|

|

Posted By IIAW Staff,

Tuesday, October 12, 2021

|

As we mentioned in last week's Big I Buzz, October is Breast Cancer Awareness Month. Throughout the month, it's important to be showing support by wearing pink throughout the month, donating to cancer research and reminding yourself of the importance of performing self-exams throughout the entire year! Raising breast cancer awareness is especially important for all of us at the IIAW. Recently, Trisha Ours, our Director of Insurance Services was diagnosed with breast cancer. A message from Trisha: "My cancer diagnosis is still new (end of September), but so far it appears to be stage 1A triple positive invasive ductal carcinoma. However, I've been told that I can be re-staged multiple times during my battle with breast cancer and at any time can have a recurrence of metastatic disease. This is why it is so important to do self-exams and schedule your mammogram screenings. If I had not been doing self checks or just brushed it off instead of contacting my doctor right away, I could be looking at a much more dire situation." As the IIAW team raises awareness for breast cancer, we have started a fundraiser for metastatic breast cancer research in Trisha's honor. METAvivor is an organization dedicated to the specific fight of women and men living with stage 4 metastatic breast cancer. If you would like to donate, please head to our team page: donate.metavivor.org/team/383943. 100% of every donation to METAvivor goes into their research grant. Consumers are Splurging on Diamonds. Signet Jewelers Just Hiked Its Full-Year Outlook - Again For the second time in weeks, Signet Jewelers have raised their fiscal 2022 forecast, as consumer demand increases before the holidays. According to the company, they're not experience any supply chain disruptions unlike many other stores in the retail industry. As consumer demand for diamonds are expected to grow throughout the holiday season, this could be a great time to push insuring expensive jewelry and gifts.

Feel free to right-click and save this image to share on your social media feeds to encourage followers on Facebook to contact you about insuring their expensive jewelry and gifts throughout the holiday season. If you don't follow our Facebook page already, head to facebook.com/iiaofwi to see our daily posts that you can share onto your own page. Insurers in Illinois Now Required to Report Dog Bite Claims Starting January 1, 2022, home and renters insurance companies must provide certain information regarding dog bites. The new Illinois insurance code asks all insurance companies to document and report information including, " 1. The breed of the dog and whether the identification was made visually, or by the owner, adjuster or insured; 2. Where the owner of the dog obtained the dog from, such as pet store, breeder, animal shelter or rescue organization, a friend or acquaintance, or if they found the dog or it was a stray; 3. The sex of the dog and whether or not it was neutered or spayed; 4. Whether or not the person injured by the dog was observed teasing, tormenting, battering, assaulting, injuring or otherwise provoking the dog; 5. The type of injury that was sustained by the victim, such as fall or bite; 6. Whether the injury occurred on the insured's property or at another location, and 7. Whether the dog had received any sort of obedience training, or there have been previous claims or past complaints against the dog." This information must be collected for a two-year period starting January 1, 2022. Read more here: https://www.propertycasualty360.com/2021/10/11/illinois-to-require-insurers-to-report-all-dog-bites-414-211070/ For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, October 6, 2021

|

October is Breast Cancer Awareness Month, and to start off this week's Big I Buzz, we'd like to raise awareness about the importance of early detection.

