance in support of vaccine mandates, provided exceptions were made for medical conditions and religious beliefs. But emergency vaccine requirements have not gone unchallenged. At least a dozen lawsuits have been filed, mostly by students against colleges, but also by employees fighting allegations of wrongful termination for refusing a shot." This new approval will make it more difficult for those who would like to challenge mandates, nearly impossible. Read more here. The 5 Reasons for Small-Business Insureds' Drooping Satisfaction A new survey from J.D. Power has found that customer satisfaction surrounding small-business insurance clients declined seven points this year and 15 points during the past two years. They outlined the top 5 reasons for this: 5. Interactions leave more to be desired - the satisfaction with insurance interactions fell off by 20 points compared to the year prior. Not only was this decline due to courtesy during calls but also in the timeliness of resolution. 4. Customers exerting too much effort - throughout the last year, small business insureds exerted three times more effort trying to interact with insurance agents. 3. Outreach comes too late - According to NU Property Casualty 360, "During 2020, less than 20% of clients reported their carrier proactively reached out to discuss their needs related to COVID-19. This significantly increased in 2021, with 45% reported having proactive contact with their insurer. However, the negative impact it had on customer satisfaction suggests the outreach might have come too late." 2. Mixed messaging - more problems and billing issues were reported in 2021 compared to 2020, among insureds who reported receiving proactive outreach. 1. Turning to multiple channels for answers - clients who experienced billing or other issues were twice as likely to use four or more communication channels. According to the study, "While they leveraged multiple communication tools, including call centers, the customer satisfaction level didn't vary much between channels with clients that experienced problems. This suggests the industry could do more to recreate a more seamless cross-channel experience. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Evan Leitch,

Tuesday, August 3, 2021

|

Happy Wednesday! This week's Big I Buzz features IIAW's Annual Business Meeting on August 26, 2021, insurtechs with multibillion dollar valuations and how the potential government spending of $1.2T on infrastructure would impact the insurance industry.

IIAW's Annual Business Meeting - August 26, 2021

Join us for an overview of the Association's past fiscal year as presented by members of the IIAW Executive Committee at 10 a.m. on Thursday, August 26th 2021. This meeting is reserved for IIAW members only. Go here to register to attend.

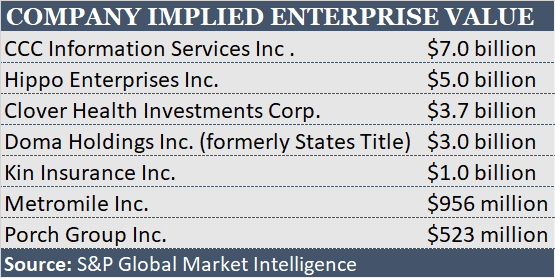

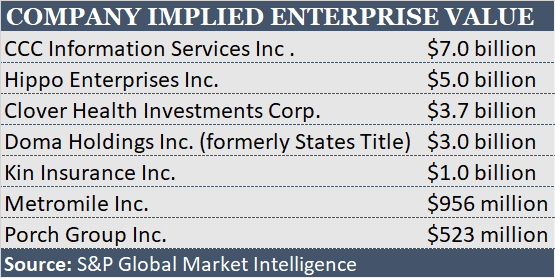

7 Insurtechs with Multibillion-Dollar Valuations

A number of insurtech startups are coming to market through blank-check companies. Here are valuations of several that have announced special purpose acquisition company (SPAC) plans.

Read more here.

