Happy Wednesday! In this week's Big I Buzz we have news about an actuary's guide on where things stand with auto insurance in 2022 and a reminder to get involved with the IIAW!

As the U.S. personal automobile insurance market combined ratio ends 2021 over 100% for the first time since 2017, many companies reported significantly worse combined ratios in the fourth quarter of 2021 and Q1 2022 compared to prior periods (e.g., Kemper’s Specialty Property & Casualty Insurance reported a 119% combined ratio in Q4 2021 and 109% in Q1 2022).

Additionally, the prior period reserves of many companies are displaying adverse trends, and their current periods are experiencing tumultuous spikes in severity. Therefore, U.S. personal auto insurance companies will face significant challenges for the rest of 2022 and 2023.

Allstate cites the main contributors to increased auto claim severity to be increased used car prices, higher parts and labor costs, medical inflation, and greater attorney representation. Kemper and Progressive also mention an increase in auto claim severity as a driving force in their fourth-quarter results. These factors appear to be affecting trends throughout the entire industry with no end in sight.

Inflation and War Create Upward Cost Pressure

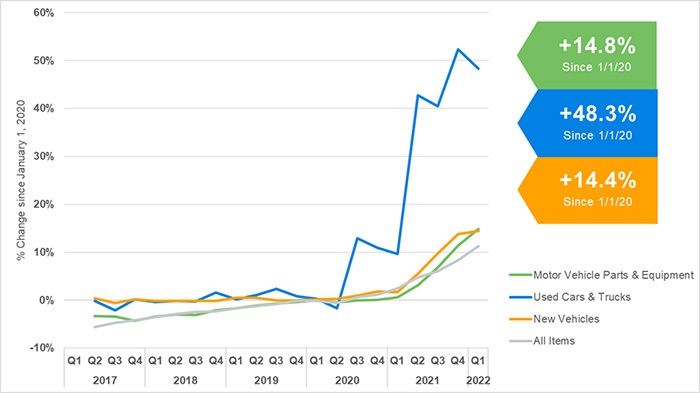

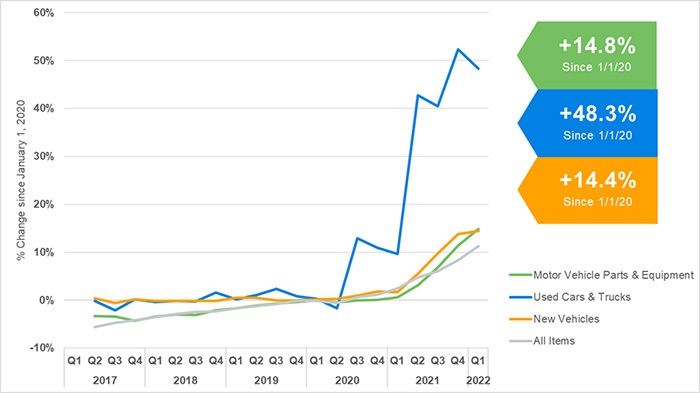

We are all feeling the effects of inflation at the pump and in the grocery store, so it seems only natural that insurers are feeling its effects through an increase in claim severity. A look at the table in Figure 1 shows that the consumer price index (CPI) for all items has increased 11.2% since the beginning of 2020. By comparison, the price of motor vehicle parts and equipment has increased by nearly 15% during the same time period.

You can read the entire article here!

Get Involved with IIAW's Task Forces & Councils

Educate • Network • Plan

The IIAW is excited announce new Task Forces and Councils! Each Task Force or Council will have 3 virtual meetings per year and act as a sounding board for planning IIAW education, events and other member benefits.

All agency employees and the following Supporting Company Members: Silver, Gold, Diamond & Exclusive are welcome to participate in one or more groups!

Learn more here!