Early Detection Remains the Best Defense Against Breast Cancer October is Breast Cancer Awareness Month, an annual campaign to raise awareness about the impact of breast cancer. According to WSAW.TV, "In Wisconsin, 5,200 women have been or will be diagnosed with breast cancer in 2021." In addition to wearing pink to show your support throughout out the month and donating to breast cancer research, make sure that you are taking precautions to detect breast cancer early. The best way to detect breast cancer early is to perform a self-exam at least once a month. Self-exams require you to feel for lumps or changes in your breasts, and it's also important to check tissue as high as your collar bone and under the armpits to examine the entire area. Checking monthly will allow you to know what is normal for your body and detect changes. If you find a change, make sure that you go to your doctor to get it checked out. To remember to perform a self-exam, we suggest putting a monthly reminder on your calendar for these self-exams. Gen X's Wealth Has Gone Up 50% During the Pandemic In between the Baby Boomers and Millennials sits Generation X, adults ranging from 41-56. Gen Xers experienced a wealth boom in the U.S. during the pandemic. According to data from the Federal Reserve, "Gen Xers saw robust gains in equities and pension entitlements, while their share of the nation's consumer debt declined." This generation's careers have since stabilized and has allowed them to invest money into the stock market and 401ks retirement accounts. According to Bloomberg, "As of June this year, Generation X held 28.6% of the nation's wealth, up 3.9 percentage points from the first quarter of 2020, according to Fed data. In dollar value, that translates into a 50% gain in their aggregate net worth -- the difference between a household's assets and debts. The shares held by the so-called Silent Generation, born before 1946, and the Boomers, the largest demographic group by far, declined in the same period." Read more about Gen X's growing wealth here. Millennial X Factor: How Does Your Digital Strategy Stack Up? According to Property Casualty 360, "Of the 78 million millennials living in the United States as of 2019, 45% own a house, and 80% own a car. It's safe to say that this group has come of age as the first digitally native generation, with Gen Z following in rapid succession. Consequently, the demands and expectations of younger generations - of which 85.9% of millennials were digital buyers in 2020 - should be front and center for today's insurers." A report from Liberty Mutual Insurance and Safeco Insurance found that millennials are more likely to connect with agents and research agents through digital channels than their older counterparts. According to the report, "80% of millennials wanted an agent to help them understand their insurance." Insurers that expect to remain relevant will understand that millennials expect simple, fast and transparent processes but they also value human interaction. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, September 28, 2021

|

Today is National Coffee Day! It's always a good day when you start it off with a cup (or three) of coffee. In this week's Big I Buzz, we are discussing how a few changes in your office can support productivity, how Wisconsin bars and restaurants are bouncing back post-pandemic and why millennials are buying more life insurance than other generations. 8 Ways to Redesign Your Office to Support Productivity - Independent Agent Independent Agent has put together a list of do's and don'ts to creating a space that encourages a productive work mindset. These are 8 things to consider when designing (or redesigning) your workspace to optimize productivity as workers return to the office: 1. Look for bottlenecks. Review the layout for your workplace to determine if the setup you currently have is best suited for your team. Do you have two departments that often work together? Consider moving them closer to each other to avoid the back and forth. 2. Room acoustics - sounds that are within a 20-foot radius have the most impact on employee concentration levels. Consider adding acoustic panels to reduce the noise in an open office space and ultimately, decrease distractions. 3. Eliminate distractions - Independent Agent suggests polling your staff as to what distracts them the most. There may be a lack of sunlight or too much space to congregate, keeping them from staying focused. 4. Offer opportunities for movement - According to the Fellowes Workplace Wellness Trend Report, around 87% of employees say they'd like healthier workplace options, including wellness rooms and ergonomic chairs. Other options include allowing a space to pace while brainstorming or encouraging time to walk during the work day. 5. Encourage breaks - The average person can work nonstop for about 20 minutes before losing focus. A good way to ramp up productivity is by encouraging frequent breaks. Add a calendar reminder every 20 minutes to either switch projects or just to get up and move around for a few minutes to encourage productivity. 6. Declutter the space - Those who are more organized than others may find another person's mess distracting from their work. Try to remove any unused items from common areas, or even within offices. 7. Prioritize workflows - Review your workplace workflow. Recognize the areas where tasks are taking longer and invest in any technology that may help to automate repetitive tasks. 8. Reassess frequently - As your business scales up, review these items to see whether these changes are continuing to improve your processes or see where you can make changes. Read more here. Wisconsin Bars and Restaurants Are Bouncing Back, But Not To Pre-Pandemic Levels Wisconsin Policy Forum has released a new report finding low employment is holding the industry back from a full recover to pre-pandemic levels. According to Wisconsin Public Radio, "Food service has been one of the hardest-hit industries during COVID-19, with employment at bars and restaurants plummeting by nearly 50% in April 2020. According to last week's report, employment was still down 8.8 percent in August compared to pre-pandemic levels in August 2019. What makes this situation even more difficult is that business is booming. As many customer flock back to restaurants and bars, the establishments are struggling to keep up with the influx of customers. "This boom in sales should help restaurants and bars recover from a difficult year and a half, but it's not. Owners must contend with supply chain shortages, and any increase in sales revenue has to cover much higher food costs and increased wages." The report found that 39.1 percent of Wisconsin workers in accommodations and food services industry filed initial unemployment claims between March 15 and July 5, 2020. Unfortunately, that hasn't led many restaurants to receive workers back as they reopen. Some restaurants interviewed for the WPR story, told reporters that they had to run on only half of the employees they had pre-pandemic, with many restaurants forced to be closed some days so they can give those employees a day or two off each week. Read more here. COVID-19 Driving More Millennials to Buy Life Insurance Than Gen X & Boomers, Study Finds A recent study from the 2021 Insurance Barometer Study found that more Americans will purchase life insurance over the next year due to the pandemic. Millennials said they're now more likely to buy life insurance coverage because of the pandemics. Compared to the Baby Boomers and Gen X individuals surveyed, millennials far exceeded those who would do the same. According to Fox Business, "While the impact of the pandemic has been tragic, it has also taught younger generations the value of financial decisions like purchasing life insurance, the study showed.... Just 52% of the American adults reported having life insurance coverage in 2021, but 73 million Americans (59%) said they need life insurance. About 29 million policyholders say they need to increase their current life insurance coverage, according to the study." Read more about the study here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, September 22, 2021

