|

|

Posted By IIAW Staff,

Tuesday, July 19, 2022

|

Happy Wednesday! In this week's Big I Buzz we are highlighting tips you can share with your clients for BBQ Safety Month and information on today's virtual event that you won't want to miss. Barbecue Safety Tips for National Grilling Month July is National Grilling Month and it's the perfect time to remind your clients about grilling safety tips to keep them and their belongings safe. According to the U.S. Fire Administration, "There are around 5,700 grill fires on residential property each year, causing around $37 million in damages, 100 injuries and 10 fatalities." NU Property Casualty 360 has listed these 8 safety tips: 1. Always operate your barbecue on a level surface. 2. Keep a fire extinguisher nearby when grilling. 3. Don't move the grill once it is lit. 4. Keep children and pets away from the grill. 5. Protect whoever is grilling with a heavy apron and oven mitts that extend over the forearm. 6. Only use lighter fluid specifically designed for grilling. 7. Never grill indoors or in enclosed areas. 8. Wait until the grill has cooled before storing/covering it. You should also soak charcoal briquettes with water to ensure they are inactive before disposing of them. 2022 Sales & Leadership Summit Preview Webinar Today at 1 p.m. MarshBerry's Don Folino will give a preview of what you can expect when you attend the 2022 Sales & Leadership Summit in Neenah, WI on August 23-24. Don will highlight how the summit focuses on the skills and knowledge needed to maximize your potential and start generating more revenue. In addition, Don will highlight MarshBerry's proprietary tool that's designed to enable your leadership team to increase sales, provide perspective on what's working and help drive predictable, profitable organic growth in your organization. Don't miss this preview webinar and learn more about the 2022 Sales & Leadership Summit. Click here to register. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Additionally, we send out monthly newsletters with content curated just for you and your role. Make sure you're on the list to receive our communications by heading to bit.ly/industrynewsforyou to stay in the loop!

Tags:

big i buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, July 13, 2022

|

Happy Wednesday! In this week's Big I Buzz, we have news about WCRB's rate changes and a new way to get involved in the IIAW. On July 12, 2022, WCRB (Wisconsin Compensation Rating Bureau announced an -8.47% rate change (8.47% decrease). This rate change will take effect October 1, 2022. Read the full Circular Letter announcing this change here. Get Involved: Volunteer to Serve We're looking for volunteers to serve on the IIAW's councils and task forces. your participation is invaluable, and your input and feedback will help drive thee work we do in the coming year and beyond. Councils & Task Forces for 2022-2023 Personal Lines Task Force - for individuals who are interested or who have a role in Personal Lines insurance Commercial Lines Task Force - for individuals who are interested in or who have a role in Commercial Lines insurance Employee Benefits Task Force - for individuals who are interested in or who have a role in Employee Benefits Industry Relations & Operations Council - for insurance professionals who have an operational or leadership role within an agency or insurance company Government Affairs Council - for individuals interested in staying informed and providing feedback to the IIAW's Board on Wisconsin & national legislative and political happenings Emerging Leaders - for insurance professionals looking to cultivate their skills for a successful career by engaging in association activities, professional develop, education and events Each council and task force will act as a sounding board for the IIAW and will only have three virtual meetings per year. Participating in the IIAW task forces and councils gives you access to industry experts, exclusive networking events and FREE CE opportunities during most virtual meetings when content allows. Make sure you fill out this survey to receive communications about an IIAW Councils & Task Forces kick off event on September 21st and other task force/council communications. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Additionally, we send out monthly newsletters with content curated just for you and your role. Make sure you're on the list to receive our communications by heading to bit.ly/industrynewsforyou to stay in the loop!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Tuesday, July 5, 2022