Construction Constrained: Market Dynamics Under U.S. Infrastructure Plan Insurance for the construction sector is already in a tough position. Supply is shrinking, but demand is rising as the economy advances in the late-COVID environment. Insurance capacity for residential homebuilders risk and excess liability are constrained following some large surety losses, and prices are rising in line with almost all other classes of business insurance. If the current bipartisan White House proposal to spend $1.2 trillion on U.S. infrastructure goes ahead — or even a bill for substantially less — the dynamics of the market will have to change dramatically if we’re to get all these projects covered. Carriers that have historically been dominant are still present, but they’ve scaled down the availability of their capacity, the Terms & Conditions they apply, or both. Various Lloyd’s syndicates have also participated in many major U.S. construction risks, but the market’s new “performance management” regime means it’s reasonable to presume appetite will be shrinking there too. With no sign yet of these changes being reversed, finding adequate cover for a trillion dollars worth of projects will not be easy. That said, the market environment may be at least somewhat different when the projects actually come on line, which for most will take a few years at least. By then, some of the traditional players may be willing to release more capacity to construction, and new players may have joined their ranks. Read the full article here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click

here

to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Sunday, July 25, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing the upcoming convention, workers' comp rate decrease in Wisconsin and the results from the Q2 IVANS Index. InsurCon2021 Countdown is On InsurCon is quickly approaching with only a short week and a half left until this must-see event. Join us on August 10-11 at the Kalahari Resorts in Wisconsin Dells. Our speakers include industry experts, marketing gurus and technology geniuses with our keynote speaker, Joe Theismann. This premier event will highlight ways for agents to build their business, increase their marketing effectiveness and improve their business skills. Register now at iiaw.com/insurcon. 5.44% Workers' Comp Rate Decrease Approved in Wisconsin Effective October 1, 2021, there will be a 5.44 percent decrease in workers' compensation insurance rates. According to Wisconsin Insurance Commissioner Mark Afable, the decrease could result in a savings of more than $90 million for Wisconsin businesses. This is now the sixth straight year of rate decreases in Wisconsin. According to Insurance Journal, "the five major industry groups for workers' compensation insurance in Wisconsin will benefit from a rate decrease. • Contracting will have a 5.35% decrease; • Office and clerical will have a 4.21% decrease; • Goods and services will have a 6.39% decrease; • Manufacturing will have a 5.53% decrease; and • The miscellaneous industry group will have a 4.12 percent decrease. " Read more here. Q2 IVANS Index Shows Ongoing Insurance Market Hardening According to the Q2 2021 IVANS Index, P&C insurance-industry renewal rates are experiencing a sustained upward trend. According to Property Casualty 360, "Second-quarter 2021 premium renewal results revealed rate changes for all major commercial lines of business increased except for the workers' compensation market, where premium renewal rates have remained negative so far in 2021. The IVANS Index provides a leading indicator of the strength of the insurance channel. Click here to read a few additional highlights from the reporting. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, July 21, 2021

|

Happy Wednesday! This week we are discussing states with the highest flood insurance costs, coverage for future pandemics and Biden's executive order taking aim at noncompete agreements.

States With the Highest Flood Insurance Costs

Research from Valuepenguin.com reported the states with the highest flood insurance costs which are predominantly located in the Northeast and Midwest. The report also found that the national average cost of flood insurance is $734 annually.

The top 10 states with the highest flood insurance costs are:

• Vermont - $1512

• Connecticut - $1471

• Rhode Island - $1418

• Pennsylvania - $1305

• Massachusetts - $1294

• West Virginia - $1273

• New York - $1152

• Ohio - $1151

• Maine - $1119

Wisconsin narrowly missed the top 10, ranking #18 on the list. However, Wisconsin ranked #49 for one of the least insured states with a 0.7% ratio of active flood insurance.

See the full report from Valuepenguin here: https://www.valuepenguin.com/average-cost-flood-insurance#high

Is this the only way to cover future pandemics?

High-profile members of the global P&C reinsurance industry are calling on government help in absorbing extreme losses from pandemic events, especially when it comes to business interruption. There has been increased contention around BI coverage after

the mandatory closure of non-essential businesses. According to Insurance Business Mag, "Commercial insurance policies and traditional BI policies typically do not offer coverage for BI or supply chain disruption due to a pandemic such as COVID-19.