|

Happy fall! Today kicks off the official start of the fall season, and it seems that the weather is starting to change too. In this week's Big I Buzz, we are looking into the effect catastrophes and COVID-19 have had on real estate, resume red flags to look out for and why deepfakes are considered a threat to the industry. Catastrophes and COVID-19 Fallout Proving Challenging for Real Estate Companies The combination of COVID-19 plus severe weather events has caused major issues for the real estate sector. Real estate companies are having trouble managing their risks between tenants having difficulty paying rent, COVID-19 safety rules, construction and labor costs and hurricanes and wildfires. According to Insurance Business Magazine, "One of the biggest challenges real estate companies are facing right now is finding capacity for CAT exposures. Given recent rends, the market is getting more restrictive - carriers are more apt to exclude CAT exposures, or potentially decline to write the whole schedule, which could force the real estate company to split out their CAT-exposed properties." Additionally, COVID-19 has caused difficulties in getting building valuations correct. Read more about how COVID-19 and catastrophes are affecting real estate here. Top 6 Resume Red Flags Independent Agent has released their top 6 resume red flags that employers should look out for when hiring: 1. Job-hopping - while it's not considered as negative now as it once did in the past due to lay-offs, company closures, COVID, you should give a deeper look into why this happened. Talk with the candidate to see why these positions didn't last, and recognize how they communicate about the past position. Did they have even more jobs than listed on their resume, did they badmouth their boss during the conversation with you or did they give constructive criticism? These questions are important for getting a deeper look at why they switched positions. 2. Gaps between employment - During the hiring process, you'll want to verify that the candidate's experience is relevant to the position they are applying to. If there is a large gap between the last position and what they're applying to now, it may take longer to get them up-to-speed. 3. Typos and spelling errors - Resumes are your first look at the candidate. A resume should have received careful consideration and review prior to your receipt of it. If there are grammar or spelling errors, this is probably an indication of how the candidate will perform in the office. 4. Career regression or lack of progress - If a candidate has stayed in the same position over the years, or took a step down to a lesser position, they may not have the drive to grow or their is an obstacle holding them back from progressing. 5. Non-work related filler - if a resume is filling their resume page with content aside from their work experience, this may be a way to draw your attention away from their deficiency in a relevant experience. 6. One-size-fits-all resume - Verify the resume and cover letter has been customized for the position they're applying to. If it seems generic, this could mean the candidate applied anywhere and everywhere and won't remember who you are when you call. Learn more about resume red flags here. Deepfakes: An Insurance Industry Threat Deepfakes use artificial intelligence to alter or synthetically generate videos, that are extremely difficult for humans and even machines to detect. According to NU Property Casualty 360, "Whereas deepfakes have largely manifested as a novelty on social media, deepfakes and similar AI-generated photos and videos can pose a significant threat to industries that make important financial decisions on the contents of photos and videos, such as insurance. The ability to distort reality in ways that are difficult or impossible to detect significantly increases the risk of digital media fraud in insurance claims at a time when many carriers have rapidly adopted self-service as a way to process claims during the COVID-19 pandemic." Any processes driven by the insured in a self-service manner are susceptible to manipulated for fake media such as auto or home claims, establishing existence and condition of assets during underwriting. There are some suggestions for implementing a layer of defense such as in-line detection, which is the process of using AI-based forensic analysis while reviewing every photo or video prior to processing a claim, and in-line prevention. This means only allowing a user to take the photos/videos in real-time instead of allowing users to upload their own photos/videos. Read more about how deepfakes are affecting the industry and what steps can be taken to weed out the fraud and deception here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, September 15, 2021