|

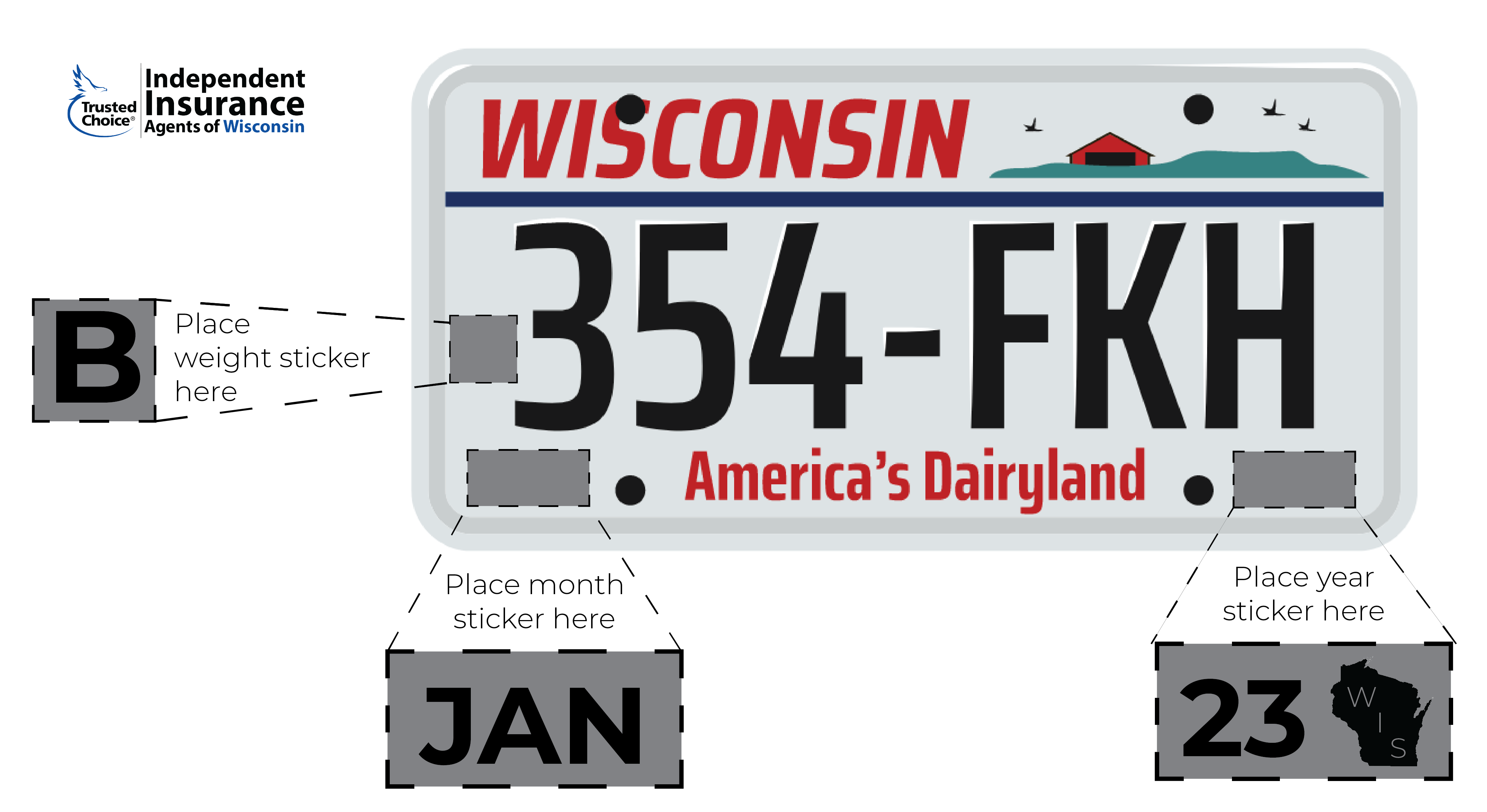

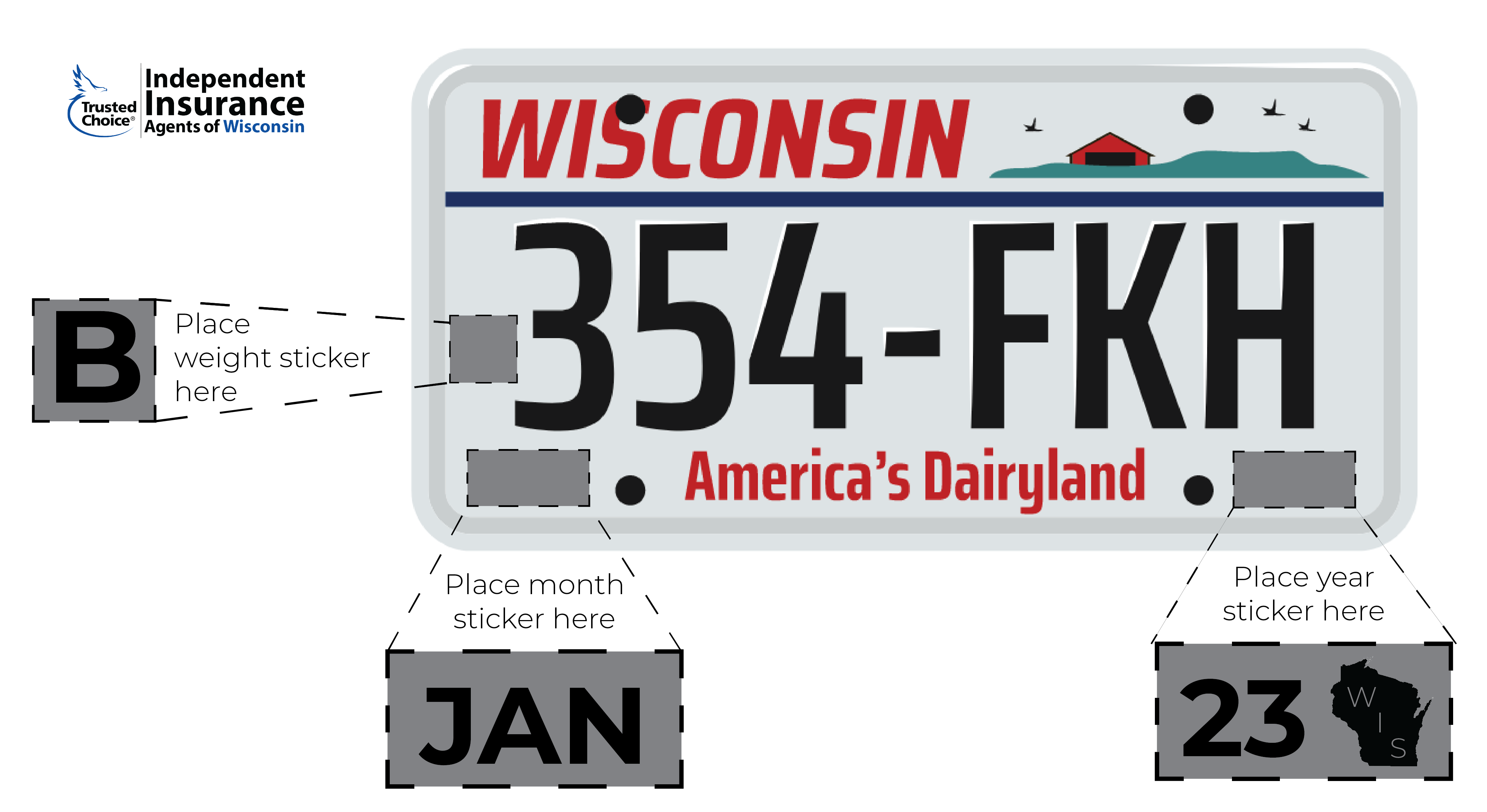

Happy Wednesday! We hope that everyone enjoyed their Fourth of July weekend and using information last week's Big I Buzz, you were able to avoid some of the holiday travel! This week we are sharing information about Wisconsin State Law license plate regulations, what's driving the cyber insurance market and how the federal interest rate hike can affect the insurance industry. License Plate Reminder Now is a great time to remind your clients about Wisconsin State Law license plate regulations to help them avoid unnecessary tickets. Feel free to share the below image and copy on your social media pages.

Did you know that per Wisconsin State Law if you are issued two license plates you must attach both to your vehicle? Your license plate must be kept in a legible condition, which means no plate covers. This also means that your registration plate lamps, wiring and connections must be maintained in a proper working condition. Finally, if you are given two license plates you must attach the validation sticker to the rear plate as shown below. Connect with your local Trusted Choice independent insurance agent to make sure you've got the coverage you need when it comes to your vehicle! Evolving Risk is Driving Cyber Insurance According to the 2021 NetDiligence Cyber Claims Study, the top five causes of loss for samll and medium-sized enterprises over the last five years based on number of claims was: ransomware, hackers, business email compromise, staff mistakes and phishing. The increase in ransomware attacks since 2016 has encouraged underwriters to focus on cybersecurity and putting controls in place to help mitigate the impact of cyber events. While there's no way to eliminate cyber risk, insurers are applying minimum requirements on risk controls to obtain cyber coverage like multifactor authentication, endpoint protection and firewalls. Read more about upcoming regulatory enforcement and prevention and resilience here. What Fed's Interest Rate Hike Means for Insurance The Federal Reserve again hiked interest rates Mid-June by 0.75%. Insurance Business reports, that Mark Bernacki, Amwins Chief Underwriting Officer believes, "Insurance agents should be talking to their clients to make sure they have "sufficient insurance" against a backdrop of soaring loss costs as the Fed seeks to dampen the effects of inflation. They should also be educating them on what the interest rate change means for the insurance market." So, what does this mean for the insurance market? Bernacki stated to Insurance Business Mag, "Obviously, there's the expectation that this could have some short-term pain, both for the economy as well as the insurance industry, but long term this should ultimately be good for both the economy and the insurance industry and also strengthen the labor markets that we're seeing." Read more from the report here. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list. Additionally, we send out monthly newsletters with content curated just for you and your role. Make sure you're on the list to receive our communications by heading to bit.ly/industrynewsforyou to stay in the loop!