Generally, BI insurance will only trigger if there is a direct physical loss to property - unless there is unique language written into the insurance contract that deems otherwise."

With evidence worldwide showing successful public-private partnerships to handle other potentially systemic exposures, like terrorism or flood, it's leaving some to wonder what the solutions could look like from a pandemic perspective that could address

gaps in insurance policies like business interruption. Read more about the members who are interested in government-supported programs here.

Biden Executive Order Takes Aim at Noncompete Agreements

A new executive order from Biden would "narrow the use of noncompete agreements to include only necessary instances of a dissolution of a partnership or the sale of a business. The legislation would also place the enforcement responsibility on the FTC

and the Department of Labor, as well as create a private right of action. Notably, the legislation would require employers to make their employees aware of the limitations." Noncompete agreements are receiving scrutiny across the aisles and a number

of states have enacted measures that restrict their use. Read more about the executive order here.

For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click

here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, July 14, 2021

|

Happy Wednesday! On this week's Big I Buzz, we are discussing how the Olympics' ban on spectators will cost the global reinsurance sector, how to earn 6 FREE CE credits and why Wisconsin taxpayers should be on high alert to suspicious mail regarding tax

collection.

Olympics Ban on Spectators to Cost Reinsurers Far Less Than Cancellation: Fitch

An analysis from Fitch Ratings has found that Japan's decision to ban spectators from the Tokyo Olympics will cost the global reinsurance sector $300 to $400 million due to payouts for ticket and hospitality refunds. According to Insurance Journal, "these

costs are only 10-15% of the amount reinsurers would have faced had the Olympics been cancelled, and its impact on earnings should be limited, leaving capital and ratings unaffected. The analysts believe reinsurers would bear most of the losses arising

from this cover given that high-severity exposures are typically heavily reinsured." Read more here.

How to Earn 6 FREE CE Credits

When you register for InsurCon2021, you'll not only get to network with everyone that you've missed throughout the last year, but you'll also receive 6 FREE CE Credits. In an effort to reduce the amount of time attendees will spend in smaller breakout

rooms, we will be providing a voucher good for six FREE CE credits (a $144 value). Attendees can redeem their free CE credits in the comfort of their own home, on their schedule giving you even more time to network while at InsurCon. These vouchers

must be used prior to November 30, 2021.

If you haven't already registered for the convention, now is the time! The rooms under IIAW's room block for the night of Tuesday, August 10th and the night of Wednesday, August 11th at the Kalahari Resorts have now sold out. If you plan to stay overnight

either nights (or both), nearby hotels (0.9 miles from the Kalahari) include the Ramada Inn and Holiday Inn. The IIAW does not have room blocks at these hotels. We do encourage everyone who plans to stay overnight to make their reservations as soon

as possible because this is peak time in Wisconsin Dells and rooms will go fast.

Fraudulent Mail Warning: Wisconsin Officials Alert Public

The Wisconsin Department of Agriculture, Trade and Consumer Protection (DATCP) and the Wisconsin Department of Revenue (DOR) revealed on Monday, July 12th that the agencies have received reports from multiple counties of individuals receiving fraudulent

letters related to tax collection.

According to Fox6 Milwaukee, the public can identify these letters by looking for:

"• A return address listing the "Benefits Suspension Unit," a Wisconsin county, and "Public Judgement Records."

• A fake government seal with an image of the U.S. in a circle, rather than a state, county or municipality seal.

• A paid postage mark indicating the letter originates from Los Angeles, CA

• There is no information on remitting payment, only a number to call to "avoid enforcement.""

Scammers may have been able to target victims by searching court filings for individuals who have already had court cases filed against them to collect taxes, according to the release from DATCP and DOR. For more information, please click here.