|

On this week's Big I Buzz, we are discussing Apple's new security update, how many Wisconsin workers will be affected by the new vaccine mandate and how Girl Scout cookies are now being delivered in Virginia. Do You Own an iPhone or iPad? Update Your Apple Devices Right Now. Researchers have recently uncovered a security flaw in Apple devices, including those for iPads, Macs and Apple Watches. The flaw could allow hackers to secretly install spyware on your Apple devices, even if you do nothing, not even click on a link. The recent Apple update includes a patch aimed to fix the security flaw. Read more here. How Many Wisconsin Workers Could Be Impacted by Biden's New Vaccine Mandate? According to the Biz Times, "In Wisconsin, the new federal vaccination rule could apply to roughly 1.2 million workers, including about 382,000 in metro Milwaukee. That's based on 2018 figures, the most recent available data, from the U.S. Equal Employment Opportunity Commission, which annually surveys private sector employers with at least 100 employees and federal contractors with at least 50 employees. That year 1,209.412 workers were included in that data in Wisconsin, including 381,584 in the Milwaukee metro." The Republican National Committee has announced its plans to file a lawsuit against the Biden administration over the mandates. Read more here. Girl Scout Cookies Take Flight in Virginia Drone Deliveries It's raining cookies - it sounds like a dream, but for some in Virginia, it's a dream come true. Residents in a Virginia community are receiving their Girl Scout cookies via a Google affiliate drone. According to Claims Journal, "The town of Christianburg has been testing a ground for commercial delivery drones operated by Wing, a subsidiary of Google's corporate parent Alphabet." Those in Christianburg who have been surveyed are showing content with the drones. Lee Vinsel, an assistant professor of science, technology and society who conducted the survey said that suburban setup is easiest for drone delivery. It's unclear at this time if they're looking to expand this delivery system to other states (like Wisconsin), but one can hope that we'll soon be opening our front door in pajamas to grab our Girl Scout cookies. Read more about the flying cookies here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, September 8, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing rising alcohol sales in Wisconsin, the end to the federal health insurance subsidy and new FEMA guidance. Report: COVID-19 Pandemic Driving Alcohol Sales in Wisconsin According to The Associated Press, a new report from the nonpartisan Wisconsin Policy Forum released findings that show revenue from state excise taxes on alcohol during the year that ended June 30 increased almost 17 percent over the $63.3 million they brought in the year prior. The increase will likely be the largest percentage jump since 1972 if the preliminary data holds. This 17% jump is huge considering between 2009 and 2020, the increase in alcohol tax revenue exceeded only 2.4 percent in one year. Read more here. The 6-Month Federal Health Insurance Subsidy for Jobless Americans is Ending. Here's What to Do Next: The government's subsidized health insurance coverage for those unemployed during the pandemic through COBRA will end this month. With the end of the Consolidated Omnibus Budget Reconciliation Act, health advocates say it's time for those using COBRA to think about other insurance choices starting in October. According to CNBC, "Those who've been relying on the coverage should get a warning from their former employer or insurer that the subsidy period is ending. In that notice, you'll be able to see what your monthly bill will be without the government's help. If you find the new premium unaffordable, which may be the case for some, you'll be entitled to a special 60-day enrollment period on the Affordable Care Act's marketplace. To avoid a gap in coverage, experts recommend you report your upcoming loss of COBRA coverage as soon as possible." Read more here. Risk Rating 2.0: FEMA Releases More Guidance Ahead of Implementation Risk Rating 2.0 is FEMA's new pricing methodology for the National Flood Insurance Program (NFIP) scheduled to be implemented on October 1st. As the implementation nears, FEMA just released the Risk Rating 2.0 edition of the NFIP Flood Insurance Manual to give guidance for administering NFIP policies under the new pricing methodology. According to IA Magazine, "The Big "I" believes that Risk Rating 2.0, if properly implemented, has the potential to improve the NFIP experience for agents and consumers, but emphasizes that the rollout of the program will be critical in determining the success of the effort. As FEMA continues to provide more information regarding Risk Rating 2.0, the Big "I" will continue to provide members with updates." Read more here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, September 1, 2021