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, June 29, 2022

|

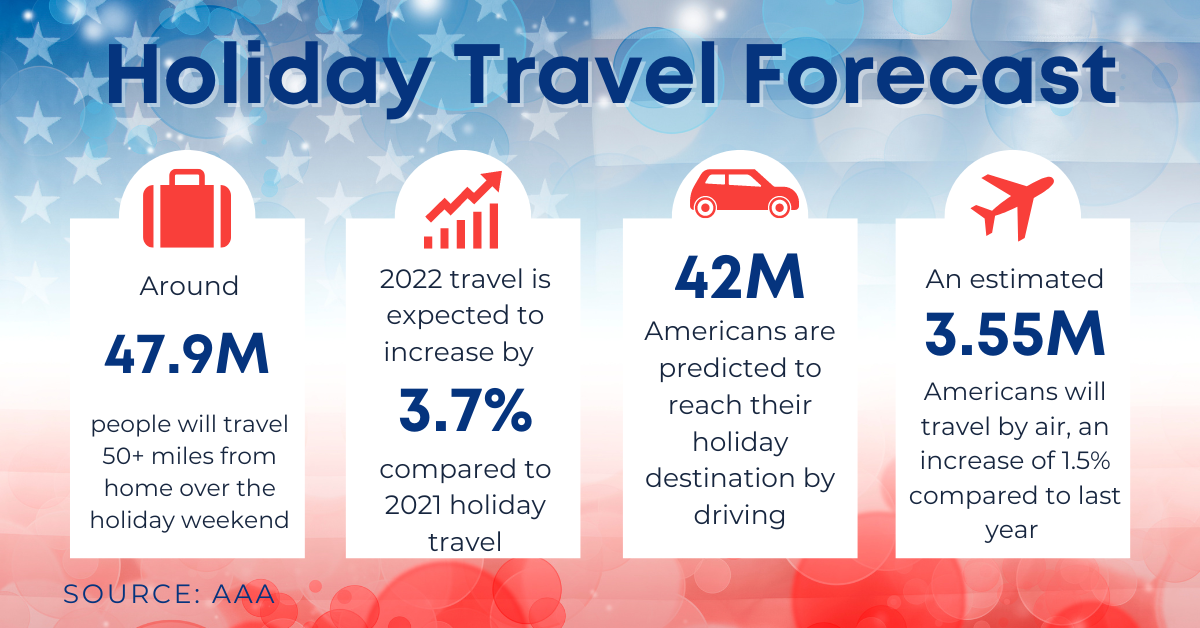

Happy Wednesday! In this week's Big I Buzz we are discussing the travel forecast for the holiday weekend, which dog breeds Animals 24-7 names as the 'most dangerous' and the Sales & Leadership Summit.

4th of July Travel Forecast: Best Days to Hit the Skies and the Road

Planning to travel for the 4th of July weekend? You're definitely not alone. AAA's Travel Forecast has reported that the Fourth of July holiday weekend is expected to be the second-busiest for travel since 2000, with 47.9 million Americans taking trips.

If you'll be hopping in your car to start your holiday on Thursday or Friday afternoons, plan for traffic as AAA has reported those will be the most crowded days on the road as commuters leave work early and mix with holiday travelers. Should you

decide to hit the roads anyways and you have some leeway for start times, Friday before 10 a.m. or after 9 p.m. will be the best and on Thursday, plan to leave before 7 a.m. or after 8 p.m. For lighter traffic, analytics company INRIX has listed July

3 and July 4th.

Use the above graphic on your social media pages to warn your clients of heavy holiday travel.

The 9 Most Dangerous Dog Breeds

According to Property Casualty 360, the American Veterinary Medical Association estimates that insurers paid out around $881 million in liability claims related to dog bites in 2021. A study from Animals 24-7 has looked at the dog breeds responsible for

the most recorded dog bite-related fatalities in the US between 2014 and 2020. Here are their top 9 breeds:

9. Doberman Pinscher - 23 attacks (2014-2020) and 8 fatalities (2014-2020)

8. Chow Chow - 61 attacks and 8 fatalities

7. Akita - 70 attacks and 8 fatalities

6. Rottweiler - 535 attacks and 8 fatalities

5. German Shepherd - 113 attacks and 15 fatalities

4. Presa Canario - 111 attacks and 18 fatalities

3. Hybrid Wolfdog - 85 attacks and 19 fatalities

2. Siberian Husky - 83 attacks and 26 fatalities

1. Pit Bull - 3,397 attacks and 295 fatalities.

"While breed isn't a fail-proof indicator of which dogs will bite - and the majority of dog bites reported are from those of mixed-breed or whose breed could not be determined - some insurers still take this into consideration because a dog's breed can

influence temperament, whether the dog is easily startled and how strong its protective instincts may be. However, no matter a dog's breed, it is common for insurers to introduce exclusions or deny coverage completely for a canine that has a history

of biting or aggression," Property Casualty 360 reports.

2022 Sales & Leadership Summit

Have you registered yet for the 2022 Sales & Leadership Summit? Now's the time!

Your registration will include access to the 1.5-day summit on August 23 & 24th PLUS it will also include your ticket for a fun evening of Timber Rattlers Baseball The IIAW will provide transportation to the Timber Rattlers Baseball game from Bridgewood

Resort. Head to https://bit.ly/SalesLeadershipSummit today to save your spot now.

For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here

to add your email to our emailing list.

Tags:

Big I Buzz

marketing

personal insurance

social media

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, June 22, 2022

|

Happy Wednesday! In this week's Big I Buzz, we are discussing the educational opportunities available for IIAW members, home renovation risks and the number of Americans facing health care debt.