For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click

here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Kaylyn Zielinski,

Wednesday, June 30, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing Fourth of July travel, upcoming webinars to add to your calendar and how offices are changing post-COVID. AAA Fourth of July Holiday Travel Forecast AAA has released their Fourth of July Holiday Travel Forecast and we are seeing upward travel trends showing Americans are ready to get back to their vacations. Similar to Memorial Day weekend, there's an expected increase of travel for the Fourth of July. More than 47.7 million Americans will take to the roads and skies for the Fourth of July weekend (July 1-5), according to AAA. Not only will travel be up 40% compared to last year, but it's expected to be the second-highest Independence Day travel volume on record (behind 2019). Americans will be hitting the road, totaling more than 91% of holiday travel this upcoming weekend. Car travel will bll be the highest on record, despite the gas prices being at the highest compared to the last seven years. AAA says that over 3.5 million Americans will travel in planes, up 2.2 million from last year. According to AAA, these are the top destinations for the Fourth of July weekend: 1. Orlando, FL 2. Anaheim, CA 3. Denver, CO 4. Las Vegas, NV 5. Seattle, WA 6. Chicago, IL 7. New York, NY 8. Atlanta, GA 9. Boston, MA 10. Kahului, Maui, HI If you're planning to head south towards Chicago for the weekend, prepare for a bit of traffic as Chicago is listed in the top 10 travel destinations for the weekend. According to the AAA News Room, "INRIX, in collaboration with AAA, predicts drivers will experience the worst congestion heading into the holiday weekend as commuters leave work early and mix with holiday travelers, along with the return trip on Monday mid-day." Upcoming Webinars to Add to Your Schedule: The IIAW, in partnership with Godfrey & Kahn, has produced the below webinars to help you navigate upcoming changes within the insurance industry and how these changes will affect you. Cost for each of these webinars: $99/person Webinar: Agency Privacy Officer - Duties & Legal Overview Join attorneys Josh Johanningmeier and Sarah Sargent from Godfrey & Kahn S.C as they provide independent agents with a detailed overview of the duties and legal requirements for an agency privacy officer. Every agency must adhere to specific requirements found in the Health Insurance Portability and Accountability Act (HIPAA) and the Gramm-Leach-Bliley Act in addition to NAIC and state-specific requirements. As these laws continue to pass and grow in complexity, there are policies that every insurance agency must follow regardless of size or location. This webinar is available on the following dates: - 9AM-10AM on Thursday, July 1st

- 11:30AM-12:30PM on Friday, July 9th

- 2PM-3PM on Wednesday, July 14th

- 10AM-11AM on Thursday, July 15th

Webinar: New Disclosure Requirements for Brokers/Consultants Attorneys Josh Johanningmeier and Todd Cleary of Godfrey & Kahn, S.C. provide legal direction and guidance regarding new disclosures under Consolidated Appropriations Act. These new rules apply to compensation paid with respect to a covered plan to a covered service provider. Listen in to learn what the term "compensation" includes, how a "covered plan" is described and who is included in "covered service provider". Additional details such as advance disclosure requirements, required disclosures and requirements for plan fiduciaries will be important topics of discussion. - 2PM-3PM on Thursday, July 1st

- 10AM-11AM on Friday, July 9th

- 12PM-1PM on Wednesday, July 14th

- 12PM-1PM on Thursday, July 15th

Offices After COVID: Wider Hallways, Fewer Desks As more and more employees are returning to work, they're seeing a different office setup than when they first left. The move back into offices is being focused on socialization within their work spaces. Associated Press reported, "Surveys show the thing employees miss most about office work is socializing and collaborating with colleagues, said Lise Newman, workplace practice director at architecture firm SmithGroup. Companies are trying to encourage that rapport by building more social hubs for employees. Some mimic coffee houses, with wood floors, booth seating and pendant lamps. "Companies are trying to create the sense that this is a cool club that people want to come into," Newman said." In addition to adding in social workspaces for employees, businesses are also creating more private spaces so those who need time to work on their own, have that sense of privacy they received while working from home. New York company, Valiant Technologies, has removed rows of desks and put more space between the remaining ones. They're encouraging a hybrid work environment, where employees have a desk to return to when they work in the office. Read more from the Associated Press story here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Kaylyn Zielinski,

Wednesday, June 23, 2021

Updated: Wednesday, June 23, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing four reasons to register for InsurCon today, Illinois' plan to verify vehicle insurance and the rise in fraud attempts against financial services.