|

Happy Wednesday! It's hard to believe that we are already kicking off the month of September, but here we are! In this week's Big I Buzz, we are discussing how some millennials are changing careers, the new budget resolution passed last week and how bears are becoming a threat in fight against the Minnesota wildfire. These Millennials Are Dumping Their Jobs to Plot New Careers According to The Wall Street Journal, some young professionals are choosing to quit the job post-pandemic without a Plan B. "U.S. workers are quitting their jobs at some of the highest rates in years, a sign of great appetite for change and confidence in better prospects down the line. The share of people leaving jobs reached 2.7% in June, according to the Labor Department, just shy of April's 2.8% rate, the highest level since the government began tracking quit rates two decades ago. Now is a great time to train the right employee who's looking for a switch into the insurance industry. The IIAW has options for employee training through New Level Partners platform, My Agency Campus. My Agency Campus is a great hub for employee training ranging from insurance basics, specific job roles ore even specific business skills. My Agency Campus is an easy-to-access learning tool with training bundles tailored by job role and experience. You can browse the course offerings and help new hires achieve their professional development goals here: https://www.iiaw.com/page/EmployeeTraining. House Democrats Pass $3.5 Trillion Budget Resolution Last week, U.S. House of Representatives Democrats passed a $3.5 trillion budget resolution that unlocks the process known as "reconciliation". While previously passed in the Senate, it did not receive a single Republican vote in either chamber. According to Independent Agent Magazine, "Reconciliation allows the majority party in the Senate to use spending or revenue bills to expedite consideration of certain tax, budget and spending-related legislation. While limited in use, budget reconciliation measures in the Senate require a majority vote and not the normal 60-vote threshold to overcome a filibuster and pass legislations." The reconciliation outlined the spending priorities, it did not outline how it will pay for the spending. "Based on the contours of the budget resolution, the reconciliation package could include up to $1.7 trillion in tax increases... Importantly for agencies that file taxes as a C corporation, which is roughly one-third of Big "I" members, President Biden has suggested raising the corporate tax rate from 21% to 28%. For the two-thirds of Big "I" members organized as pass-through entities, President Biden's proposals earlier this year did not call for any changes to the 20% tax deduction for small businesses that was created in former President Donald Trump's Tax Cuts and Jobs Act. " Read more here. Bears Emerge as Threat in Fight Against Minnesota Wildfire As officials are working to stop the spread of the wildfires in northeaster Minnesota, bears are creating a new threat. Generous donations of food and supplies have out-stripped the need and storage ability. Because the storage space has been filled with donations, extras are needing to be stored out in the open, making them an attractant to bears. While blackbears common in northern Minnesota rarely attack people, food can cause conflicts with the bears. So far, the fire has destroyed 14 "primary structures" - mostly homes and cabins - and 57 outbuildings in a major run last week. it stood at 14% contained as of August 30th with a projected containment date of September 10th. Despite the damage, Superior National Forest officials are appreciative of the donations, however, they do not need any more. For those that would like to continue to donate, officials suggest donations to local food banks and fire departments instead. According to Insurance Journal, "The Forest Service also reported no growth thanks to the rain on two other, smaller wildfires of concern, the John Ek and Whelp fires, which are inside the Boundary Waters Canoe Area Wilderness. Crews have just begun efforts to fight those fires on the ground because they're deep in the wilderness in hard-to-reach places. Fears that the two fires could expand while firefighting resources have already been stretched thin by the Greenwood Lake fire and severe drought conditions led the Forest Service Aug. 21 to entirely close the Boundary