IIAW Educational Opportunities The IIAW is an honored recipient of the Big "I" National 2022 Excellence in Insurance Education (EIE) Diamond Award. This award recognizes state associations and staff who have made significant contributions to insurance educations for their members and the industry. The IIAW offers various traditional and cutting-edge professional development programs! IIAW members have access to our educational opportunities. First, we offer in-person and online prelicensing options for Wisconsin insurance professionals. The in-person and online insurance licensing course is led by Gabrielle O'Brien, who has taught more than 20,000 prelicensing students! The IIAW prelicensing course is designed to help you pass your state licensing exam by the quickest method of meeting the WI educations hours requirement. Next, we offer online continuing education courses. The WI OCI requires insurance agents in Wisconsin complete 24 hours of continuing education credits with three of those being in ethics every two years. The IIAW provides unique and attention-grabbing courses through our partnership with ABEN. ABEN offers high-quality CE and professional development online webcasts. Now through the end of the month, you can receive 20% off online CE through ABEN with code SUMMERCE. Last, but certainly not least, we offer employee training through MyAgencyCampus. MyAgencyCampus offers employee training ranging from insurance basics, specific job roles or even specific business skills. A few bundles we'd like to mention are the Commercial Lines Coverage Basics which includes 25 courses in one bundle, their Introduction to Employee Benefits Insurance Basics and the Personal Lines Coverage Basics. MyAgencyCampus has these bundles and so much more (four pages worth of courses) that you can take to enhance onboarding new employees. To learn more about the educational opportunities we offer IIAW members, visit iiaw.com/education. Insureds Need Help Avoiding Home-Renovation Risks According to NU Property Casualty 360, "Over a third of homeowners in the U.S. and Canada embarked on renovations during the last year." With the number of homeowners starting home renovations, it's a great time to help them avoid the risks of renovation. [Home renovation projects] "are a chance for home insurance agents to step up for their clients, who may not realize the high chance that their property may sustain water damage during a renovation, or that certain updates, such as finishing a basement or installing a swimming pool, will require additional coverage. One great way to put yourself front-of-mind for your clients is by utilizing your social media sites. IIAW members have access to Trusted Choice's Content to Share. Trusted Choice puts together graphics and captions that you can use on your social media page, and they have great reminders for your social media followers to reach out to you when considering home renovation. 100 Million People in U.S. Saddled With Health Care Debt Benefits Pro has reported that, "6 in 10 working-age adults with coverage have gone into debt getting care in the past five years, a rate only slightly lower than the uninsured." A nationwide poll from KFF found that about 1 in 7 people said that they've been denied access to a hospital, doctor or other provider because of unpaid bills. "Patient debt is piling up despite the landmark 2010 Affordable Care Act. The law expanded insurance coverage to tens of millions of Americans. Yet, it also ushered in years of robust profits for the medical industry, which has steadily raised prices over the past decade," according to Benefits Pro. This article from Benefits Pro goes in depth about the the KFF Health Care Debt Survey and additional research conducted by the Urban Institute. Read more from this article here. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, June 15, 2022

|

Happy Thursday! Today we are talking about the most popular passwords in the world. PLUS if you didn't see it yesterday, we have an exciting announcement about InsurCon2023!

The Most Common Passwords Around the Globe

We've talked about creating secure passwords, but this article is the perfect reminder to review your passwords. ExpressVPN has gone through the most frequently used passwords across the world:

China: wangyut2

Brazil: rental

France: doudou

Indonesia: sayang

India: Indya123

Greece: 212121

Germany: passwort

To see more frequently used passwords, check out this Property Casualty 360 article here.

Webroot and ExpressVPN give these tips for crafting a secure password, "

• Long passwords (12 characters or more) are more secure than short ones. One way to accomplish this is to choose a phrase, rather than a single word.

• Avoid using any personal information in your passwords (first, middle or last name, date of birth, children's names, etc.). This could make your password easy to guess for those who know you, or who can find this often readily available information

online.

• You should use a different password for each of your online accounts. This way, if your password for one account is compromised, your other accounts are still secure. Encrypted password managers can be used to easily keep track of passwords across platforms.

• Utilize a combination of letters (both upper and lower case,) numbers and symbols to create each password. Avoid making obvious number-to-letter substitutions in words, like using "1" in place of "i" or "3" in place of "E."

Read more here.

Save the Date for InsurCon2023 from IIAW on Vimeo.

Once we wrap up one convention, the planning for the next begins! 2023 will be a new & unique convention experience. Save the date for InsurCon2023 on May 16-17, 2023 at the EAA in Oshkosh, WI. More details coming soon.

For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click

here to add your email to our emailing list.

Tags:

big i buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, June 8, 2022

|

Good morning & happy Wednesday! In this week's Big I Buzz, we are discussing the free for members report you must see, why you need to register for an upcoming webinar and a look at OSHA's top 10 safety violations. Are you taking advantage of the Trusted Choice content library? As we move into a new season, don't forget to access the new content to share from Trusted Choice. They have a variety of graphics for you to share with your customers (or potential customers) on your social media pages with everything from summer safety tips, holiday graphics and good reminders for your clients to see. If you didn't know that Trusted Choice had a content library for you to use on your social media pages, this is a great time to register for the Intro to Trusted Choice Webinar at 1 p.m. on June 14th. Trusted Choice has much more than just social media posts. They also have a marketing reimbursement plan, they offer free digital reviews and so much more. Make sure you're accessing all of your IIAW benefits and take full advantage of all that Trusted Choice has to offer. NEW! The 2021 WI P-C Marketplace Report is Here IIAW members can access our annual 2021 WI P-C Marketplace Report for FREE (a $399 value). The presentation of data focuses on the 26 lines of business independent agents work with the most. For these agent-focused lines of business, data is provided on loss ratios, growth rates, penetration rates by the various distribution styles and commission rates. In addition, and important to independent agents, a breakout of surplus lines activity is provided to show trends and utilization rates. US national data is provided for comparison purposes. Check out the report here. If you are an IIAW member and you need assistance logging into your IIAW account, please email info@iiaw.com. Non-members can access the report for $399, or you can join the IIAW today. A Look at OSHA's Top 10 Safety Violations Each fiscal year OSHA lists the top 10 workplace safety standards violations that employers should pay attention to. Share this list with your workers' compensation policyholders to better their workplace safety. According to OSHA as published in the National Safety's Council's Safety + Health Magazine here are the top 10 most common violations: 1. Fall protection - this issue is back at the top of the list for the 11th year in a row. According to Insurance Journal, "Some 5,271 violations were issued to framing contractors, roofing contractors, masonry firms and housing construction contractors. The main cause for citations was a lack of protection near unprotected edges or sides and on steep roofs or lesser-sloped surfaces." 2. Respiratory protection. Insurance Journal reports that, "The chief culprits were auto body refinishing companies, painting contractors, wall covering contractors and masonry contractors. They were cited for absence of a protection program, failure to perform required fit testing and/or lack of medical evaluations." 3. Ladders. "Violations included structurally deficient ladders, a lack of siderails extending three feet beyond a landing surface and the use of ladders for purposes which they're not designed. Another issue: allowing workers to use the top step of a ladder. 4. Scaffolds. "The causes included proper or inadequate decking, failure to provide adequate scaffold support on a solid foundation and lack of safety guardrails," as reported by Insurance Journal. 5. Hazard communication. According to Insurance Journal, "The main causes were lack of a written hazard communication program as well as inadequate training and/or failure to develop and maintain data safety sheets." 6. Lockout/tagout. This is a category of safety related to the control of hazardous energy. Violations for this category included failure to conduct procedure evals, a lack of established energy control procedures and not providing adequate training. 7. Fall protection training requirements. This is a separate category from #1, as the failure to give required fall protection training and failure to certify fall protection safety were the main causes of 1,660 violations, according to Insurance Journal. 8. Eye and face protection, in the category of personal protective and lifesaving equipment. 9. Powered industrial trucks, including forklifts and motorized hand trucks. "Main causes were failure to operate safely, lack of refresher training and evaluation, absence of certification of training and evaluation and failure to examine equipment for adverse conditions." 10. Machine guarding standards, which covers guarding of machinery to protect operators and other workers from hazards. "Main causes were violations of the types of required guards, lack of guarding at point of operation, not properly anchoring machinery, a lack of secure attachment of guards to machinery and improper guarding of fan blades." Read more here. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

big i buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, June 1, 2022

|

We're back with another Big I Buzz, kicking off the month of June. As we start a new month, we want to remind everyone about our monthly newsletters. Our monthly newsletters target four interest areas: personal lines, commercial lines, employee benefits and industry relations & operations. If you're not already receiving one of these targeted newsletters, make sure you sign up! You don't want to miss the industry news important to you and your role, PLUS in addition to news, we're also sharing targeted member benefits that you might not know you can take advantage of and education opportunities that fit your role. Visit bit.ly/industrynewsforyou to make sure you're on the list for one (or more) of our targeted newsletters. Intro To Trusted Choice Webinar Speaking of member benefits that you might not know you can take advantage of, don't forget about Trusted Choice! Trusted Choice offers FREE programs and resources, including marketing reimbursement opportunities! Want to learn more about all that Trusted Choice has to offer? Tune into the "Intro to Trusted Choice Webinar" happening at 1 p.m. CST on Tuesday, June 14th. Register now here. Properly Insuring Against Copyright and Intellectual Property Risk Does your company have a website, post on social media or run a blog? If so, you could be exposing yourself to intellectual property risks. According to NU Property Casualty 360, here are five common activities that can expose companies to intellectual property risks: 1. Publication of photos and video clips on websites and social media. When you share photos or video clips, whether that be on social media or in other content you create, you could be subject to liability for copyright infringement if you don't have permission to do so from the copyright owner. It doesn't matter what size your following is on social media, or if you don't think that they'll ever see your website. There is an industry of plaintiff attorneys who represent photographers and their licensing agents that are using software to search for specific photos. If you use images without permission and without the copyright identifying information, these lawyers could contact you and demand a settlement amount for much higher than their usual regular license fee. 2. Use of third-party music in social media posts Have you tried to post a video to Facebook in the last few years with sound and it gets taken down because you "don't have the rights to the music"? This can be frustrating, but they're actually doing you a favor by taking the video down. According to NU Property Casualty 360, "When a company posts a video on its website or social media posts, such as TikTok or Instagram Reels, that is synced to music owned by a third party, copyright exposures arises for the use of that music if it was not properly licensed. The risk also applies if music plays incidentally in the background. For instance, a local bar and restaurant posts a video interviewing employees and patrons while a song happens to be playing on the sound system in the background. Even though the bar may have a "blanket license" with ASCAP or BMI that permits the bar's public performance of the song, that license does not include the synchronization rights needed to sync the song to video." An option around this is to setup your TikTok and Instagram accounts as "Business" accounts. This will give you access to a library of music that has been authorized for commercial use (only on those platforms). These platforms can eventually remove the sound from their "business" library if they decide to change their usage to personal use only, but when that happens, the sound will be removed from your video. If you're not using business accounts for your social media sites, and when you're creating video content for your website and elsewhere, make sure you purchase the commercial use license when selecting music for videos. There are a few websites where you can access free commercial use music, we have those listed in the IIAW's Digital Marketing Playbook. IIAW members access the playbook here. 3. Promotional materials and advertising could violate trademark and trade dress rights. "When a company disseminates content that promotes its products or services, if it uses a word, phrase, slogan or label that is confusingly similar to the intellectual property owned by someone else, the company could be exposed to trademark or trade dress infringement claim." A good rule of thumb when deciding whether you should use a word, phrase, slogan, or label is: if the wording reminds you of something else (another company or product), you shouldn't use it. 4. Misappropriation of name or likeness. Similar to using wording similar to intellectual property owned by someone else, "promotional materials and advertising can also subject a company to claims for misappropriation of name or likeness, otherwise known as a violation of the right of publicity. While some company employees might think it is useful, fun or effective to reference and/or post photos of celebrities, politicians or sports figures in their promotional materials or advertising, this creative use could give rise to significant liability exposure." 5. Misappropriation of ideas, plagiarism and trade secrets. NU Property Casualty 360 reports, "The work of any company is the sum of the input and creative effort of its employees, independent contractors and other associated staff or vendors. While any creative contribution by an employee is usually owned by the company as "work made for hire" under the Copyright Act, other types of relationships between the company and its workers, and other associated individuals or entities, are subject to varying contractual terms. Sometimes disputes erupt over the ownership of the intellectual property rights that accompany such creative contributions.... A worker who authored written material and pitched a concept to a company could bring a claim of idea misappropriation if the worker believes the company took the written material or developed the concept without appropriately compensating the worker." Read more about these exposures and how to mitigate the risks here. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By IIAW Staff,