Four Reasons Why You Should Register for InsurCon Today 1. FREE CE Credit Voucher Included with all InsurCon registrations, you'll receive a voucher good for 6 FREE CE credits (a $144 value)! Attendees can then redeem their free CE courses online in the comfort of their own homes through the IIAW and ABEN. Once you receive your credit voucher at registration of InsurCon, you can redeem your credits through November 30, 2021. 2. Time to Reconnect 2020 was a long year to be apart, and now is the perfect time to reconnect with everyone! The Kalahari's new convention center offers plenty of space for us to connect safely. We will be following all safety guidelines outlined by the Kalahari, the Wisconsin Department of Health Services and the CDC. 3. Exhibitor Showcase Our annual Exhibitor Showcase will be held on Wednesday, August 11th. New to InsurCon2021, we will be playing Blackout Bingo! Connect with the exhibitors, and earn awesome prizes! The more exhibitors you visit, the greater the chance to win BINGO! 4. Keynote Speakers Our speakers include industry experts, marketing gurus and technology geniuses. First, our keynote speaker, Joe Theismann will highlight his strategies for handling unforeseen change. e can't think of a better topic to discuss at this year's convention! You will not want to miss all of the great information that Beth Ziesenis has to share about finding the best bargain technology tools for work and home. As we continue to move forward in this post-COVID world, you can apply Beth's insights to your work situation, whether that's in-person, remote or hybrid! Lastly, but definitely not least, join us to hear from Bill Pieroni, President & CEO of ACORD. Bill's expertise revolves around digitization, change management and the strategic and capability imperatives for high performance in the insurance industry. Now, it's time to register! Head to iiaw.com/insurcon to save your spot today, you have so many reasons not to miss this event! We can't wait to see you August 10-11 at the Kalahari Resorts & Convention Center for InsurCon2021. Illinois Isn't Playing Games, Will Randomly Verify Vehicle Insurance Starting Next Month Illinois' Secretary of State will be launching a new program to check for proof of insurance without drivers knowing it. While drivers who don't already have insurance are already at risk for fines, on July 1, 2021 there will be a new program verifying valid insurance. The program, Illinois Insurance Verification System, or ILIVS, will allow the Secretary of State's office to randomly verify valid insurance for Illinois vehicle owners, according to Rockford-based radio station, Q98.5. If a driver's vehicle is flagged, drivers will face fines and suspensions if their vehicle pops up uninsured. If a vehicle is flagged, the Secretary of State asks that the customer's insurance company will need to confirm that the vehicle owner has auto insurance on the verification date mentioned through the Illinois Insurance Verification System. According to Q98.5, "If you are unable to prove your vehicle is properly insured, you will face license plate suspension along with a $100 reinstatement fee." TransUnion: Fraud Attempts Against Financial Services Rise 149% A new TransUnion Report has found that global digital fraud attempts against financial services spiked 149% compared to the last four months of 2020. According to NU Property Casualty, "In the U.S. specifically, financial services fraud attempts increased 109%, the global information and insights company said. The top type of fraud targeting financial services was true identity theft, which TransUnion defined as when a consumer uses a stolen identity to commit fraud, with the victim being a real person. For the insurance industry, suspected ghost broker fraud was the top type of fraud TransUnion detected during the research period." Read more about the report here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Kaylyn Zielinski,

Wednesday, June 16, 2021

|

We are back with another week of Big I Buzz. In this week's Big I Buzz, we are discussing OSHA's new COVID-19 emergency temporary guidance for all workplaces, the future of passwords and the results from a new J.D. Power study on auto insurance customer

satisfaction.