Waters through at least Sept. 4." Learn more here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, August 25, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing how material and labor prices are affecting property insurance, the new FDA COVID vaccine approval and why small business insureds are showing drooping satisfaction. How Material, Labor Price Hikes Are Affecting Property Insurance The COVID-19 pandemic has created a sharp increase in the price of materials and labor. These increases have in turn increased property claim costs. According to the Vice President of pricing solutions for Verisk's Xactware, "The price of sheathing materials such as plywood and oriented strand board increased by more than 350 percent from July 2020 to July 2021 and other lumber materials increased by more than 100 percent... A labor shortage is driving up costs as well." Pyle said that guess future prices is a "foggy crystal ball". Previously when COVID-19 appeared to be under control in the US, prices started to level out, however, with the Delta variant's arrival, rates started surging again. Read more here. FDA's COVID Vaccine Approval Makes Challenges to Mandates Tougher to Win This week the FDA approved the Pfizer vaccine. According to Insurance Journal, this change will make it nearly impossible to successfully challenge mandates by employers, legal experts said. According to Reuters, "Legal experts said there already was a growing consensus that employers could mandate an emergency vaccine. During the pandemic, both the Equal Employment Opportunity Commission and the Department of Justice issued guidance in support of vaccine mandates, provided exceptions were made for medical conditions and religious beliefs. But emergency vaccine requirements have not gone unchallenged. At least a dozen lawsuits have been filed, mostly by students against colleges, but also by employees fighting allegations of wrongful termination for refusing a shot." This new approval will make it more difficult for those who would like to challenge mandates, nearly impossible. Read more here. The 5 Reasons for Small-Business Insureds' Drooping Satisfaction A new survey from J.D. Power has found that customer satisfaction surrounding small-business insurance clients declined seven points this year and 15 points during the past two years. They outlined the top 5 reasons for this: 5. Interactions leave more to be desired - the satisfaction with insurance interactions fell off by 20 points compared to the year prior. Not only was this decline due to courtesy during calls but also in the timeliness of resolution. 4. Customers exerting too much effort - throughout the last year, small business insureds exerted three times more effort trying to interact with insurance agents. 3. Outreach comes too late - According to NU Property Casualty 360, "During 2020, less than 20% of clients reported their carrier proactively reached out to discuss their needs related to COVID-19. This significantly increased in 2021, with 45% reported having proactive contact with their insurer. However, the negative impact it had on customer satisfaction suggests the outreach might have come too late." 2. Mixed messaging - more problems and billing issues were reported in 2021 compared to 2020, among insureds who reported receiving proactive outreach. 1. Turning to multiple channels for answers - clients who experienced billing or other issues were twice as likely to use four or more communication channels. According to the study, "While they leveraged multiple communication tools, including call centers, the customer satisfaction level didn't vary much between channels with clients that experienced problems. This suggests the industry could do more to recreate a more seamless cross-channel experience. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Evan Leitch,

Tuesday, August 3, 2021

|

Happy Wednesday! This week's Big I Buzz features IIAW's Annual Business Meeting on August 26, 2021, insurtechs with multibillion dollar valuations and how the potential government spending of $1.2T on infrastructure would impact the insurance industry.

IIAW's Annual Business Meeting - August 26, 2021

Join us for an overview of the Association's past fiscal year as presented by members of the IIAW Executive Committee at 10 a.m. on Thursday, August 26th 2021. This meeting is reserved for IIAW members only. Go here to register to attend.