Wednesday, May 25, 2022

|

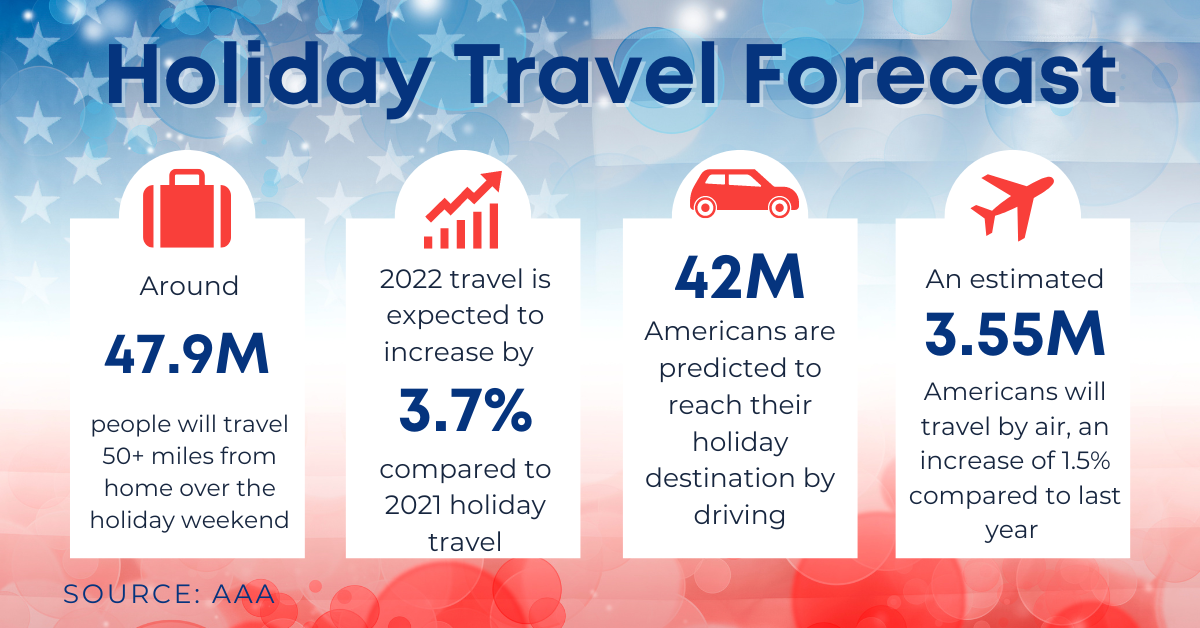

Happy Wednesday! In this week's Big I Buzz, we are discussing our August Sales & Leadership Conference, the Memorial Day weekend travel forecast and states hit hardest by inflation. AAA 2022 Memorial Day Travel Forecast Shows Pre-Pandemic Travel Levels AAA has released their 2022 Memorial Day Holiday Travel Forecast, and it seems as though travel through this holiday is full-steam ahead! Travel for the holiday weekend is nearing pre-pandemic levels. Highlights from the forecast: • Memorial Day travel to increase 8.3% over 2021 to 39.2 million. Rising prices are not deterring travel's resurgence this Memorial Day weekend, with travel volumes expected to reach 92% of pre-pandemic levels in 2019. • Car travel to increase 4.6% over 201 to 34.9 million. Despite historic highs in gas prices that began in early March, car travel remains a popular choice and will approach 93% of 2019's volume. • More than 3 million people will fly this holiday weekend. Air travel continues to rebound, up 25% over 2021 and will make up 7.7% of all holiday weekend travelers, the highest share for air travel since 2011. • Travel by other modes will triple from last year's level, with 1.3 million people using transportation like buses, trains and cruise ships. The IIAW has shared a graphic outlining the forecast highlights on our Facebook page and in our Big I Buzz email. Feel free to share this with your clients to encourage safe & alert travel this holiday weekend.