OSHA Issues COVID-19 Emergency Temporary Standard for Health Care Workers and Guidance for All Workplaces

On June 10, 2021, OSHA issued an Emergency Temporary Standard relating to COVID-19. According to Godfrey & Kahn, "Since the beginning of the COVID-19 pandemic, OSHA has exclusively relied on existing safety standards to regulate employer conduct during

the COVID-19 pandemic. Consequently, all of OSHA's previous employer directives, to date, have taken the form of non-binding informal guidance and recommendations." President Biden issued an Executive order on January 21, 2021, directed towards OSHA

to consider implementing "any emergency temporary standards on COVID-19 and that these standards should be released by March 15, 2021.

OSHA updated their existing COVID-19 guidance for all workplaces on June 10, 2021. The new guidance says:

• Encourages employers to grant paid time off for employees to get vaccinated

• Suggests that employers provide unvaccinated and at-risk workers with face coverings or surgical mask at no cost

• States that workers should continue to wear face coverings while working indoors

• Recommends that employers, especially public-facing workplaces such as retail environments, "suggest" that unvaccinated customers, visitors or guests wear face coverings when entering the workplace.

Read more about the new guidance here.

Forgotten Your Passwords? They Soon May Be Lost Altogether - with Insurers' Help

Scary enough, the most popular password used in 2020 was "123456". Passwords like this were easily cracked almost 24 million times throughout the past year. According to Insurance Journal, "This data perfectly encapsulates the flaws inherent in passwords,

and why it is easy to predict that it won't be too long until passwords are phased out altogether." A 2017 Verizon Data Breach Investigations Report found that 80 percent of cyber breaches were the direct result of stolen or hacked passwords.

Biometric data which is used for unlocking our phones, paying for groceries, speaking to our bank and entering the country has caused a push for app developers to incorporate biometrics to enable users to bypass passwords altogether when accessing online

accounts. According to Insurance Journal, "The phasing away from passwords to biometric data represents a shift away from "something you have" to "something you are", and this shift is welcome. Thanks to biology, our biometric data is nearly impossible

to phish, guess or hack. While biometrics aren't infallible, attempts to hack biometrics are largely only attempted by some of the more sophisticated criminals, meaning the prevalence of this threat is minimal when compared to the threat facing our

passwords."

Auto Insurance Customer Satisfaction Stalls Despite $18 Billion in Premium Relief, J.D. Power Finds

The auto insurance industry returned more than $18 billion in auto insurance premiums to customers in 2020 to address the sharp decline in miles driven during the COVID-19 pandemic. Despite this relief, the 2021 J.D. Power U.S. Auto Insurance Study found

that customer satisfaction with auto insurers is flat, following four consecutive years of improvement.

Here are the key findings of the study, according to Business Wire:

•Overall satisfaction is stagnant: This is the first time since 2017 that auto insurance customer satisfaction has not improved year over year.

• Insurers miss the mark in communication: There were significant declines in satisfaction with customer interaction. Satisfaction with the assisted online channel, is comprised of chat and e-mail functions, declines 12 points from a year ago, with decreases

also seen in contact center, website and local agent.

•Customer awareness of COVID-19 relief efforts boosts brand perception: Overall brand impressions are significantly higher among customers who were aware of these relief efforts, which was also reflected in their intent to renew their policy.

• Pandemic as catalyst to telematics growth: More than 1/3 of auto insurance customers say they are willing to try usage-based insurance which uses telematics technology to track customer driving patterns and includes discounts based on safe driving and

fewer miles driven.

• Ready to switch at hint of premium: Nearly half of auto insurance customers say they would switch if they could receive a saving of $200 or less.

Read the more about the study here.

For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Don’t forget you can stay up-to-date on other industry news as its happening on our Online Community. You can join the Online Community (exclusive to IIAW members)

here

. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|