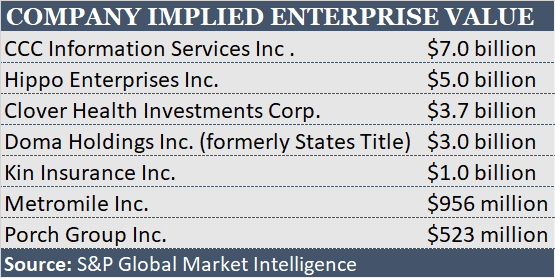

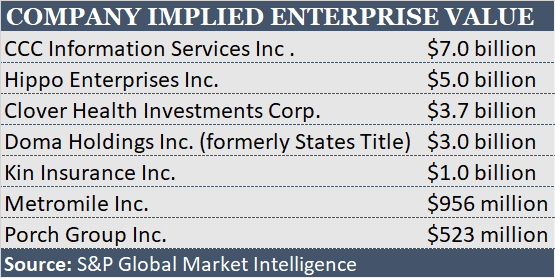

7 Insurtechs with Multibillion-Dollar Valuations

A number of insurtech startups are coming to market through blank-check companies. Here are valuations of several that have announced special purpose acquisition company (SPAC) plans.

Read more here.

Construction Constrained: Market Dynamics Under U.S. Infrastructure Plan Insurance for the construction sector is already in a tough position. Supply is shrinking, but demand is rising as the economy advances in the late-COVID environment. Insurance capacity for residential homebuilders risk and excess liability are constrained following some large surety losses, and prices are rising in line with almost all other classes of business insurance. If the current bipartisan White House proposal to spend $1.2 trillion on U.S. infrastructure goes ahead — or even a bill for substantially less — the dynamics of the market will have to change dramatically if we’re to get all these projects covered. Carriers that have historically been dominant are still present, but they’ve scaled down the availability of their capacity, the Terms & Conditions they apply, or both. Various Lloyd’s syndicates have also participated in many major U.S. construction risks, but the market’s new “performance management” regime means it’s reasonable to presume appetite will be shrinking there too. With no sign yet of these changes being reversed, finding adequate cover for a trillion dollars worth of projects will not be easy. That said, the market environment may be at least somewhat different when the projects actually come on line, which for most will take a few years at least. By then, some of the traditional players may be willing to release more capacity to construction, and new players may have joined their ranks. Read the full article here. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click

here

to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Sunday, July 25, 2021

|

Happy Wednesday! In this week's Big I Buzz, we are discussing the upcoming convention, workers' comp rate decrease in Wisconsin and the results from the Q2 IVANS Index. InsurCon2021 Countdown is On InsurCon is quickly approaching with only a short week and a half left until this must-see event. Join us on August 10-11 at the Kalahari Resorts in Wisconsin Dells. Our speakers include industry experts, marketing gurus and technology geniuses with our keynote speaker, Joe Theismann. This premier event will highlight ways for agents to build their business, increase their marketing effectiveness and improve their business skills. Register now at iiaw.com/insurcon. 5.44% Workers' Comp Rate Decrease Approved in Wisconsin Effective October 1, 2021, there will be a 5.44 percent decrease in workers' compensation insurance rates. According to Wisconsin Insurance Commissioner Mark Afable, the decrease could result in a savings of more than $90 million for Wisconsin businesses. This is now the sixth straight year of rate decreases in Wisconsin. According to Insurance Journal, "the five major industry groups for workers' compensation insurance in Wisconsin will benefit from a rate decrease. • Contracting will have a 5.35% decrease; • Office and clerical will have a 4.21% decrease; • Goods and services will have a 6.39% decrease; • Manufacturing will have a 5.53% decrease; and • The miscellaneous industry group will have a 4.12 percent decrease. " Read more here. Q2 IVANS Index Shows Ongoing Insurance Market Hardening According to the Q2 2021 IVANS Index, P&C insurance-industry renewal rates are experiencing a sustained upward trend. According to Property Casualty 360, "Second-quarter 2021 premium renewal results revealed rate changes for all major commercial lines of business increased except for the workers' compensation market, where premium renewal rates have remained negative so far in 2021. The IVANS Index provides a leading indicator of the strength of the insurance channel. Click here to read a few additional highlights from the reporting. For more news, check out the Action news section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. We hope that everyone has a great rest of their week!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|