2022 Sales & Leadership Summit - An IIAW & MarshBerry Partnership Join the IIAW on August 23 & 24 in Neenah, WI for our 2022 Sales & Leadership Summit, a partnership with MarshBerry. MarshBerry is a nationally recognized advisory firm and top growth consultant for insurance agents, brokers & carriers. MarshBerry instructors will deliver an action-packed 1.5-day summit filled with fantastic topics you won't want to miss. Whether you are looking to train a new sales producer or develop a sales management team, this summit will provide solutions to build and maintain sustainable sales practices and strategies. Stay tuned for our June magazine, where we'll be giving an in-depth look at the different topics that will be covered throughout the summit. Registration is $249 per person and includes your ticket and dinner for the Timber Rattlers game. We have limited space available for the event and we encourage everyone to sign up early to secure your spot. Learn more about the event here. QuoteWizard: States Hardest Hit By Inflation A recent study by QuoteWizard, an insurance shopping website, compared the impact of inflation in 2021 versus 2022. Their study found that these are the top 10 states affected (spoiler alert: Wisconsin is among the top 10 states impacted!). 10. Idaho - 5% of people had a "very difficult time" in June 2021 vs. 12% in May 2022. 9. Montana - 5% of people had a "very difficult time" in June 2021 vs. 12% in May 2022. 8. Maine - 6% of people had a "very difficult time" in June 2021 vs. 15% in May 2022. 7. Washington (tie) - 4% of people had a "very difficult time" in June 2021 vs. 10% in May 2022. 7. Louisiana (tie) - 10% of people had a "very difficult time" in June 2021 vs. 25% in May 2022. 6. Wisconsin - 5% of people had a "very difficult time" in June 2021 vs. 13% in May 2022. 5. New Hampshire - 5% of people had a "very difficult time" in June 2021 vs. 13% in May 2022. 4. Indiana - 5% of people had a "very difficult time" in June 2021 vs. 13% in May 2022. 3. Missouri - 6% of people had a "very difficult time" in June 2021 vs. 16% in May 2022. 2. Florida - 8% of people had a "very difficult time" in June 2021 vs. 22% in May 2022. 1. Arkansas - 5% of people had a "very difficult time" in June 2021 vs. 15% in May 2022. For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

big i buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|

|

Posted By Evan Leitch,

Thursday, May 19, 2022

Updated: Thursday, May 19, 2022

|

Happy Thursday! In this week's Big I Buzz, we have news about WCRB's rate changes, fraud in disaster claims and a look at how auto insurance rates have changed over the past decade. We also want to thank all of you that attended InsurCon2022 last week! Look for an InsurCon recap coming soon! Today, WCRB (Wisconsin Compensation Rating Bureau) announced an -8.47% rate change (8.47% decrease). This rate change will become effective October 1, 2022.The Circular Letter announcing this change can be found here.

Fraud in Disaster Claims Cost Insurers as much as $9.2B in 2021

In 2021, property & casualty insurers paid an additional $4.6 billion-$9.2 billion in disaster claims as a result of fraud, according to the National Insurance Crime Bureau (NICB).

The NICB estimates fraud adds 5%-10% to the overall amount in claims paid after a disaster. The FBI found similar results when looking at reconstruction costs following Hurricane Katrina: Of the $80 billion in government funding to aid rebuilding efforts, insurance fraud accounted for $6 billion, or about 7.5%. Fraud is also contributing to increasing insurance costs across the U.S., according to NICB, which noted contractor fraud is one element contributing to the property insurance crisis in Florida.

How Auto Insurance Rates have Changed Over the Past Decade

1970s

– Average monthly insurance premium: $56

– Premium increase from start of decade: $34 (up 80%)

1980s

– Average monthly insurance premium: $119

– Premium increase from start of decade: $85 (103%)

1990s

– Average monthly insurance premium: $225

– Premium increase from start of decade: $76 (43%)

2000s

– Average monthly insurance premium: $315

– Premium increase from start of decade: $100 (39%)

2010s

– Average monthly insurance premium: $464

– Premium increase from start of decade: $196 (52%)

2020s

– Average monthly insurance premium: $564

– Premium increase from start of decade: $38 (7%)

For more news, check out the Action News section of our weekly e-newsletter, Big I Buzz. If you aren’t subscribed, click here to add your email to our emailing list.

Tags:

Big I Buzz

insuring Wisconsin

wisconsin independent insurance association

wisconsin insurance agency help

wisconsin insurance blog

Permalink

| Comments (0)

|

|